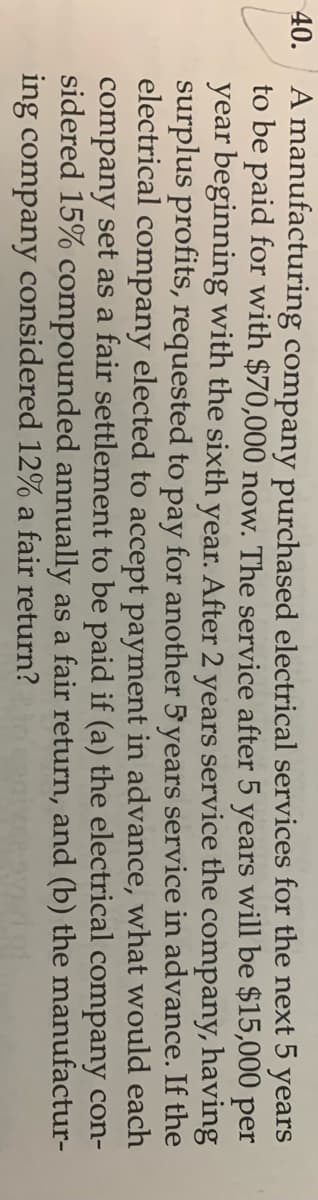

. A manufacturing company purchased electrical services for the next 5 years to be paid for with $70,000 now. The service after 5 years will be $15,000 per year beginning with the sixth year. After 2 years service the company, having surplus profits, requested to pay for another 5 years service in advance. If the electrical company elected to accept payment in advance, what would each company set as a fair settlement to be paid if (a) the electrical company con- sidered 15% compounded annually as a fair return, and (b) the manufactur- ing company considered 12% a fair return?

. A manufacturing company purchased electrical services for the next 5 years to be paid for with $70,000 now. The service after 5 years will be $15,000 per year beginning with the sixth year. After 2 years service the company, having surplus profits, requested to pay for another 5 years service in advance. If the electrical company elected to accept payment in advance, what would each company set as a fair settlement to be paid if (a) the electrical company con- sidered 15% compounded annually as a fair return, and (b) the manufactur- ing company considered 12% a fair return?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 7C: On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial...

Related questions

Question

Transcribed Image Text:A manufacturing company purchased electrical services for the next 5 years

to be paid for with $70,000 now. The service after 5 years will be $15,000 per

year beginning with the sixth year. After 2 years service the company, having

surplus profits, requested to pay for another 5 years service in advance. If the

electrical company elected to accept payment in advance, what would each

company set as a fair settlement to be paid if (a) the electrical company con-

sidered 15% compounded annually as a fair return, and (b) the manufactur-

ing company considered 12% a fair return?

40.

Expert Solution

Step 1

The current value of a future sum of money or stream of cash flows with a constant rate of return is the present value of that sum or stream of cash flows (PV). The present value of future cash flows is reduced by the discount rate; the higher the discount rate, the lower the present value of future cash flows. Choosing the appropriate discount rate is the key to appropriately valuing future cash flows, whether earnings or debt obligations. In order to calculate the present value, you must assume that a rate of return on investment will be generated over time.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College