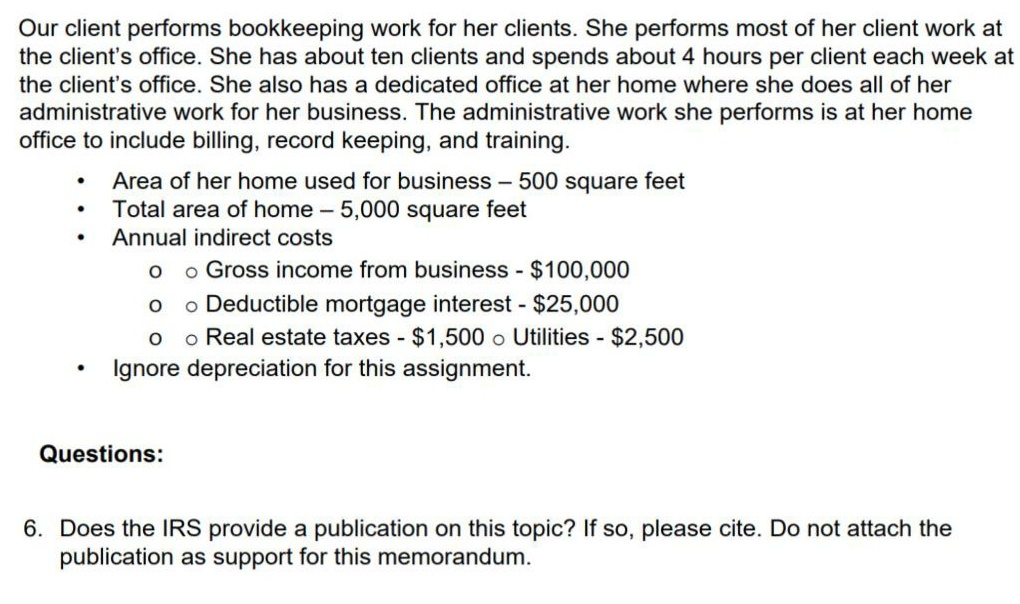

6. Does the IRS provide a publication on this topic? If so

Q: DuPage Company purchases a factory machine at a cost of $18,000 on January 1, 2010. DuPage expects…

A: The correct answer for the above mentioned question is given in the following steps for you…

Q: Pell Corporation’s Property, Plant, and Equipment and Accumulated Depreciation accounts had the…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following…

A: Since you have posted a question with multiple parts. we will be answering you first three subparts…

Q: he following information for ABCs Projects is available: MARCH APRIL MAY JUNE JULY AUGUS T…

A: A Cash Budget is one of the various budgets prepared by the business organization. A Cash Budget is…

Q: The federal corporate income tax rate is 35 percent and firms may carry-back losses for two years…

A: Net taxes paid is amount that need to be paid to the government. Tax refund or tax offset is the…

Q: The break-even point can be calculated with the following formula: Total fixed expenses / (Variable…

A: Break-even point = Total fixed expenses / (Selling price per unit - Variable cost per unit)

Q: The wholesale cost of a desk is $490. The original markup was 67% based on selling price. Find the…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Prepare the journal entry for the following transactions (1) Geysler Company sold some old equipment…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Find the percent markup based on selling price, if the percent markup based on the cost is 18%.

A: Solution... Markup on cost = 18% Markup on sales = ?

Q: Why are elasticities useful to managers? What are the most prevalence and useful elasticities? Why…

A: Price elasticity of demand refers to as the proportionate change in the quantity demanded due to a…

Q: nded c -ments

A: Loan amount was paid every month and interest rate compounded quarterly with making end of every…

Q: Discuss the various types of business-type funds used in governmental units and provide an example…

A: The two types of business-type funds used in governmental units are-: 1. Enterprise funds 2.…

Q: Problem #2: AMA cooperative store had the following activities for year ended 2021: grös3 sales…

A: Net sales is the sales after any discount or return and allowances. Gross profit is the amount which…

Q: Hurtt’s Java Seeds is an independent roaster of specialty coffee beans. The company budgets 2 months…

A: Particular Amount beginning direct material inventory $5,000 (+) Cost of Direct Material…

Q: ansactions in February 2022: Sales to local customers - $1,300,000 (VAT inclusive) Sales to local…

A: Value-added tax: Value-added tax or VAT refers to the indirect tax which is levied on the…

Q: SCHEDULE OF EXPANDED WITHHOLDING TAX (EWT) Income Payment EWT Income Payment EWT…

A: Expenses like rent, professional fees, sub-contracted services are subject to withholding tax in…

Q: Halcrow Yolles purchased equipment for new highway construction in Manitoba, Canada, costing…

A: Depreciation is an accounting method for allocating the cost of a tangible or physical asset over…

Q: 3. Using the format demonstrated in your textbook - Prepare the following budgets (be sure to…

A: Here Student asked for Multi sub part question we will solve for first three sub part question for…

Q: McKenzie’s Soap Sensations, Inc., produces hand soaps with three different scents: morning glory,…

A: Solution Joint cost are cost that are incurred from buying or producing the two products at the…

Q: Problem #2: AMA cooperative store had the following activities for year ended 2021: gross sales…

A: Lets understand the basics. Income statement is prepared by the organization to know the income and…

Q: Ending Partner balances Burns and Allan have formed a partnership and invested $20.000 and $40,000,…

A: Lets understand the basics. Partnership is an agreement between two or more person who works…

Q: Prepare bank Reconciliation statement

A: Answer:

Q: entxies JOUnal Green Company sells goods to Thumb Inc. on account on January 1, 2017.The goods have…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Finch Company began its operations on March 31 of the current year. Finch has the following…

A: Calculation of cash expense for April month Particulars Amount Manufacturing cost (156800*3/4)…

Q: The business paid cash for the goods which was purchased on credit last month. Which of the…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: 10. The following information is for Grimsley Electrical Supplies Inc. payroll for the week ending…

A: Payroll Payroll is considered to be important in the business which can be timely payment is…

Q: 4. Department B (the final production process) had 3,000 units in Work in Process that was 25%…

A: "Since you have posted a question with multiple sub parts, we will solve first three sub parts for…

Q: On January 1, 2021, the Marjlee Company began construction of an office building to be used as its…

A: Interest Capitalized=Interest on specific construction loan+Interest at Average cost of borrowing

Q: The following information has been extracted from the records of Marie Company about one of its…

A: Inventory methods: Inventory methods are the accounting techniques applied by manufacturing entities…

Q: Denmark Torralba did not file his income tax return for the calendar year 2022 which was due for…

A: A tax is generally defined as a mandatory expense that is imposed on the income of particular…

Q: Income statement?

A: Answer:

Q: Required: Journal entries to record transactions of 2021 to determine the following 1. Total amount…

A: Shareholders Equity Shareholders equity which consist of both equity shares and preference shares…

Q: Bettinghaus Corporation began business on January 2, 2019, with five employees. Its sick leave and…

A: The financial statements which covers a period of less than one year is known as interim financial…

Q: Hurtt’s Java Seeds is an independent roaster of specialty coffee beans. The company budgets 2 months…

A: Standard Production Cost=Direct material+Direct labor+Variable Overhead+Fixed Overhead

Q: The following data relates to the operation of a company over a period of two years; year 1: 12,000…

A: Answer is option C = 22,680 Units Cost Inflation Index Cost Before Inflation…

Q: Chan Company received a bill totaling $3,700 for machine parts used in maintaining factory…

A: Journal entry means the book of original entry where the first time transaction is recorded. After…

Q: For each ratio listed, identify whether the change in ratio value from the Prior Year te favorable…

A: Ratio analysis is one of the various tools to analyze financial statements. Ratio analysis tests…

Q: h. [Page-89] The Kenosha Company has three product lines of beer mugs-A, B, and C-with contribution…

A: Solution The break even point of an entity with multiple products (sales mix) is computed by…

Q: Last year, YG had P250,000,000 of sales and P100,000,000 of fixed assets, so its FA/Sales ratio was…

A: Sales Revenue: The amount which a company gets from the sale of disposals of their manufactured…

Q: cord July

A: Answer Good will = P-(A-L) given P= 70,000,000 A= 115,000,000 L=52,500,000

Q: a)Evaluate the case in your own word.

A: Leander is laible to pay extra cost (jason has incurred.) If contract availbale before december…

Q: Jenkins Corporation had $675,000 of taxable income for 2018 and $575,000 for 2019. What is the…

A: Tax is the mandatory contribution by the taxpayer to the government. The tax is paid as a percentage…

Q: First Cost - P5M First cost - P8,914,223 Annual operating cost - PO.2M Annual operating cost -…

A: PV stands for Present value which refers to the present or the current value of the future amount of…

Q: General Computers Inc. purchased a computer server by taking a loan of $36,500 at 3.50% compounded…

A: The question is based on the concept of Financial Accounting.

Q: Beginning inventory, purchases, and sales for Item Copper are as follows: Mar. 1 Inventory 450 units…

A: FIFO states that the inventory purchased first would be sold first by the company. Whereas, LIFO…

Q: 1. How is the flexible budget used within the variance analysis system to evaluate effectiveness and…

A: 1) Flexible budget refers to a budget that flexes with change in volume or change in activity. It is…

Q: Number Cost of Units per Unit Beginning inventory 130 $71 Purchased goods during the period 240 80…

A: Formula: Goods available for sale in units = Beginning inventory + Purchases

Q: Is all accounting income taxable? is there any accounting income that is not taxable? Please Explain…

A: After all necessary expenses have been removed from sales revenue, accounting income is the profit…

Q: MC27 On November 1, 2019, a newly established manufacturing outfit paid cash to acquire a patent for…

A: Amortization Allocation of costs to the asset over an estimated life is known as amortization…

Q: Prepare an income statement through gross profit for Bellingham Company for the month ending March…

A: Interpretation of data given: Standard Quantity=2.5*15000*3.75=1,40,625 Standard…

Step by step

Solved in 2 steps with 2 images

- Dave Elliott, CPA, is an assistant to the controller of Lyric Consulting Co. In his spare time, Dave also prepares tax returns and performs general accounting services for clients. Frequently, Dave performs these services after his normal working hours, using Lyric Consulting Co.’s computers and laser printers. Occasionally, Dave’s clients will call him at the office during regular working hours.Discuss whether Dave is performing in a professional manner.Tim is the vice president of western operations for Maroon Oil Company and is stationed in San Francisco. He is required to live in an employer-owned home, which is three blocks from his company office. The company-provided home is equipped with high-speed internet access and several telephone lines. Tim receives telephone calls and e-mails that require immediate attention any time of day or night, as the company's business is spread all over the world. A full-time administrative assistant resides in the house to assist Tim with urgent business matters. Tim often uses the home for entertaining customers, suppliers, and employees. The fair market value of comparable housing is $9,000 per month. Tim is also provided with free parking at his company's office. The value of the parking is $370 per month. Question Content Area a. Complete the statements below regarding Tim's exclusion issue and what he must include in his gross income for 2023. Section 119 excludes from income the…Richard has been a highly regarded employee of the Brier Corporation for almost 20 years. Her loyalty to the company is reflected in her dedication to her job as a general accounting clerk, from which she has not taken a vacation in almost 12 years. Because of her dedication and long tenure, she has acquired many related responsibilities, which have allowed Brier Corporation to reduce its workforce through attrition, control salary expenses and become more efficient and competitive. The following describes Richard's responsibilities. Richard receives copies of credit sales orders from the sales department. She accesses the AR subsidiary ledger from her office computer and records the AR from these documents. She then records the sale in the sales journal and posts the transactions to the general ledger accounts. Cash receipts in payment of customer AR come directly to her office. She records the cash receipts in the GL cash and AR accounts and updates the AR subsidiary ledger. She…

- Richard has been a highly regarded employee of the Brier Corporation for almost 20 years. Her loyalty to the company is reflected in her dedication to her job as a general accounting clerk, from which she has not taken a vacation in almost 12 years. Because of her dedication and long tenure, she has acquired many related responsibilities, which have allowed Brier Corporation to reduce its workforce through attrition, control salary expenses and become more efficient and competitive. The following describes Richard's responsibilities. Richard receives copies of credit sales orders from the sales department. She accesses the AR subsidiary ledger from her office computer and records the AR from these documents. She then records the sale in the sales journal and posts the transactions to the general ledger accounts. Cash receipts in payment of customer AR come directly to her office. She records the cash receipts in the GL cash and AR accounts and updates the AR subsidiary ledger. She…For the past 11 years, Elaine Wright has been an employee of the Star-Bright Electrical Supply store. Elaine is a very diligent employee who rarely calls in sick and staggers her vacation days throughout the year so that no one else gets bogged down with her tasks for more than one day. Star-Bright is a small store that employs only four people other than the owner. The owner and one of the employees help customers with their electrical needs. One of the employees handles all receiving, stocking, and shipping of merchandise.Another employee handles the purchasing, payroll, general ledger, inventory, and AP functions. Elaine handles all of the point-of-sale cash receipts and prepares the daily deposits for the business. Furthermore, Elaine opens the mail and deposits all cash receipts (about 30 percent of the total daily cash receipts). Elaine also keeps the AR records and bills the customers who purchase on credit.Point out any control weaknesses you see in the scenario. List some…Hayim Accardi is the accounting manager for a small, local firm that has full- and part-time staff. How do FLSA guidelines regarding working hours apply to Hayim's employees?

- Mary Tan is the controller for Duck Associates, a property management company in Portland, Oregon. Each year, Tan and payroll clerk Toby Stock meet with the external auditors about payroll accounting. This year, the auditors suggest that Tan consider outsourcing Duck Associates' payroll accounting to a company specializing in payroll processing services. This would allow Tan and her staff to focus on their primary responsibility: accounting for the properties under management. At present, payroll requires 1.5 employee positions—payroll clerk Toby Stock and a bookkeeper who spends half her time entering payroll data in the system. Tan considers this suggestion, and she lists the following items relating to outsourcing payroll accounting: The current payroll software that was purchased for $4,000 three years ago would not be needed if payroll processing were outsourced. Duck Associates' bookkeeper would spend half her time preparing the weekly payroll input form that is given to the…Mary Tan is the controller for Duck Associates, a property management company in Portland, Oregon. Each year, Tan and payroll clerk Toby Stock meet with the external auditors about payroll accounting. This year, the auditors suggest that Tan consider outsourcing Duck Associates’ payroll accounting to a company specializing in payroll processing services. This would allow Tan and her staff to focus on their primary responsibility: accounting for the properties under management. At present, payroll requires 1.5 employee positions: payroll clerk Toby Stock and a bookkeeper who spends half her time entering payroll data in the system. Tan considers this suggestion, and she lists the following items relating to outsourcing payroll accounting: a. The current payroll software that was purchased for $4,000 three years ago would not be needed if payroll processing were outsourced. b. Duck Associates’ bookkeeper would spend half her time preparing the weekly payroll input form that is…Mary Tan is the controller for Duck Associates, a property management company in Portland, Oregon. Each year, Tan and payroll clerk Toby Stock meet with the external auditors about payroll accounting. This year, the auditors suggest that Tan consider outsourcing Duck Associates’s payroll accounting to a company specializing in payroll processing services. This would allow Tan and her staff to focus on their primary responsibility: accounting for the properties under management. At present, payroll requires 1.5 employee positions—payroll clerk Toby Stock and a bookkeeper who spends half her time entering payroll data in the system. Tan considers this suggestion, and she lists the following items relating to outsourcing payroll accounting: The current payroll software that was purchased for $4,000 three years ago would not be needed if payroll processing were outsourced. Duck Associates’s bookkeeper would spend half her time preparing the weekly payroll input form that is given to the…