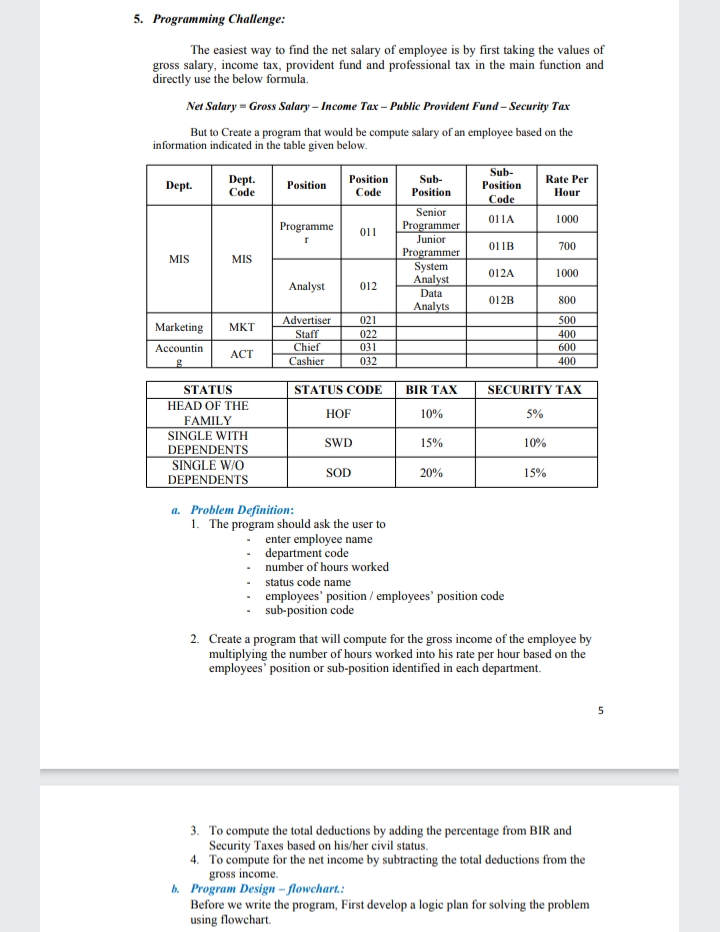

5. Programming Challenge: The easiest way to find the net salary of employee is by first taking the values of gross salary, income tax, provident fund and professional tax in the main function and directly use the below formula. Net Salary = Gross Salary-Income Tax-Public Provident Fund - Security Tax But to Create a program that would be compute salary of an employee based on the information indicated in the table given below. Dept. MIS Dept. Code MIS Marketing MKT Accountin ACT STATUS HEAD OF THE FAMILY SINGLE WITH DEPENDENTS SINGLE W/O DEPENDENTS Position Programme Analyst Advertiser Staff Chief Cashier Position Code HOF SWD 011 SOD 012 STATUS CODE 021 022 031 032 a. Problem Definition: 1. The program should ask the user to enter employee name department code - number of hours worked status code name Sub- Position Senior Programmer Junior Programmer System Analyst Data Analyts BIR TAX 10% 15% 20% Sub- Position Code 0114 011B 012A 012B employees' position / employees' position code sub-position code Rate Per Hour 1000 700 5% SECURITY TAX 10% 1000 15% 800 500 400 600 400

5. Programming Challenge: The easiest way to find the net salary of employee is by first taking the values of gross salary, income tax, provident fund and professional tax in the main function and directly use the below formula. Net Salary = Gross Salary-Income Tax-Public Provident Fund - Security Tax But to Create a program that would be compute salary of an employee based on the information indicated in the table given below. Dept. MIS Dept. Code MIS Marketing MKT Accountin ACT STATUS HEAD OF THE FAMILY SINGLE WITH DEPENDENTS SINGLE W/O DEPENDENTS Position Programme Analyst Advertiser Staff Chief Cashier Position Code HOF SWD 011 SOD 012 STATUS CODE 021 022 031 032 a. Problem Definition: 1. The program should ask the user to enter employee name department code - number of hours worked status code name Sub- Position Senior Programmer Junior Programmer System Analyst Data Analyts BIR TAX 10% 15% 20% Sub- Position Code 0114 011B 012A 012B employees' position / employees' position code sub-position code Rate Per Hour 1000 700 5% SECURITY TAX 10% 1000 15% 800 500 400 600 400

C++ for Engineers and Scientists

4th Edition

ISBN:9781133187844

Author:Bronson, Gary J.

Publisher:Bronson, Gary J.

Chapter6: Modularity Using Functions

Section6.2: Returning A Single Value

Problem 9E

Related questions

Question

Kindly make a flowchart that will calculate the total salary of an employee using this chart

Transcribed Image Text:5. Programming Challenge:

The easiest way to find the net salary of employee is by first taking the values of

gross salary, income tax, provident fund and professional tax in the main function and

directly use the below formula.

Net Salary = Gross Salary-Income Tax - Public Provident Fund - Security Tax

But to Create a program that would be compute salary of an employee based on the

information indicated in the table given below.

Dept.

MIS

Dept.

Code

MIS

Marketing MKT

Accountin

g

ACT

STATUS

HEAD OF THE

FAMILY

SINGLE WITH

DEPENDENTS

SINGLE W/O

DEPENDENTS

Position

Programme

Analyst

Advertiser

Staff

Chief

Cashier

Position

Code

HOF

SWD

011

STATUS CODE

SOD

012

021

022

031

032

a. Problem Definition:

1. The program should ask the user to

enter employee name

department code

number of hours worked

status code name

Sub-

Position

Senior

Programmer

Junior

Programmer

System

Analyst

Data

Analyts

BIR TAX

10%

15%

20%

Sub-

Position

Code

011A

011B

012A

012B

Rate Per

Hour

1000

employees' position / employees' position code

sub-position code

SECURITY TAX

5%

10%

1000

15%

800

500

400

600

400

2. Create a program that will compute for the gross income of the employee by

multiplying the number of hours worked into his rate per hour based on the

employees' position or sub-position identified in each department.

3. To compute the total deductions by adding the percentage from BIR and

Security Taxes based on his/her civil status.

4. To compute for the net income by subtracting the total deductions from the

gross income.

b. Program Design-flowchart.:

Before we write the program, First develop a logic plan for solving the problem

using flowchart.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning