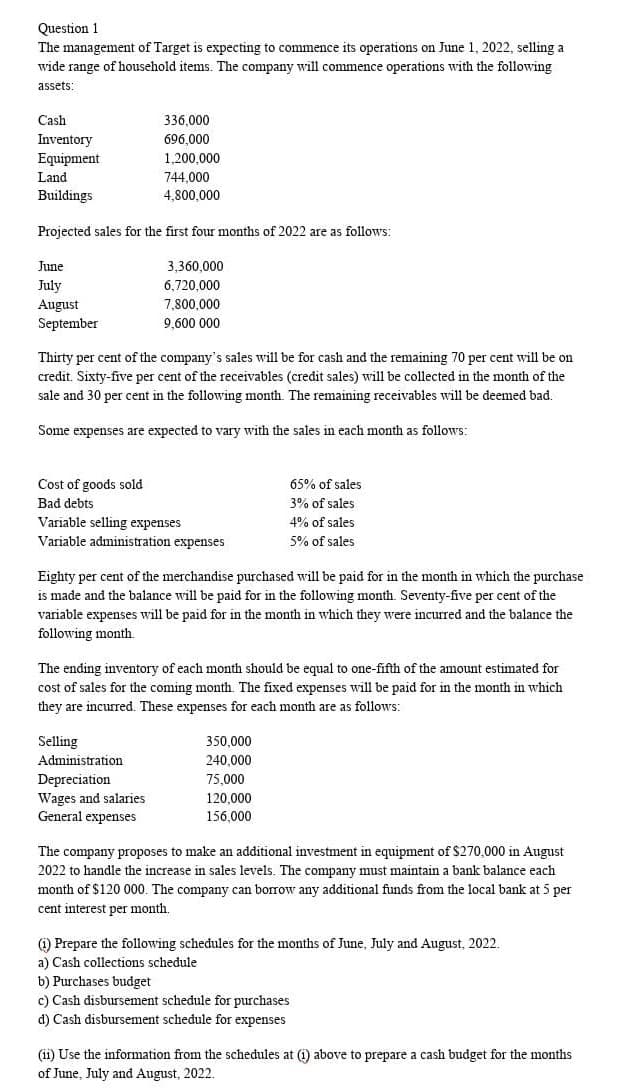

Question 1 The management of Target is expecting to commence its operations on June 1, 2022, selling a wide range of household items. The company will commence operations with the following assets: Cash Inventory Equipment 336,000 696,000 1,200,000 744,000 4,800,000 Land Buildings Projected sales for the first four months of 2022 are as follows: June 3,360,000

Question 1 The management of Target is expecting to commence its operations on June 1, 2022, selling a wide range of household items. The company will commence operations with the following assets: Cash Inventory Equipment 336,000 696,000 1,200,000 744,000 4,800,000 Land Buildings Projected sales for the first four months of 2022 are as follows: June 3,360,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 38E: Exercise 1-38 Identifying Current Assets and Liabilities Dunn Sporting Goods sells athletic clothing...

Related questions

Question

Transcribed Image Text:Question 1

The management of Target is expecting to commence its operations on June 1, 2022, selling a

wide range of household items. The company will commence operations with the following

assets:

Cash

Inventory

Equipment.

Land

Buildings

Projected sales for the first four months of 2022 are as follows:

June

July

August

September

336,000

696,000

1,200,000

Cost of goods sold

Bad debts

744,000

4,800,000

Thirty per cent of the company's sales will be for cash and the remaining 70 per cent will be on

credit. Sixty-five per cent of the receivables (credit sales) will be collected in the month of the

sale and 30 per cent in the following month. The remaining receivables will be deemed bad.

Some expenses are expected to vary with the sales in each month as follows:

3,360,000

6,720,000

7,800,000

9,600 000

Variable selling expenses

Variable administration expenses

Selling

Administration

Depreciation

Wages and salaries

General expenses

65% of sales

3% of sales

Eighty per cent of the merchandise purchased will be paid for in the month in which the purchase

is made and the balance will be paid for in the following month. Seventy-five per cent of the

variable expenses will be paid for in the month in which they were incurred and the balance the

following month.

4% of sales

5% of sales

The ending inventory of each month should be equal to one-fifth of the amount estimated for

cost of sales for the coming month. The fixed expenses will be paid for in t month in which

they are incurred. These expenses for each month are as follows:

350,000

240.000

75,000

120,000

156,000

The company proposes to make an additional investment in equipment of $270,000 in August

2022 to handle the increase in sales levels. The company must maintain a bank balance each

month of $120 000. The company can borrow any additional funds from the local bank at 5 per

cent interest per month.

(1) Prepare the following schedules for the months of June, July and August, 2022.

a) Cash collections schedule

b) Purchases budget

c) Cash disbursement schedule for purchases

d) Cash disbursement schedule for expenses

(ii) Use the information from the schedules at (1) above to prepare a cash budget for the months

of June, July and August, 2022.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning