5. You want to make a car-loan to buy a new car and you have two choices. Bank X charges 4.25% compounded quarterly on its auto loans. Bank Z charges 4.225% compounded bi-weekly on its auto loans. Which bank would you go for a new loan? Why?

5. You want to make a car-loan to buy a new car and you have two choices. Bank X charges 4.25% compounded quarterly on its auto loans. Bank Z charges 4.225% compounded bi-weekly on its auto loans. Which bank would you go for a new loan? Why?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 4P: Gifts Galore Inc. borrowed 1.5 million from National City Bank. The loan was made at a simple annual...

Related questions

Question

Qw.151.

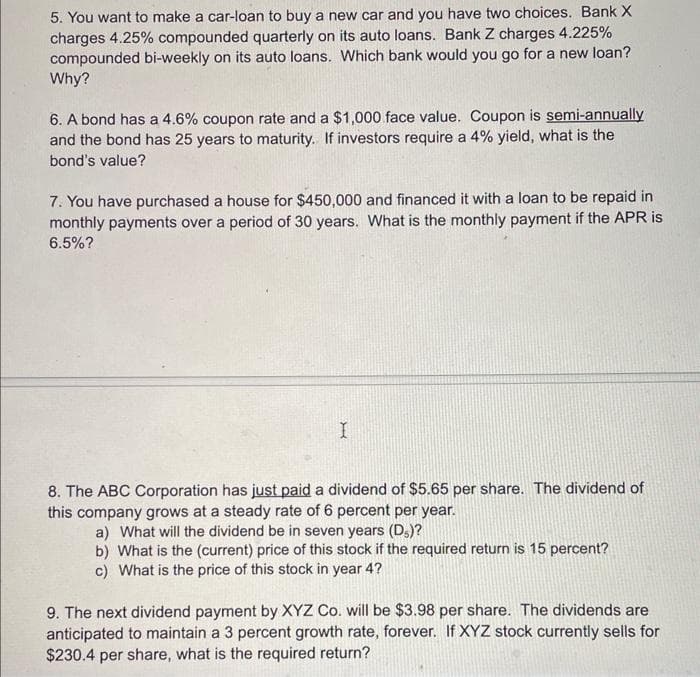

Transcribed Image Text:5. You want to make a car-loan to buy a new car and you have two choices. Bank X

charges 4.25% compounded quarterly on its auto loans. Bank Z charges 4.225%

compounded bi-weekly on its auto loans. Which bank would you go for a new loan?

Why?

6. A bond has a 4.6% coupon rate and a $1,000 face value. Coupon is semi-annually

and the bond has 25 years to maturity. If investors require a 4% yield, what is the

bond's value?

7. You have purchased a house for $450,000 and financed it with a loan to be repaid in

monthly payments over a period of 30 years. What is the monthly payment if the APR is

6.5%?

I

8. The ABC Corporation has just paid a dividend of $5.65 per share. The dividend of

this company grows at a steady rate of 6 percent per year.

a) What will the dividend be in seven years (D₂)?

b) What is the (current) price of this stock if the required return is 15 percent?

c) What is the price of this stock in year 4?

9. The next dividend payment by XYZ Co. will be $3.98 per share. The dividends are

anticipated to maintain a 3 percent growth rate, forever. If XYZ stock currently sells for

$230.4 per share, what is the required return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT