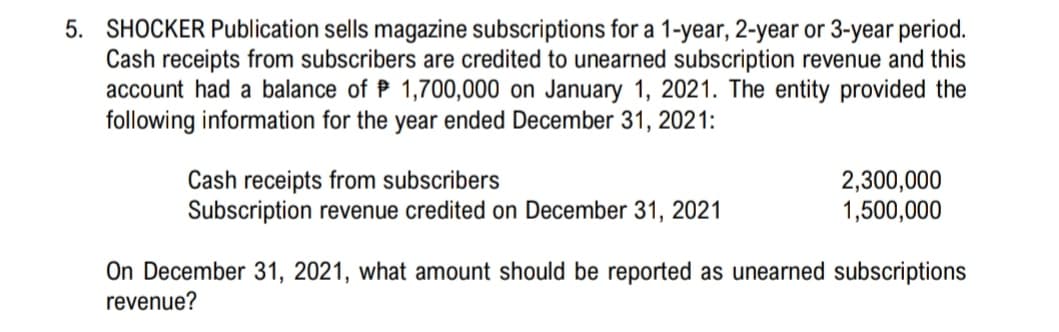

5. SHOCKER Publication sells magazine subscriptions for a 1-year, 2-year or 3-year period. Cash receipts from subscribers are credited to unearned subscription revenue and this account had a balance of P 1,700,000 on January 1, 2021. The entity provided the following information for the year ended December 31, 2021: Cash receipts from subscribers Subscription revenue credited on December 31, 2021 2,300,000 1,500,000 On December 31, 2021, what amount should be reported as unearned subscriptions revenue?

5. SHOCKER Publication sells magazine subscriptions for a 1-year, 2-year or 3-year period. Cash receipts from subscribers are credited to unearned subscription revenue and this account had a balance of P 1,700,000 on January 1, 2021. The entity provided the following information for the year ended December 31, 2021: Cash receipts from subscribers Subscription revenue credited on December 31, 2021 2,300,000 1,500,000 On December 31, 2021, what amount should be reported as unearned subscriptions revenue?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 69E: Unearned Revenue Jennifers Landscaping Services signed a $400-per-month contract on November 1,...

Related questions

Question

This lesson is under non-financial liabilities.

Transcribed Image Text:5. SHOCKER Publication sells magazine subscriptions for a 1-year, 2-year or 3-year period.

Cash receipts from subscribers are credited to unearned subscription revenue and this

account had a balance of P 1,700,000 on January 1, 2021. The entity provided the

following information for the year ended December 31, 2021:

Cash receipts from subscribers

Subscription revenue credited on December 31, 2021

2,300,000

1,500,000

On December 31, 2021, what amount should be reported as unearned subscriptions

revenue?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT