5. Use Walmart's condensed financial statements on Canvas to compute its inventory turnover ratios for 2021 and 2022. Which of the following is correct regarding Walmart's inventory liquidity? (a) Walmart's inventory liquidity in 2021 was higher than in 2022. O (d) Walmart's inventory liquidity in 2022 was higher than in 2021. O (c) Walmart's inventory liquidity is the same in 2021 and 2022. O (d) There is insufficient information to compute Walmart's inventory liquidity.

5. Use Walmart's condensed financial statements on Canvas to compute its inventory turnover ratios for 2021 and 2022. Which of the following is correct regarding Walmart's inventory liquidity? (a) Walmart's inventory liquidity in 2021 was higher than in 2022. O (d) Walmart's inventory liquidity in 2022 was higher than in 2021. O (c) Walmart's inventory liquidity is the same in 2021 and 2022. O (d) There is insufficient information to compute Walmart's inventory liquidity.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 13MCQ

Related questions

Question

V6

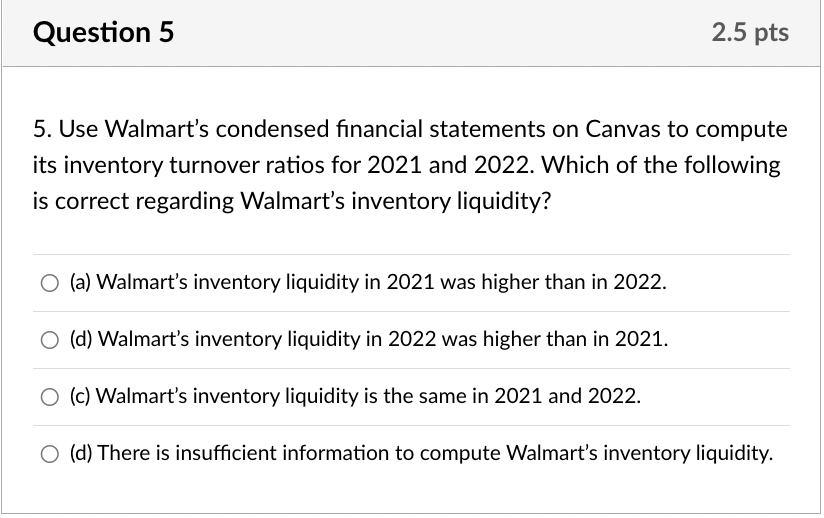

Transcribed Image Text:Question 5

2.5 pts

5. Use Walmart's condensed financial statements on Canvas to compute

its inventory turnover ratios for 2021 and 2022. Which of the following

is correct regarding Walmart's inventory liquidity?

O (a) Walmart's inventory liquidity in 2021 was higher than in 2022.

O (d) Walmart's inventory liquidity in 2022 was higher than in 2021.

O (c) Walmart's inventory liquidity is the same in 2021 and 2022.

O (d) There is insufficient information to compute Walmart's inventory liquidity.

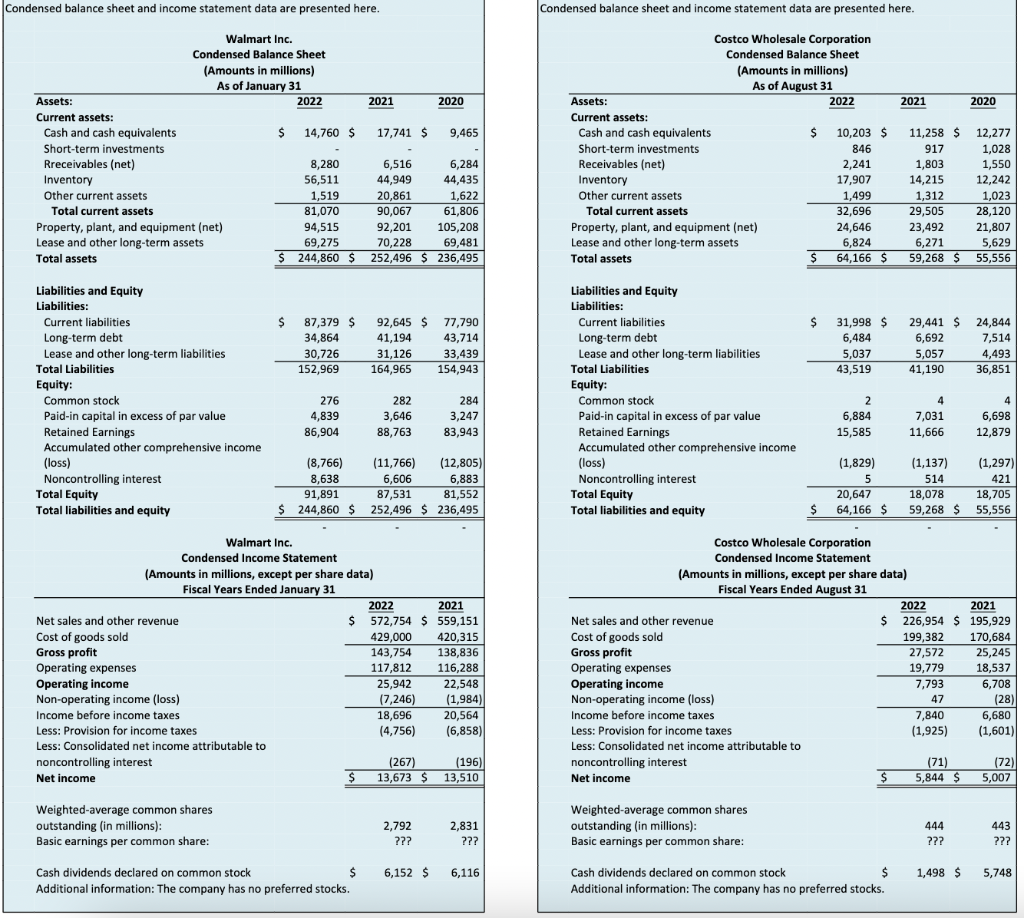

Transcribed Image Text:Condensed balance sheet and income statement data are presented here.

Assets:

Current assets:

Cash and cash equivalents

Short-term investments

Rreceivables (net)

Inventory

Other current assets

Total current assets

Property, plant, and equipment (net)

Lease and other long-term assets

Total assets

Liabilities and Equity

Liabilities:

Current liabilities

Long-term debt

Lease and other long-term liabilities

Total Liabilities

Equity:

Common stock

Paid-in capital in excess of par value

Retained Earnings

Accumulated other comprehensive income

(loss)

Noncontrolling interest

Total Equity

Total liabilities and equity

Walmart Inc.

Condensed Balance Sheet

(Amounts in millions)

As of January 31

Net sales and other revenue

Cost of goods sold

Gross profit

Operating expenses

Operating income

Non-operating income (loss)

Income before income taxes

Less: Provision for income taxes

Less: Consolidated net income attributable to

noncontrolling interest

Net income

$

Weighted-average common shares

outstanding (in millions):

Basic earnings per common share:

2022

$

14,760 $

8,280

56,511

1,519

81,070

87,379 $

34,864

30,726

152,969

276

4,839

86,904

(8,766)

8,638

Walmart Inc.

Condensed Income Statement

(Amounts in millions, except per share data)

Fiscal Years Ended January 31

2021

94,515

92,201

105,208

69,275

70,228

69,481

$ 244,860 $ 252,496 $ 236,495

17,741 $

6,516

44,949

20,861

90,067

$

Cash dividends declared on common stock

Additional information: The company has no preferred stocks.

31,126

164,965

282

3,646

88,763

2020

92,645 $ 77,790

41,194

43,714

33,439

154,943

9,465

(11,766)

6,606

(12,805)

6,883

91,891

87,531

81,552

$ 244,860 $ 252,496 $ 236,495

6,284

44,435

1,622

61,806

2,792

???

284

3,247

83,943

2022

2021

$ 572,754 $ 559,151

429,000 420,315

143,754 138,836

117,812

116,288

25,942

22,548

(7,246)

(1,984)

18,696

(4,756)

(267)

(196)

$ 13,673 $13,510

20,564

(6,858)

2,831

???

6,152 $ 6,116

Condensed balance sheet and income statement data are presented here.

Assets:

Current assets:

Cash and cash equivalents

Short-term investments

Receivables (net)

Inventory

Costco Wholesale Corporation

Condensed Balance Sheet

(Amounts in millions)

As of August 31

2022

Other current assets

Total current assets

Property, plant, and equipment (net)

Lease and other long-term assets

Total assets

Liabilities and Equity

Liabilities:

Current liabilities

Long-term debt

Lease and other long-term liabilities

Total Liabilities

Equity:

Common stock

Paid-in capital in excess of par value

Retained Earnings

Accumulated other comprehensive income

(loss)

Noncontrolling interest

Total Equity

Total liabilities and equity

Operating expenses

Operating income

Net sales and other revenue

Cost of goods sold

Gross profit

$

Non-operating income (loss)

Income before income taxes

mcon

Less: Provision for income taxes

Less: Consolidated net income attributable to

noncontrolling interest

Net income

$

Weighted-average common shares

outstanding (in millions):

Basic earnings per common share:

$

$

10,203 $

846

2,241

17,907

1,499

32,696

24,646

6,824

64,166 $

31,998 $

6,484

5,037

43,519

2

6,884

15,585

(1,829)

5

Costco Wholesale Corporation

Condensed Income Statement

20,647

64,166 $

(Amounts in millions, except per share data)

Fiscal Years Ended August 31

2021

$

$

Cash dividends declared on common stock

Additional information: The company has no preferred stocks.

11,258 $ 12,277

917

1,028

1,803

1,550

12,242

1,023

28,120

21,807

5,629

55,556

14,215

1,312

29,505

23,492

6,271

59,268 $

29,441 $

6,692

5,057

41,190

4

7,031

11,666

(1,137)

514

(1,297)

421

18,705

59,268 $ 55,556

18,078

2022

2021

$ 226,954 $ 195,929

199,382 170,684

27,572

19,779

7,793

47

7,840

(1,925)

(71)

5,844 $

2020

444

???

24,844

7,514

4,493

36,851

1,498 $

4

6,698

12,879

25,245

18,537

6,708

(28)

6,680

(1,601)

(72)

5,007

443

???

5,748

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning