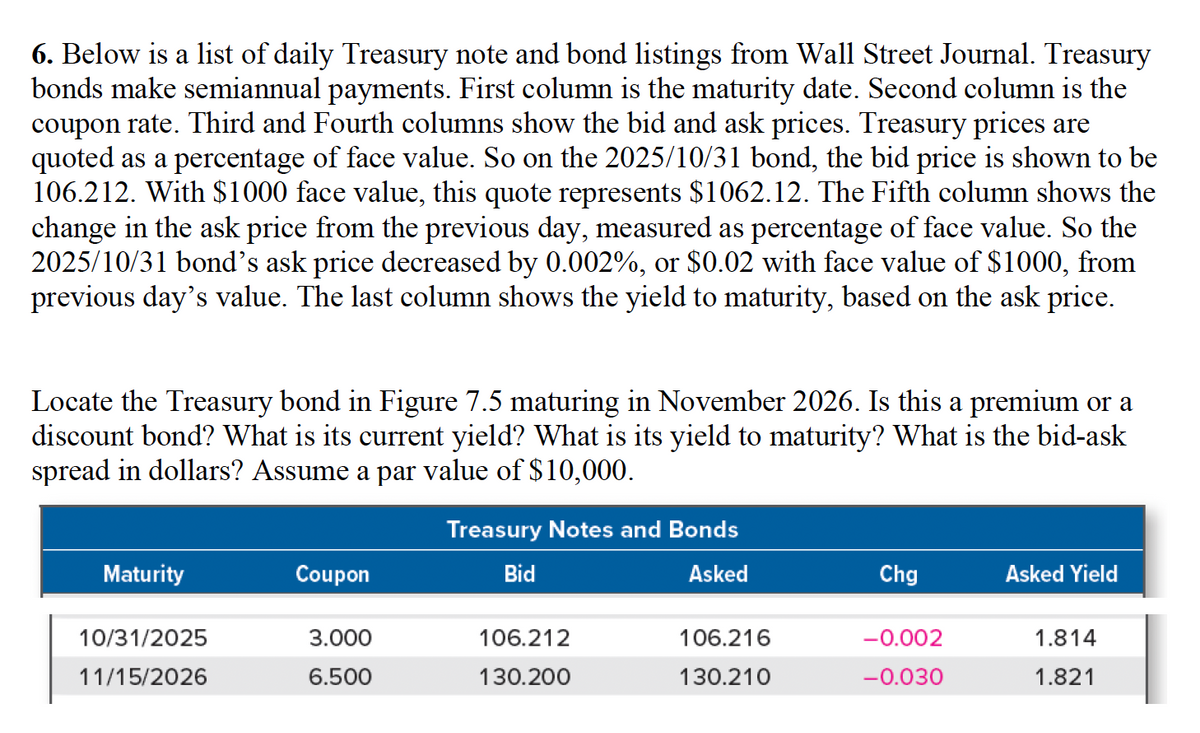

6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury bonds make semiannual payments. First column is the maturity date. Second column is the coupon rate. Third and Fourth columns show the bid and ask prices. Treasury prices are quoted as a percentage of face value. So on the 2025/10/31 bond, the bid price is shown to be 106.212. With $1000 face value, this quote represents $1062.12. The Fifth column shows the change in the ask price from the previous day, measured as percentage of face value. So the 2025/10/31 bond's ask price decreased by 0.002%, or $0.02 with face value of $1000, from previous day's value. The last column shows the yield to maturity, based on the ask price. Locate the Treasury bond in Figure 7.5 maturing in November 2026. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in dollars? Assume a par value of $10,000. Maturity 10/31/2025 11/15/2026 Coupon 3.000 6.500 Treasury Notes and Bonds Bid Asked 106.212 130.200 106.216 130.210 Chg -0.002 -0.030 Asked Yield 1.814 1.821

6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury bonds make semiannual payments. First column is the maturity date. Second column is the coupon rate. Third and Fourth columns show the bid and ask prices. Treasury prices are quoted as a percentage of face value. So on the 2025/10/31 bond, the bid price is shown to be 106.212. With $1000 face value, this quote represents $1062.12. The Fifth column shows the change in the ask price from the previous day, measured as percentage of face value. So the 2025/10/31 bond's ask price decreased by 0.002%, or $0.02 with face value of $1000, from previous day's value. The last column shows the yield to maturity, based on the ask price. Locate the Treasury bond in Figure 7.5 maturing in November 2026. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in dollars? Assume a par value of $10,000. Maturity 10/31/2025 11/15/2026 Coupon 3.000 6.500 Treasury Notes and Bonds Bid Asked 106.212 130.200 106.216 130.210 Chg -0.002 -0.030 Asked Yield 1.814 1.821

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury

bonds make semiannual payments. First column is the maturity date. Second column is the

coupon rate. Third and Fourth columns show the bid and ask prices. Treasury prices are

quoted as a percentage of face value. So on the 2025/10/31 bond, the bid price is shown to be

106.212. With $1000 face value, this quote represents $1062.12. The Fifth column shows the

change in the ask price from the previous day, measured as percentage of face value. So the

2025/10/31 bond's ask price decreased by 0.002%, or $0.02 with face value of $1000, from

previous day's value. The last column shows the yield to maturity, based on the ask price.

Locate the Treasury bond in Figure 7.5 maturing in November 2026. Is this a premium or a

discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask

spread in dollars? Assume a par value of $10,000.

Maturity

10/31/2025

11/15/2026

Coupon

3.000

6.500

Treasury Notes and Bonds

Bid

Asked

106.212

130.200

106.216

130.210

Chg

-0.002

-0.030

Asked Yield

1.814

1.821

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College