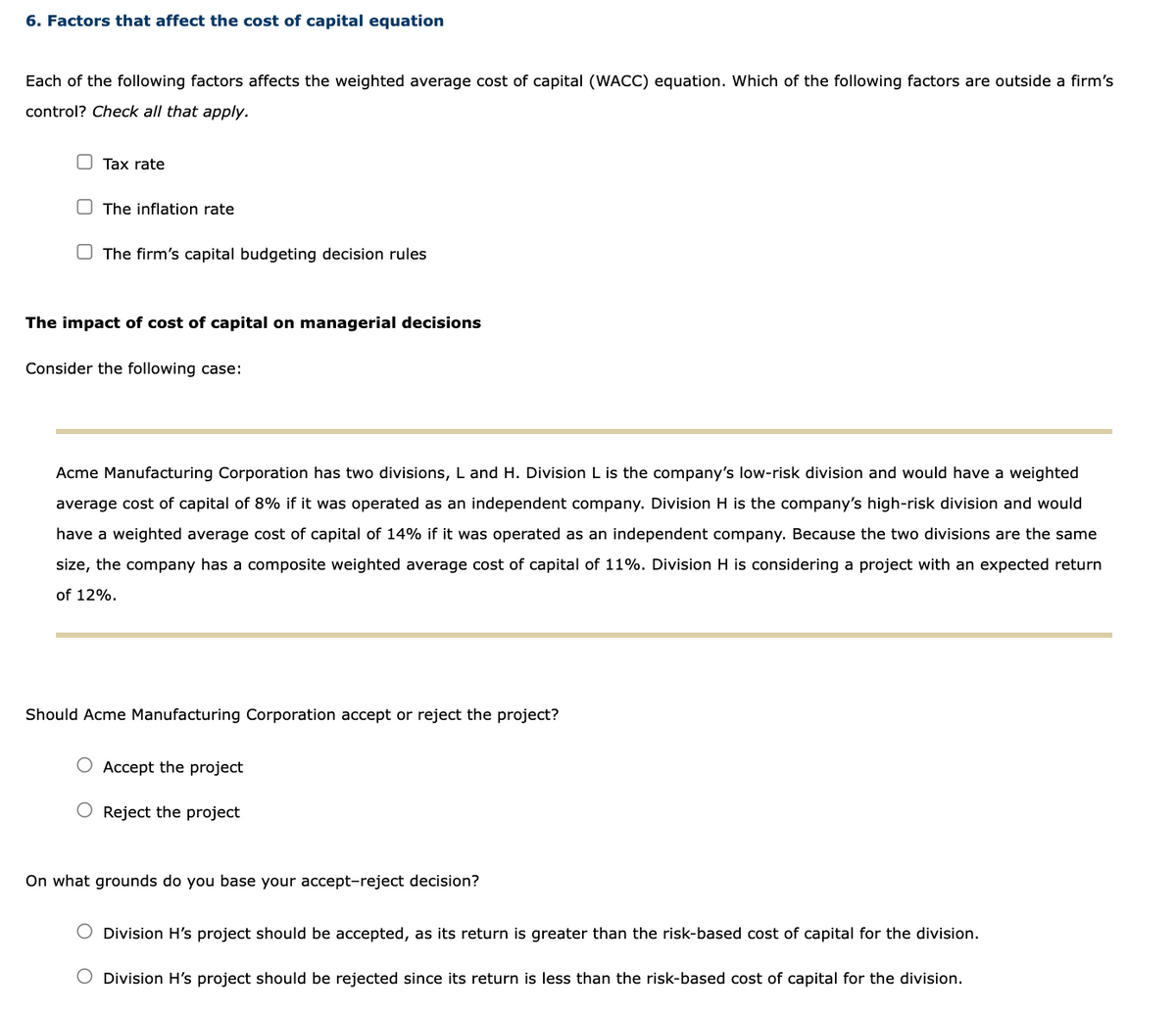

6. Factors that affect the cost of capital equation Each of the following factors affects the weighted average cost of capital (WACC) equation. Which of the following factors are outside a firm's control? Check all that apply. Tax rate The inflation rate The firm's capital budgeting decision rules The impact of cost of capital on managerial decisions Consider the following case: Acme Manufacturing Corporation has two divisions, L and H. Division L is the company's low-risk division and would have a weighted average cost of capital of 8% if it was operated as an independent company. Division H is the company's high-risk division and would have a weighted average cost of capital of 14% if it was operated as an independent company. Because the two divisions are the same size, the company has a composite weighted average cost of capital of 11%. Division H is considering a project with an expected return of 12%. Should Acme Manufacturing Corporation accept or reject the project? O Accept the project O Reject the project On what grounds do you base your accept-reject decision? O Division H's project should be accepted, as its return is greater than the risk-based cost of capital for the division. O Division H's project should be rejected since its return is less than the risk-based cost of capital for the division.

Dividend Policy

A dividend is a part of the profit paid to the shareholder in an organization. The management of the organization has the right to decide the policy for giving a dividend from the earnings to the shareholder. However, an organization is not in the obligation to declare a dividend for the investor. Dividend policy differs from organization to organization. As the management has the only authority to decide dividend rate, dividend amount, and time of dividend payout by considering all other elements that create an impact on the payment of a dividend.

Stocks And Dividends

Stock or equities are generally sold and bought in the Stock Exchange or which is popularly known as the stock market. Stocks are issued in the Stock Exchange for the sole purpose of raising funds for the Corporation or the company itself. Now since an individual has purchased a portion of the Corporation or company, he or she may claim to be a part of the earnings or profit of the company.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps