f 1,026,000 Polish zlotys (PLN). Mertag enters into a forward contract on October 1, 2020 lanuary 31, 2021). U.S. dollar-Polish zloty exchange rates are as follows: Forward Rate -pot Rate $ 0.27 (to January 31, 2021) $ 0.31 0.30 0.34 0.32 N/A d contract as a fair value hedge of a foreign currency firm commitment. The fair value of eferring to changes in the forward rate, and, therefore, forward points are included in as ose its books and prepare financial statements on December 31. Discounting to present he foreicun cuurrencu fonward contract foreian Currena firm co mmit mont and oxn ert

f 1,026,000 Polish zlotys (PLN). Mertag enters into a forward contract on October 1, 2020 lanuary 31, 2021). U.S. dollar-Polish zloty exchange rates are as follows: Forward Rate -pot Rate $ 0.27 (to January 31, 2021) $ 0.31 0.30 0.34 0.32 N/A d contract as a fair value hedge of a foreign currency firm commitment. The fair value of eferring to changes in the forward rate, and, therefore, forward points are included in as ose its books and prepare financial statements on December 31. Discounting to present he foreicun cuurrencu fonward contract foreian Currena firm co mmit mont and oxn ert

Chapter10: Measuring Exposure To Exchange Rate Fluctuations

Section: Chapter Questions

Problem 2ST

Related questions

Question

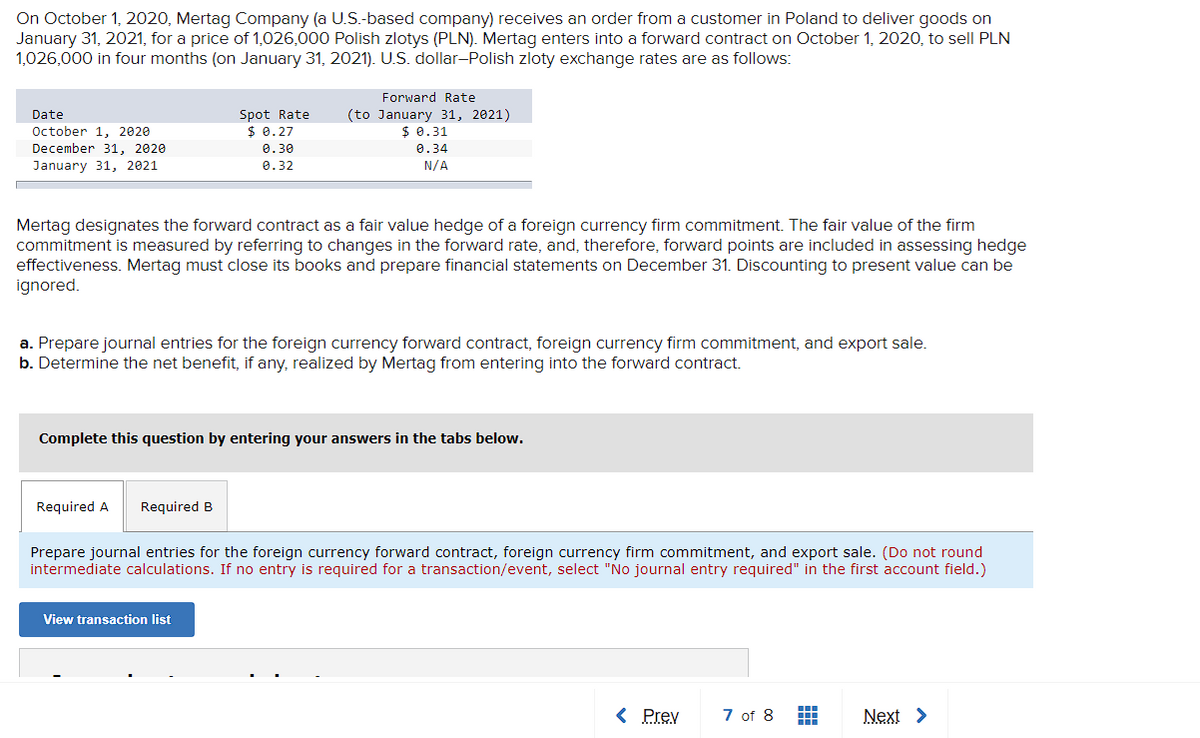

Transcribed Image Text:On October 1, 2020, Mertag Company (a U.S.-based company) receives an order from a customer in Poland to deliver goods on

January 31, 2021, for a price of 1,026,000 Polish zlotys (PLN). Mertag enters into a forward contract on October 1, 2020, to sell PLN

1,026,000 in four months (on January 31, 2021). U.S. dollar-Polish zloty exchange rates are as follows:

Forward Rate

Spot Rate

$ 0.27

(to January 31, 2021)

$ 0.31

Date

October 1. 2020

December 31, 2020

0.30

0.34

January 31, 2021

0.32

N/A

Mertag designates the forward contract as a fair value hedge of a foreign currency firm commitment. The fair value of the firm

commitment is measured by referring to changes in the forward rate, and, therefore, forward points are included in assessing hedge

effectiveness. Mertag must close its books and prepare financial statements on December 31. Discounting to present value can be

ignored.

a. Prepare journal entries for the foreign currency forward contract, foreign currency firm commitment, and export sale.

b. Determine the net benefit, if any, realized by Mertag from entering into the forward contract.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Prepare journal entries for the foreign currency forward contract, foreign currency firm commitment, and export sale. (Do not round

intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

View transaction list

< Prev

7 of 8

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT