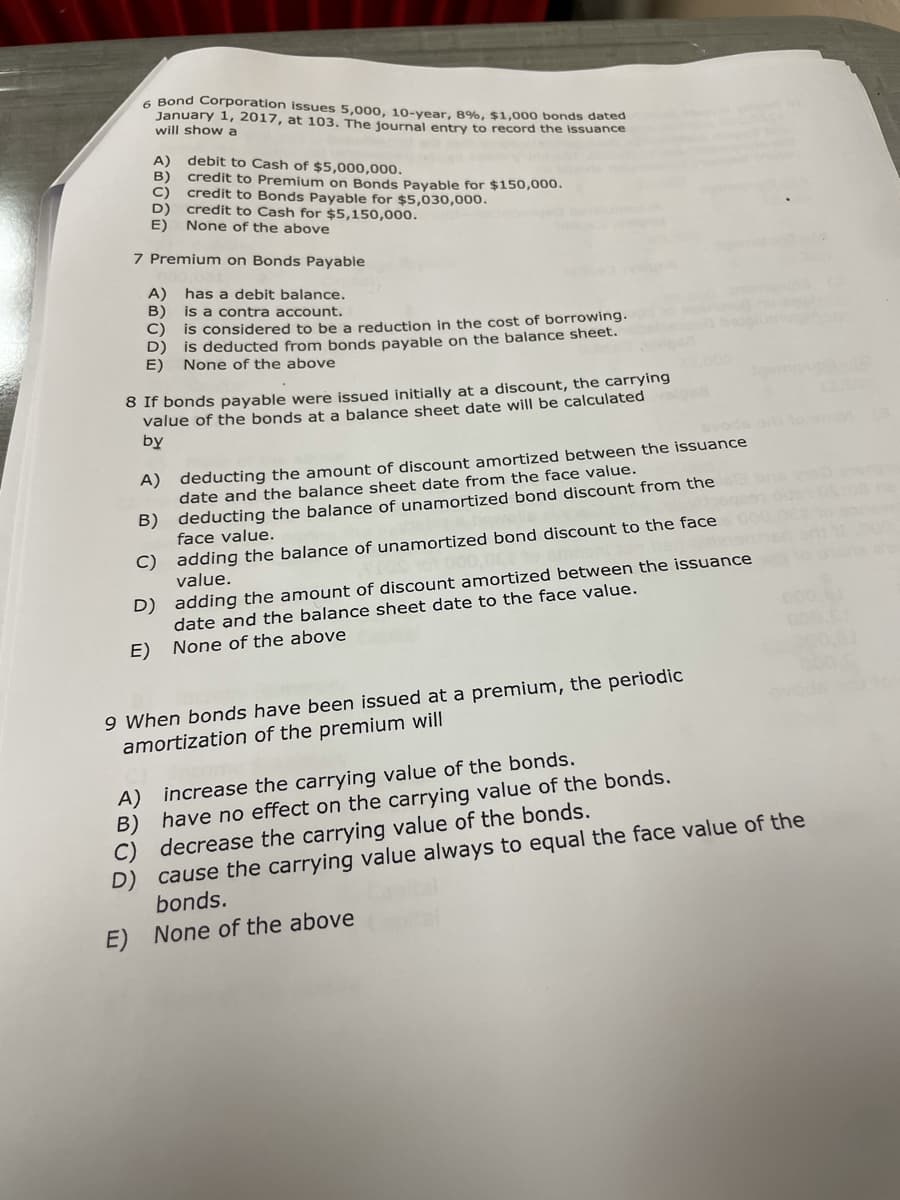

6 Bond Corporation issues 5,000, 10-year, 8%, $1,000 bonds dated January 1, 2017, at 103. The journal entry to record the issuance will show a A) debit to Cash of $5,000,000. credit to Premium on Bonds Payable for $150,000. C) credit to Bonds Payable for $5,030,000. B) D) credit to Cash for $5,150,000. E) None of the above 7 Premium on Bonds Payable A) has a debit balance. B) is a contra account. C) is considered to be a reduction in the cost of borrowing. D) is deducted from bonds payable on the balance sheet. E) None of the above 8 If bonds payable were issued initially at a discount, the carrying value of the bonds at a balance sheet date will be calculated by A) deducting the amount of discount amortized between the issuance date and the balance sheet date from the face value. B) deducting the balance of unamortized bond discount from the face value. C) adding the balance of unamortized bond discount to the face value. D) adding the amount of discount amortized between the issuance date and the balance sheet date to the face value. None of the above E)

6 Bond Corporation issues 5,000, 10-year, 8%, $1,000 bonds dated January 1, 2017, at 103. The journal entry to record the issuance will show a A) debit to Cash of $5,000,000. credit to Premium on Bonds Payable for $150,000. C) credit to Bonds Payable for $5,030,000. B) D) credit to Cash for $5,150,000. E) None of the above 7 Premium on Bonds Payable A) has a debit balance. B) is a contra account. C) is considered to be a reduction in the cost of borrowing. D) is deducted from bonds payable on the balance sheet. E) None of the above 8 If bonds payable were issued initially at a discount, the carrying value of the bonds at a balance sheet date will be calculated by A) deducting the amount of discount amortized between the issuance date and the balance sheet date from the face value. B) deducting the balance of unamortized bond discount from the face value. C) adding the balance of unamortized bond discount to the face value. D) adding the amount of discount amortized between the issuance date and the balance sheet date to the face value. None of the above E)

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PA: Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July...

Related questions

Question

Transcribed Image Text:6 Bond Corporation issues 5,000, 10-year, 8%, $1,000 bonds dated

January 1, 2017, at 103. The journal entry to record the issuance

will show a

A)

debit to Cash of $5,000,000.

B)

C)

credit to Premium on Bonds Payable for $150,000.

credit to Bonds Payable for $5,030,000.

D)

credit to Cash for $5,150,000.

E)

None of the above

7 Premium on Bonds Payable

A) has a debit balance.

B)

is a contra account.

C)

is considered to be a reduction in the cost of borrowing.

D)

is deducted from bonds payable on the balance sheet.

None of the above

E)

8 If bonds payable were issued initially at a discount, the carrying

value of the bonds at a balance sheet date will be calculated slo

by

A)

deducting the amount of discount amortized between the issuance

date and the balance sheet date from the face value.

B)

deducting the balance of unamortized bond discount from the be

face value.

C)

adding the balance of unamortized bond discount to the face

value.

D)

adding the amount of discount amortized between the issuance

date and the balance sheet date to the face value.

E)

None of the above

9 When bonds have been issued at a premium, the periodic

amortization of the premium will

A)

increase the carrying value of the bonds.

B) have no effect on the carrying value of the bonds.

C)

decrease the carrying value of the bonds.

cause the carrying value always to equal the face value of the

bonds.

E) None of the above

ne

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning