5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal.

5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the journal.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.12MCE: Determining an Ending Account Balance Jessies Accounting Services was organized on June 1. The...

Related questions

Question

question 4, 5, 6

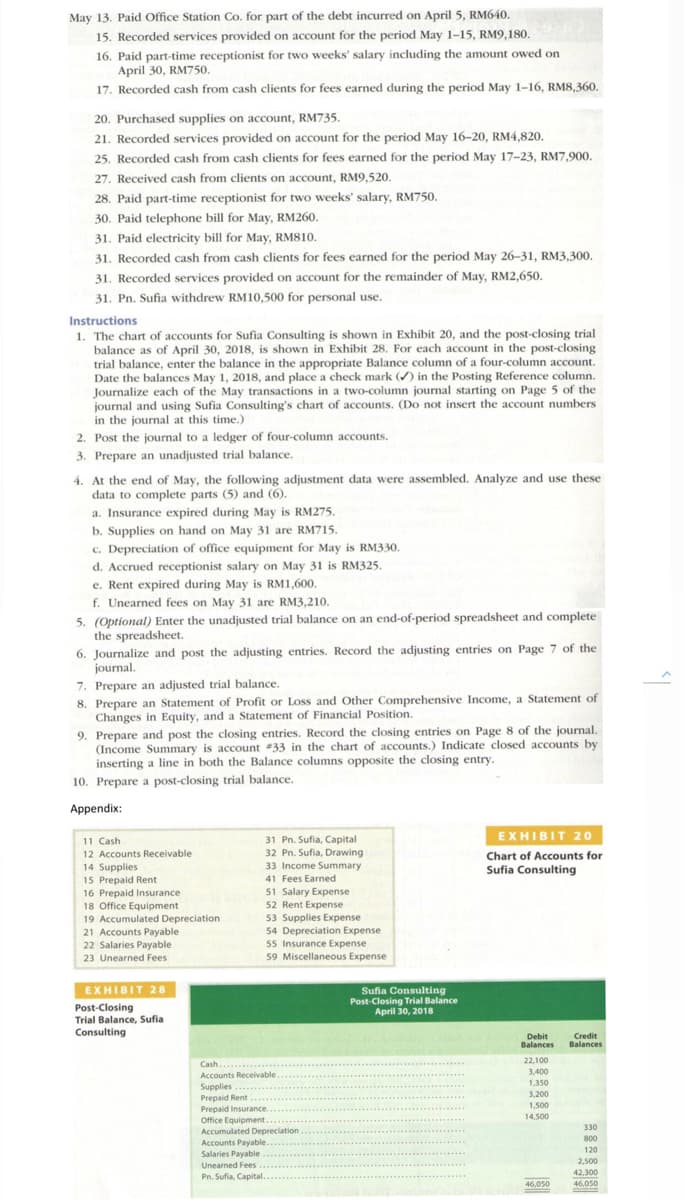

Transcribed Image Text:May 13. Paid Office Station Co. for part of the debt incurred on April 5, RM640.

15. Recorded services provided on account for the period May 1-15, RM9,180.

16. Paid part-time receptionist for two weeks' salary including the amount owed on

April 30, RM750.

17. Recorded cash from cash clients for fees earned during the period May 1-16, RM8,360.

20. Purchased supplies on account, RM735.

21. Recorded services provided on account for the period May 16-20, RM4,820.

25. Recorded cash from cash clients for fees earned for the period May 17-23, RM7,900.

27. Received cash from clients on account, RM9,520.

28. Paid part-time receptionist for two weeks' salary, RM750.

30. Paid telephone bill for May, RM260.

31. Paid electricity bill for May, RM810.

31. Recorded cash from cash clients for fees earned for the period May 26-31, RM3,300.

31. Recorded services provided on account for the remainder of May, RM2,650.

31. Pn. Sufia withdrew RM10,500 for personal use.

Instructions

1. The chart of accounts for Sufia Consulting is shown in Exhibit 20, and the post-closing trial

balance as of April 30, 2018, is shown in Exhibit 28. For each account in the post-closing

trial balance, enter the balance in the appropriate Balance column of a four-column account.

Date the balances May 1, 2018, and place a check mark (/) in the Posting Reference column.

Journalize each of the May transactions in a two-column journal starting on Page 5 of the

journal and using Sufia Consulting's chart of accounts. (Do not insert the account numbers

in the journal at this time.)

2. Post the journal to a ledger of four-column accounts.

3. Prepare an unadjusted trial balance.

4. At the end of May, the following adjustment data were assembled. Analyze and use these

data to complete parts (5) and (6).

a. Insurance expired during May is RM275.

b. Supplies on hand on May 31 are RM715.

c. Depreciation of office equipment for May is RM330.

d. Accrued receptionist salary on May 31 is RM325.

e. Rent expired during May is RM1,600.

f. Unearned fees on May 31 are RM3,210.

5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete

the spreadsheet.

6. Journalize and post the adjusting entries. Record the adjusting entries on Page 7 of the

journal.

7. Prepare an adjusted trial balance.

8. Prepare an Statement of Profit or Loss and Other Comprehensive Income, a Statement of

Changes in Equity, and a Statement of Financial Position.

9. Prepare and post the closing entries. Record the closing entries on Page 8 of the journal.

(Income Summary is account 33 in the chart of accounts.) Indicate closed accounts by

inserting a line in both the Balance columns opposite the closing entry.

10. Prepare a post-closing trial balance.

Appendix:

EXHIBIT 20

31 Pn. Sufia, Capital

32 Pn. Sufia, Drawing

11 Cash

12 Accounts Receivable

Chart of Accounts for

33 Income Summary

14 Supplies

15 Prepaid Rent

16 Prepaid Insurance

18 Office Equipment

19 Accumulated Depreciation

21 Accounts Payable

22 Salaries Payable

Sufia Consulting

41 Fees Earned

51 Salary Expense

52 Rent Expense

53 Supplies Expense

54 Depreciation Expense

55 Insurance Expense

59 Miscellaneous Expense

23 Unearned Fees

EXHIBIT 28

Sufia Consulting

Post-Closing Trial Balance

April 30, 2018

Post-Closing

Trial Balance, Sufia

Consulting

Debit

Balances

Credit

Balances

22,100

Cash... **

Accounts Receivable

Supplies

3,400

1,350

....

Prepaid Rent..

3.200

1,500

Prepaid Insurance.

14,500

Office Equipment...

330

Accumulated Depreciation

800

Accounts Payable

Salaries Payable

120

2,500

Unearned Fees

42,300

Pn. Sufia, Capital..

46,050

46,050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College