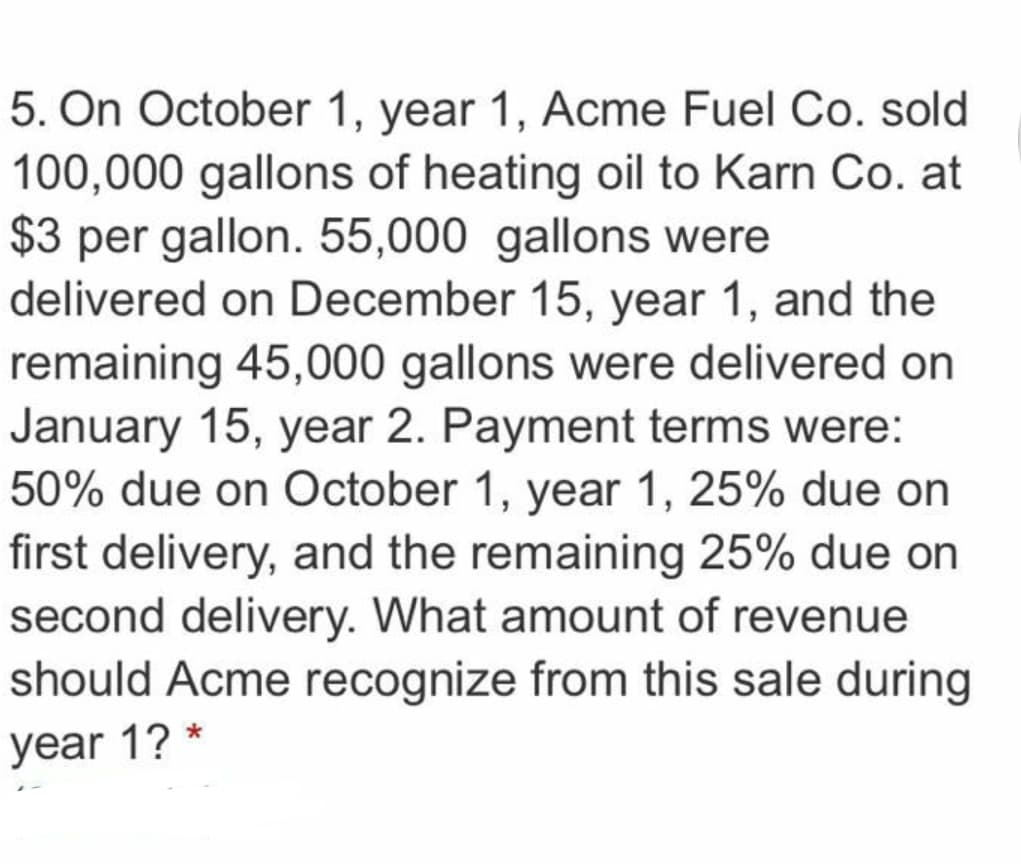

5. On October 1, year 1, Acme Fuel Co. sold 100,000 gallons of heating oil to Karn Co. at $3 per gallon. 55,000 gallons were delivered on December 15, year 1, and the remaining 45,000 gallons were delivered on January 15, year 2. Payment terms were: 50% due on October 1, year 1, 25% due on first delivery, and the remaining 25% due on second delivery. What amount of revenue should Acme recognize from this sale during year 1? *

Q: Cobra Company sells appliance service contracts agreeing to repair appliances for a three-year…

A: In the given question, the company is engaged in providing appliance service and repairs and in…

Q: On January 1, 20x1, Pete Electrical Shop received from Marion Trading 300 pieces of bread toasters.…

A: Consignment is a commercial agreement in which a company, also known as a consignee, agrees to pay a…

Q: 19. ABC Company sells appliance service contracts agreeing to repair appliances for a two-year…

A: In the given case, ABC Company spends 40% during year 1, and 60% during year 2 Hence, the revenue…

Q: The Super power electricity company provides service during the period and bills its customers for…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: 2. Pistons company sells portable DVD players for P28,000 each and offers to each customer a 3-year…

A: Warranty means the undertaking given by the company selling the goods that in case of any defect ,…

Q: August 2021, Commonlo Corp. commits to selling 100 of its merchandise to M&H Co. for P30,000 (P300…

A: As per IAS 15 Revenue recognition When distinct goods or services are provided at standalone…

Q: On August, 2019, HBO consigned to GEO 10 laptops costing $15,000 each, paying freight charge of…

A: Consignment Account: It is made to calculate the profit earned or loss incurred by the consignor…

Q: Batman Company paid the annual fee of P30,000 for an equipment maintenance contract on July 1, the…

A: Annual Equipment Maintenance Contract is of P30,000 taken on 1-July(beginning of quarter). Expense…

Q: ABC Company sells equipment service contracts that cover 2-year period. The sales price of each…

A: Unearned revenue is the amount of cash collected for which services are yet to be performed. It is…

Q: Kikiam Company sells equipment service contracts that cover a two-year period. The sales price of…

A: Warranty means where the company is undertaking to make good the loss which has been incurred due to…

Q: .LIA Co. sells service contracts that cover a 2-year period. The sale price of each contract is…

A: A service contract seems to be an arrangement between you or your company and the people or…

Q: On November 30, 20x1, Northup Co. consigned 90 freezers to Watson Co. for sale at ₱1,600 each and…

A: It includes two parties (consignor and consignee) wherein the consignee will be the one in charge to…

Q: NAPAPALUNOK AKO AS OF THE MOMENT INC. sells 3-year service contracts for air conditioning units for…

A: Revenue means the amount earned by selling the goods or services. Unearned revenue means the amount…

Q: On January 1, 20x1, Pete Electrical Shop received from Marion Trading 300 pieces of bread toasters.…

A: Sales value = (amount remitted + repair cost + deliver expense) / (1 - commission rate) =…

Q: 8. Zahir company is constructing a building. Construction began on February 1 and was completed on…

A: Capitalization rate: It is the rate that is used to compare different real-estate investments based…

Q: 1. On July 1, APPLE purchased a machine worth P21,000,000 subject to a 2% cash discount if paid…

A: ‘’Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: On July 1, APPLE purchased a machine worth ₱21,000,000 subject to a 2% cash discount if paid within…

A: Introduction: Balance sheet: All Assets and liabilities are shown in Balance sheet. It tells the net…

Q: On 1 July 20X7 The Qtakamiro Company handed over to a client a new computer system. The contract…

A: IFRS 15: an entity recognises revenue to depict the transfer of promised goods or services to the…

Q: The Cougars football team sells season tickets in advance for $480 each. The season consists of 16…

A: Revenue means the amount earned by selling the goods or services. Unearned revenue means the amount…

Q: In accordance with IFRS 15, how much is the balance of Unearned Revenue for Premium Claims at the…

A: Unearned premium revenue is a liability account that is used by an insurer to record that portion of…

Q: A local Starbucks sells gift cards of $10,000 during the year. By the end of the year, customers…

A: Deferred revenues: Collection of cash in advance to render service or to deliver goods in future is…

Q: . A manufacturing company purchased electrical services for the next 5 years to be paid for with…

A: The current value of a future sum of money or stream of cash flows with a constant rate of return is…

Q: Kikiam Company sells equipment service contracts that cover a two-year period. The sales price of…

A: The question is based on the concept of Finacial Accounting.

Q: Gem construction company was working on a contract and it uses the percentage-of- completion method…

A: As per percentage of completion method profits and revenues have to be reported on the basis of…

Q: Dunne Co. sells equipment service contracts that cover a twoyear period. The sales price of each…

A: Ans. As given in the question, the service contract is spread over 2 years. And so the revenue will…

Q: Roeher Company sold $9,000 of its specialty shelving to Elkins Office Supply Co. on account. Prepare…

A: No. Account Titles and Explanation Debit Credit a. Accounts receivable $9,000…

Q: 6. ABC Co. owns a branch. At the end of the month, the balance of the Allowance on overvaluation is…

A: The profit percentage is calculated as profit divided by total cost.

Q: A manufacturing company purchased electrical services for the next 5 years to be paid for with…

A: The present value is the value of the cash flow stream or the fixed lump sum amount at time 0 or the…

Q: Stratus Inc. purchased equipment for $18,500 and received an invoice with terms 4/10, 3/30, n/45. If…

A: Stratus Incorporation purchased equipment and it had terms 4/10, 3/30, n/45. In this case, the…

Q: ABC Co. owns a branch. At the end of the month, the balance of the Allowance on overvaluation is…

A: Percentage of profit on cost= Allowance on overvaluation/ Cost*100

Q: ABC Co. sells equipment service contracts that cover a two-year period. The sales price of each…

A: Introduction:- Calculation of total sales value as follows:- Total sales value = No. of contracts…

Q: he new machinery, on the other hand, is expected to have a residual worth of $5,000. On that date,…

A: As per rule, allowed to answer first question and post the remaining in the next submission.

Q: SM Appliances consigned five electric fans, which cost P800,000 each, to Asahi Marketing Co., which…

A: Cash remittance to cosigner by consignee will be calculated as the cash collections made by the…

Q: The year end of M Inc is 30 November 20X0. The company pays for its gas by a standing order of $600…

A: We have the following information The company pays for its gas by a standing order of $600 per…

Q: Ines Company consigned twenty five (25) calculators, with cost of P800 each, to Hola Company for a…

A: Under consignment sales one party gives their goods to another party for selling. The one who gives…

Q: I need answers from item 1-5 please help.

A: Income Statement - It is financial statement of the company which shows the income and expenses of…

Q: ia Company’s liabilities are $65,000 and its equity is $45,000. On January 3, Lumia purchases and…

A: Total Assets = Liabilities + Equity On Jan 1 Lumia Company’s liabilities are $65,000 and its equity…

Q: Motor Co. sells service contracts that cover a 2-year period. The sale price of each contract is…

A: Deferred revenue is the revenue which has not been earned by the company but the payment has been…

Q: Valley Spa purchased $11,200 in plumbing components from Tubman Company. Valley Spa signed a 90-day,…

A: Interest applicable on the note = $11,200 x 7% x 90/360 = $196

Q: Valley Spa purchased $11,200 in plumbing components from Tubman Co. Valley Spa Studios signed a…

A: Notes payable is a promise in writing issued by the borrower to the lender providing that the amount…

Q: NAPAPALUNOK AKO AS OF THE MOMENT INC. sells 3-year service contracts for air conditioning units for…

A: Unearned revenue= Contract*Contract price*% to be recognized

Q: Westinghouse Company, a producer of washing machines, sells o various customers. It has a contract…

A: "A performance obligation is a guarantee in a contract with a customer to transfer an asset (such…

Q: During December, Rainey Equipment made a $600,000 credit sale. The state sales tax rate is 6% and…

A: Liabilities: Liabilities are the obligations of the business to pay the creditors and others,…

Q: MAYUMI Co. sold 50,000 units at P 225 per unit during May of this year. The cost per unit is P150.…

A: Revenue should be recognise for the amount for which entity expects to be receive against goods…

Q: Rapoo Inc. sells gift certificates. One-half of the gift certificates outstanding on January 1…

A: Unearned revenue from gift card on 1 JANUARY 1,80,000 Closing balance of unearned…

Q: Outlook Corporation sells gas stoves. Its sales had a total of P250,000 during its first year of…

A: The question is multiple choice question. Required Choose the Correct Option.

Q: Peyton Company started construction of a new office building on January 1, 20x1, and moved into the…

A: The question is multiple choice question. Required Choose the Correct Option.

Q: On October 1, 20x3, ABC Fuel Co. sold 100,000 gallons of heating oil to DEF Co. at ₱4 per gallon.…

A: Revenue means the amount earned by selling the goods or services. Revenue is recognized in books of…

Q: On August, 2019, HBO consigned to GEO 10 laptops costing P15,000 each, paying freight charge of…

A: Cost of Goods Sold is the cost of producing the goods, and it consists of direct materials, direct…

Q: On January 1, 20x1, Pete Electrical Shop received from Marion Trading 300 pieces of bread toasters.…

A: Under Consignment, consignee sells the goods and remits back the money to the consignor after…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- On October 1, 20x3, ABC Fuel Co. sold 100,000 gallons of heating oil to DEF Co. at ₱4 per gallon. TwentyFive thousand gallons were delivered on December 15, 20x3, and the remaining 75,000 gallons were deliveredon January 15, 20x4. Payment terms were: 25% due on October 1, 20x3, 50% due on first delivery, and theremaining 25% due on second delivery. What amount of revenue should ABC Fuel Co. recognize from thissale during 20x3?On May 1, RR Products Company ships five (5) of its appliances to SZ Company on consignment. The cost of the appliances shipped is 155 per unit. The consignor paid shipping costs totaling 50. Each unit is to be sold at 250 payable 50 in the month of purchase and P10 per month thereafter. The consignee is entitled to 20% of all amounts collected on consignment sales. SZ Company was able to sell 3 appliances in May and 1 in June. Regular monthly collections by the consignee, and appropriate cash remittances have been made to the consignor at the end of each month . 17. What is the total amount of remittance to consignor as of June? A. P-0- B. P184 C. P64 D. P200 18. How much is the profit on consignment? A. P150 B. P294 C. P140 D. None of the above 19. What is the cost of inventory on consignment? A. P155 B. P165 C. P245 D. None of the above ConAt the beginning of the current year, Clan Company offers the customers a pottery bowl if they send in three boxtops from the products and P10. The entity estimated that 60% of the boxtops would be redeemed.During the year, the entity sold 675,000 boxes and customers redeemed 330,000 boxtops receiving 110,000 bowls. The cost of each bowl is P 25.What is the liability for outstanding premium at year-end?

- 1. On 1 April 20x1, ABC Co. bought a new lorry and made the following payments in relation to it: Costs as per supplier’s list $120,000 Less: Agreed discount 10,000 110,000 Delivery charge 1,000 Installation charge 4,000 Maintenance charge 4,000 An additional component to increase capacity 3,000 Spare parts 3,500 Total 125,500 The lorry is depreciated on a straight-line basis over a four-year life and the estimated residual value $38,000. ABC Co. prepares their accounts on 31 December each year, the company policy is to charge depreciation on a month for month basis. After exactly two years and three months, the lorry is out of…Ines Company consigned twenty five (25) calculators, with cost of P800 each, to Hola Company for a commission of 10% of selling price. Ines Company paid shipping costs of P1,000 on the shipment. Correspondingly, Hola Company paid P500 on the freight of the shipment. On the last day of the year, Hola Company reported that it had sold twenty (20) of the calculators, fifteen (15) for cash at P1,500 each and five (5) on credit at P1,800 each, of which 25% was collected as down payment. Hola Company incurred P650 for delivery of the sold units and remitted all the cash due. How much is the consignment profit?NAPAPALUNOK AKO AS OF THE MOMENT INC. sells 3-year service contracts for air conditioning units for P1,500 each. Sales of service contracts are made evenly throughout each year. The company estimates that 15% of repairs are done in the first year from the date of sale, 35% in the second year, and 50% in the third year. Service contracts sold are as follows. How much is the unearned revenue from service contracts as of December 31, 2019? a. P 1,417,500 b. P 2,525,250 c. P 3,370,500 d. P 3,942,750

- On July 1, 20x1, Lala Home Store shipped 150 ovens, costing P9,000 each on consignment basis to SM Aura to be sold at P15,000 each. The consignee is to be allowed a 15% commission. Lala Home Store incurred P15,000 in shipping the 150 units. The agreement requires that SM Aura will advance 50% of the cost of the oven, to be applied to periodic remittances in proportion to the units sold. Any expenses related to the consigned units incurred by SM Aura are also deductible from the remittance. On October 31, 20x1, SM Aura rendered an account sale that includes the following deductions: Advertising costs, P15,000; delivery expenses to customers of P350 per unit; commission of P146,250. REQUIRED: Amount remitted to Lala Home StoreOn July 1, 20x1, Lala Home Store shipped 150 ovens, costing P9,000 each on consignment basis to SM Aura to be sold at P15,000 each. The consignee is to be allowed a 15% commission. Lala Home Store incurred P15,000 in shipping the 150 units. The agreement requires that SM Aura will advance 50% of the cost of the oven, to be applied to periodic remittances in proportion to the units sold. Any expenses related to the consigned units incurred by SM Aura are also deductible from the remittance. On October 31, 20x1, SM Aura rendered an account sale that includes the following deductions: Advertising costs, P15,000; delivery expenses to customers of P350 per unit; commission of P146,250. Amount remitted to Lala Home StoreShrek Company consigned 100 freezers costing P50,000 each to Disney Company on January 2, 2020. The cost of shipping the freezers amounted to P85,000 and was paid by Shrek Company. On January 31, a report was received from the consignee indicating that 60 of the freezers had been sold for P75,000 each. Remittance was made by the consignee for the amount due after deducting a commission of 10%, advertising of P20,000, the installation cost of P32,000, and shipping costs for the 10 defective units of P15,000. 1. How much is the Cash Remittance? 2.how much is the Consignment Income (Loss)? 3. how much is the cost of inventory held by the consignee?

- On March 1, Bartholomew Company purchased a new stamping machine with a list price of $88,000. The company paid cash for the machine; therefore, it was allowed a 5% discount. Other costs associated with the machine were: transportation costs, $3100; sales tax paid, $6,720, installation costs, $1,900; routine maintenance during the first month of operation, $3,000. The cost recorded for the machine was:Kikiam Company sells equipment service contracts that cover a two-year period. The sales price of each contract is P4,000. Kikiam Company’s past experience shows that of the total pesos spent for repairs in service contracts, 40% in incurred evenly during the first contract year and 60% evenly during the second contract year. Kikiam Company sold 1,500 contracts evenly throughout 2020 and 900 contracts evenly throughout 2021. How much should Kikiam Company report as contract service revenue for the year ended December 31, 2021?needed in 8 minutes BC has entered into a non-cancellable purchase contract which the company to purchase 5,000 sacks of copra from seller at P650 per sack middle of 20x1. By the end of 20x1, the price of copra per sack increases to P670 and by the end of the first quarter of 20x2, it rolls back to 630 a sack when ABC made the actual purchase triggered from the continuing decline since 20x2 commenced. At year end, inventory shall be carried at