6. Assuming the donor is a resident citizen, what is the amount of the donation inter- vivos? a. P1,000,000 b. P1,400,000 c. P4,000,000 d. P4,400,000

Q: Zac Peterson’s estate reports the following information: Value of estate assets . . . .…

A:

Q: With $6,790,000 Paul's will creates a trust with the following provisions: life estate to Jacob…

A: The generation-skipping transfer tax is a statutory tax imposed when the property is transferred by…

Q: Manny, a resident citizen, made the following donations in 2021: To Mercy, a land worth P450,000 in…

A: The answer is stated below:

Q: Section 1015 – basis of property received as a gift is the basis of the property in the hands of the…

A: In case FMV is greater than adjusted basis, the carryover basis of donor will be basis of receiver.…

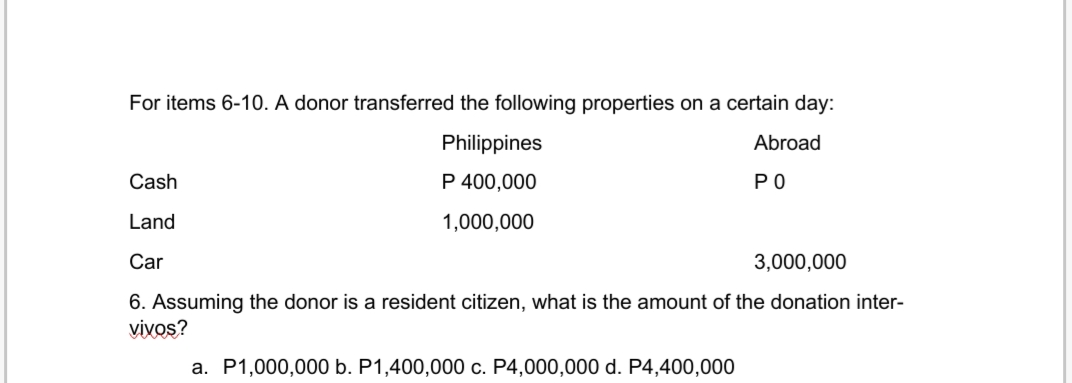

Q: For items 6-10. A donor transferred the following properties on a certain day: Philippines Abroad…

A: Donation Inter Vivos:- A Contract which takes place by the mutual consent of the giver who divests…

Q: purchased a piece of land in 2001 for P500,000 when it was worth 450,000. He transferred the…

A: The estate and gift tax is imposed on bequests at death and on inter-vivos (during lifetime) gifts.…

Q: Required: a. His AGI is $104,000. b. His AGI is $442,000. c. His AGI is $422,300, and his daughters…

A: Joint tax filing means when both the husband and wife file their tax together. A tax credit means a…

Q: For items 6-10. A donor transferred the following properties on a certain day: Philippines Abroad…

A: Donation Inter Vivos:- A Contract which takes place by the mutual consent of the giver who divests…

Q: Which is TRUE in family home? S1 If the decedent has five houses, the heirs may choose to claim from…

A: S1 If the decedent has five houses, the heirs may choose to claim from among the houses a family…

Q: Mr. Masigasig created a trust in favor of Pedro. A large sum entrusted to BDO (Trustee), the income…

A: Statement of income of trust Income from business Gross income of trust 3,000,000…

Q: According to the FASB, net assets with donor restrictions are released from restrictions: A. At the…

A: Assets are the resources owned by an entity for the purpose of using them or selling them…

Q: For items 6-10.A donor transferred the following properties on a certain day: Cash Land Car…

A: we will only answer the first question , for the remianing question kindly resubmit the question…

Q: 9. Assuming the donor is a non-resident alien, what is the amount of the donation inter- vivos? a.…

A: answer: b. P1,400,000

Q: Juliet, a Filipina made the following donations: To Nick Land in Manila 450,000 To Rosalee…

A: Taxable Income:- Taxable income is defined as the part of a person’s or corporation’s income that is…

Q: A donor gives Charity 1 $50,000 in cash that it must convey to Charity 2. However, the donor can…

A: Here the donor has retained the right to revoke the gift anytime prior to its conveyance to the…

Q: 5. A resident citizen died, leaving the following properties at the point of his death: Fair Value…

A: Donation Mortis Causa-:A gift in the possibility of the death of a person. When an individual in his…

Q: Juliet, a Filipina made the following donations. a. To Nick, a land worth P450,000 in Manila. b.…

A: The gift tax is a federal tax applied to an individual giving money or valuable items such as…

Q: Question #44 of 85 Question ID: 1251825 Which of the following are correct statements regarding a…

A: Option number A will be the correct answer.

Q: Compute for the following: 1. Compute for the Gross estate 2. The net estate 3. The estate tax…

A: The gross estate is the total amount of assets held by the deceased person at the time of his or her…

Q: Which of the following is a permanent difference? Donations received Interest on savings deposit…

A: Solution: Dividends from a domestic corporation is a permanent difference as certain portion of…

Q: G transferred $20,000,000 to Trust T. Trust T was an irrevocable trust which provided for income to…

A: Gift is an amount which the donor donates to the other person. The other person can be a trust as…

Q: Which of the following will a Notice of Donation is needed? Donated P90,000 worth of medical…

A: The correct answer for the above mentioned question I given in the following steps for your…

Q: Zac Peterson’s estate reports the following information: What is the taxable estate value?

A: Note: Federal estate tax is a tax on the right to transfer the property. The calculation starts by…

Q: Mr

A: Solution; Taxes are due James Santiago II Gross income = P 800,000 Addition: A total of $ 300,000…

Q: Which of the following is a charitable lead trust? Choose the correct.a. The income of the trust…

A: Identify the correct option for the given statement. Option a: The income of the trust fund goes…

Q: 10. Assuming the donor is a non-resident alien with a reciprocity exemption, what is the amount of…

A: Answer: option b

Q: E 19-3 Multiple choice Which of the following is considered an exchange transaction under GASB…

A: Hi, since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Which of the following is a specific legacy? The gift of all remaining estate property to a…

A: A specific legacy is a gift of personal property which is "specifically' identifiable object in the…

Q: gross income?

A: Gross income refers to the amount that a person or institution earned from the business operations…

Q: Jaylen made a charitable contribution to his church in the current year. He donated common stock…

A: Given that: Donated common stock = $32050 Investment = $16000 AGI = $81000

Q: A family has a net worth of $165,000 and liabilities of $176,000. What is the amount of their…

A: Net worth can be defined as the accurate worth of an individual or an organization after adjusting…

Q: 2. The gift tax payable of Mr. Alba on the July 14 donation is Mr. and Mrs. Alba gave the following…

A: As per Section 98 There shall be levied, assessed, collected and paid upon the transfer by any…

Q: Question ID: 1251900 All of the following statements regarding charitable remainder annuity trusts…

A: Charitable remainder trusts are a trust set up to divide the estate of the insured between their…

Q: A gift is valued at the date of* the death of the donor. notarization of the deed of donation.…

A: Taxation: Taxation refers to the imposition of compulsory financial obligations by the government on…

Q: usiness income ng expenses including SSS and Philhealt utions to government for priority project…

A: Given:

Q: A donor gives Charity 1 $50,000 in cash that it must convey to Charity 2. However, the donor can…

A: In the given case, the donor maintains the control over the asset contributed and the donor does not…

Q: Which of the following is a specific legacy? Choose the correct.a. The gift of all remaining estate…

A:

Q: Question #2 of 85 If a transferor is concerned about shielding his assets from a creditor, which of…

A: Introduction: A transferor is concerned with keeping his assets safe from a creditor. He needs to…

Q: Use the following data for the next two questions: Jhon, a NON-RESIDENT ALIEN, died on NOV. 2, 2018,…

A: The net taxable estate is calculated for determining the tax liability of a nonresident alien.

Q: The estate of Nancy Hanks reports the following information: What is the taxable estate value?…

A: The Order of reduction of items from gross value to derive taxable estate value is as follows:…

Q: Han Geu Ru, a resident alien, made the following donations during the year: * SOUTH KOREA DONATION…

A: Donors tax refers to the form of tax which is levied on the donations or gifts and it is imposed on…

Q: Marco made the following donations to his children in 2021: To Juan - Argicultural land in Nueva…

A: In Philippine Donor’s tax for each calendar year shall be six percent (6%) computed on the basis of…

Q: donor transferred the following properties on a certain day: Philippines Abroad Cash P 400,000 P 0…

A: Donation Inter Vivos:- A Contract which takes place by the mutual consent of the giver who divests…

Step by step

Solved in 2 steps

- A donor gave the following donations during 2021: March 5 – Land located in the Philippines valued at P3,000,000.00 to her uncle subject to the condition that the latter will pay the donor’s tax due and unpaid mortgage amounting to P500,000.00. May 1 – Land located in Makati City valued at P1,950,000 to her daughter, on account of marriage December 30 – Building in Australia valued at P3,500,000.00 to her Donor’s tax paid in Australia was P250,000.00. Questions: Compute the donor's tax payable on the March 5 donation.Angel, married resident alien, died on January 15, 2021. She left the following properties, expenses and obligations: Community properties, Philippines (including family home valued at P1,800,000) P8,000,000 Community properties, Abroad 2,000,000 Exclusive properties, Philippines 3,000,000 Claims against the estate (Common) 300,000 Devise to National Gov’t included in Common Properties 500,000 Legacy to Local Gov’t included in exclusive properties 700,000 Compute for the following: 1. Compute for the Gross estate 2. The net estate 3. The estate tax due and payableOn January 1, 20x1, Entity A receives a financial aid from the government amounting to ₱1M as compensation for losses it has incurred on a recent calamity. How much income from government grant will Entity A recognize in 20x1? 1,000,000 3 53,334 100,000 4. 0

- Carding received the following during the year: 200,000 car as donation; 50,000 income of donated property before donation; 30,000 income from donated property after donation; 100,000 inherited properties. How much is excluded from gross income? P380,000 P350,000 P50,000 P30,000Zahid donated P500,000 to a religious institution. During the year, the total receipts from donations of the religious institution was P1,000,000. Its total administrative expenses amounted to P400,000. How much was the total exempt gift?Ana, a self-employed resident citizen provided the following data for 2018 taxable year:Sales P2,800,000Cost of sales 1,125,000Business expenses 650,000Interest income from peso bank deposit 80,000Interest income from bankdeposit under FCDS 120,000Gain on sale of land in the Philippines held ascapital asset with cost P1.5Mwhen zonal is P1.2M 500,000 How much is the total income tax expense of Ana for the year? * P342,500 P321,500 P358,000 P351,500 How much is the total income tax of Ana assuming she opted to be taxed at 8%? * P321,500 P358,000 P342,500 P351,500 Assuming Ana is a VAT-registered taxpayer, how much is her total income tax expense assuming she opted to be taxed at 8% income tax rate? * P342,500 P351,500 P321,500 P358,000 Using the same date except that her gross sales for the year was P3.8M, how much is her total income tax expense assuming she opted to be taxed at 8% income tax rate? * P351,500 P321,500 P342,500 P652,000

- Ana, a self-employed resident citizen provided the following data for 2018 taxable year:Sales P2,800,000Cost of sales 1,125,000Business expenses 650,000Interest income from peso bank deposit 80,000Interest income from bankdeposit under FCDS 120,000Gain on sale of land in the Philippines held ascapital asset with cost P1.5Mwhen zonal is P1.2M 500,000 Using the same date except that her gross sales for the year was P3.8M, how much is her total income tax expense assuming she opted to be taxed at 8% income tax rate? * P351,500 P321,500 P342,500 P652,000Juliet, a Filipina made the following donations: To Nick Land in Manila 450,000 To Rosalee Jewelry in Japan 100,000 To Adalind PLDT Shares 150,000 To Renard Building in Italy with mortgage of P50,000 assumed by the done 1,600,000 To Drew Land in Davao 300,000 To Hank Cash in PNB New York 300,000 REQUIREMENT: DONOR’S TAX DUE5-6 Inday is settling the estate of his husband Nicanor, who died intestate. The following are the summary of the details of Nicanor’s properties in connection with the processing and payment of his estate tax: Location of properties Philippines New Zealand Gross estate 8,000,000 10,000,000 Allowable Deductions 5,000,000 4,000,000 Net estate 3,000,000 6,000,000 Estate tax paid Php 600,000 How much is the ESTATE TAX PAYABLE?

- Nicanor made the following donations to his children in 2021: To Jose – Agricultural land in Nueva Ecija (Zonal value Php 5 Million; Assessed value Php 4 Million) made on January 31, 2021. To Boni – New car worth Php 5 Million made on March 22, 2021 To Goyo – Cash in the amount of Php 5 Million made on April 19, 2021 1. How much is the donor’s tax to be paid on January 31, 2021? 2. How much is the donor’s tax to be paid on March 22, 2021? 3. How much is the donor’s tax to be paid on April 19, 2021?Which of the following is a specific legacy? Choose the correct.a. The gift of all remaining estate property to a charity.b. The gift of $44,000 cash from a specified source.c. The gift of $44,000 cash.d. The gift of 1,000 shares of stock in IBM.A donor gives Charity 1 $50,000 in cash that it must convey to Charity 2. However, the donor can reconsider and revoke the gift at any time prior to its conveyance to Charity 2. Which of the following statements is true?a. Charity 1 should report a contribution revenue.b. The donor continues to report an asset even after it is given to Charity 1.c. As soon as the gift is made to Charity 1, Charity 2 should recognize a contribution revenue.d. As soon as the gift is made to Charity 1, Charity 2 should recognize an asset.