5. Suppose you have an opportunity to buy an annuity that pays $3,500 at the end of each year for 6 years, at a 9% interest rate. What is the most you should pay for the annuity?

5. Suppose you have an opportunity to buy an annuity that pays $3,500 at the end of each year for 6 years, at a 9% interest rate. What is the most you should pay for the annuity?

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 2STP

Related questions

Question

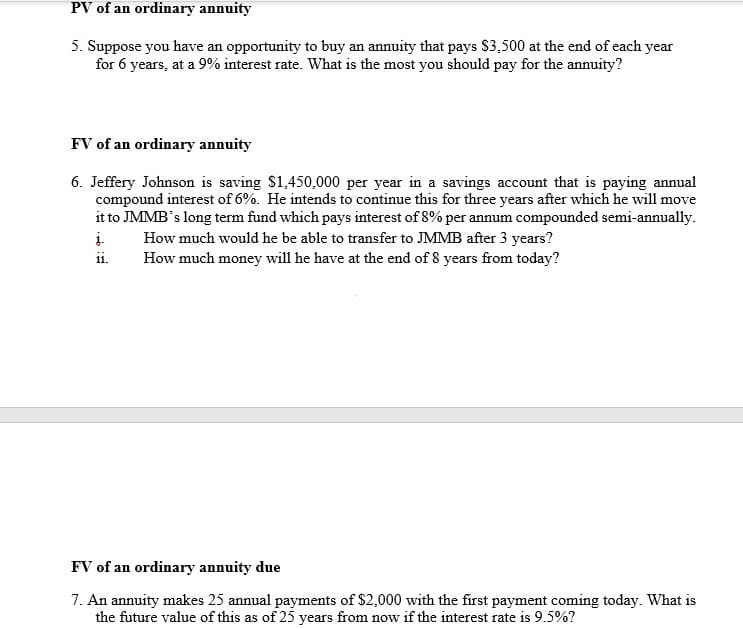

Transcribed Image Text:PV of an ordinary annuity

5. Suppose you have an opportunity to buy an annuity that pays $3,500 at the end of each year

for 6 years, at a 9% interest rate. What is the most you should pay for the annuity?

FV of an ordinary annuity

6. Jeffery Johnson is saving $1,450,000 per year in a savings account that is paying annual

compound interest of 6%. He intends to continue this for three years after which he will move

it to JMMB's long term fund which pays interest of 8% per annum compounded semi-annually.

į.

How much would he be able to transfer to JMMB after 3 years?

How much money will he have at the end of 8 years from today?

ii.

FV of an ordinary annuity due

7. An annuity makes 25 annual payments of $2,000 with the first payment coming today. What is

the future value of this as of 25 years from now if the interest rate is 9.5%?

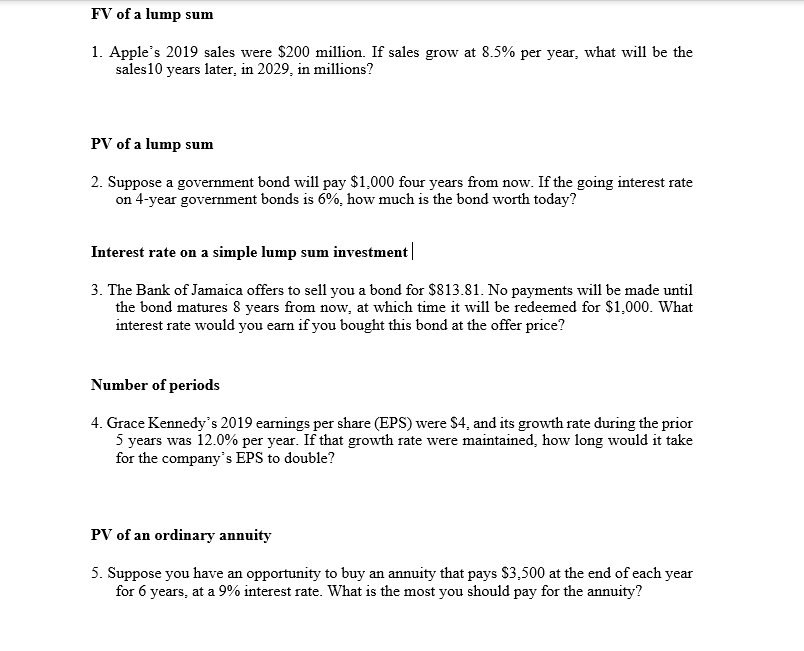

Transcribed Image Text:FV of a lump sum

1. Apple's 2019 sales were $200 million. If sales grow at 8.5% per year, what will be the

sales10 years later, in 2029, in millions?

PV of a lump sum

2. Suppose a government bond will pay $1,000 four years from now. If the going interest rate

on 4-year government bonds is 6%, how much is the bond worth today?

Interest rate on a simple lump sum investment|

3. The Bank of Jamaica offers to sell you a bond for $813.81. No payments will be made until

the bond matures 8 years from now, at which time it will be redeemed for $1,000. What

interest rate would you earn if you bought this bond at the offer price?

Number of periods

4. Grace Kennedy's 2019 earnings per share (EPS) were $4, and its growth rate during the prior

5 years was 12.0% per year. If that growth rate were maintained, how long would it take

for the company's EPS to double?

PV of an ordinary annuity

5. Suppose you have an opportunity to buy an annuity that pays $3,500 at the end of each year

for 6 years, at a 9% interest rate. What is the most you should pay for the annuity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College