6. If current assets are P270,000 and total assets are P810,000, what percentage of total assets are current assets? a) 3.5 percent 7. Comparing the amount of a balance sheet item in one year to the amount for the same item in a prior year is called a) common-size analysis. c) horizontal analysis. 8. A firm has liabilities of P30,000 and owner's capital of P90,000. The percentage of total liabilities to total assets is b) 30 percent c) 25 percent d) 33 percent b) vertical analysis. d) ratio analysis. c) 50 percent. d) 75 percent. a) 25 percent. 9. A firm had owner's capital of P150,000 in 2013 and P187,500 in 2013. The increase in owner's capital from 2013 to 2014 is a) 12.5 percent. 10. If long-term liabilities are P300,000 and total assets are P2,100,000, what percentage of total assets are long-term liabilities? a) 7 percent b) 20 percent. b) 20 percent. c) 25 percent. d) 125 percent. b) 16.7 percent c) 12.5 percent d) 14.3 percent

6. If current assets are P270,000 and total assets are P810,000, what percentage of total assets are current assets? a) 3.5 percent 7. Comparing the amount of a balance sheet item in one year to the amount for the same item in a prior year is called a) common-size analysis. c) horizontal analysis. 8. A firm has liabilities of P30,000 and owner's capital of P90,000. The percentage of total liabilities to total assets is b) 30 percent c) 25 percent d) 33 percent b) vertical analysis. d) ratio analysis. c) 50 percent. d) 75 percent. a) 25 percent. 9. A firm had owner's capital of P150,000 in 2013 and P187,500 in 2013. The increase in owner's capital from 2013 to 2014 is a) 12.5 percent. 10. If long-term liabilities are P300,000 and total assets are P2,100,000, what percentage of total assets are long-term liabilities? a) 7 percent b) 20 percent. b) 20 percent. c) 25 percent. d) 125 percent. b) 16.7 percent c) 12.5 percent d) 14.3 percent

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 11MCQ: Chasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital...

Related questions

Question

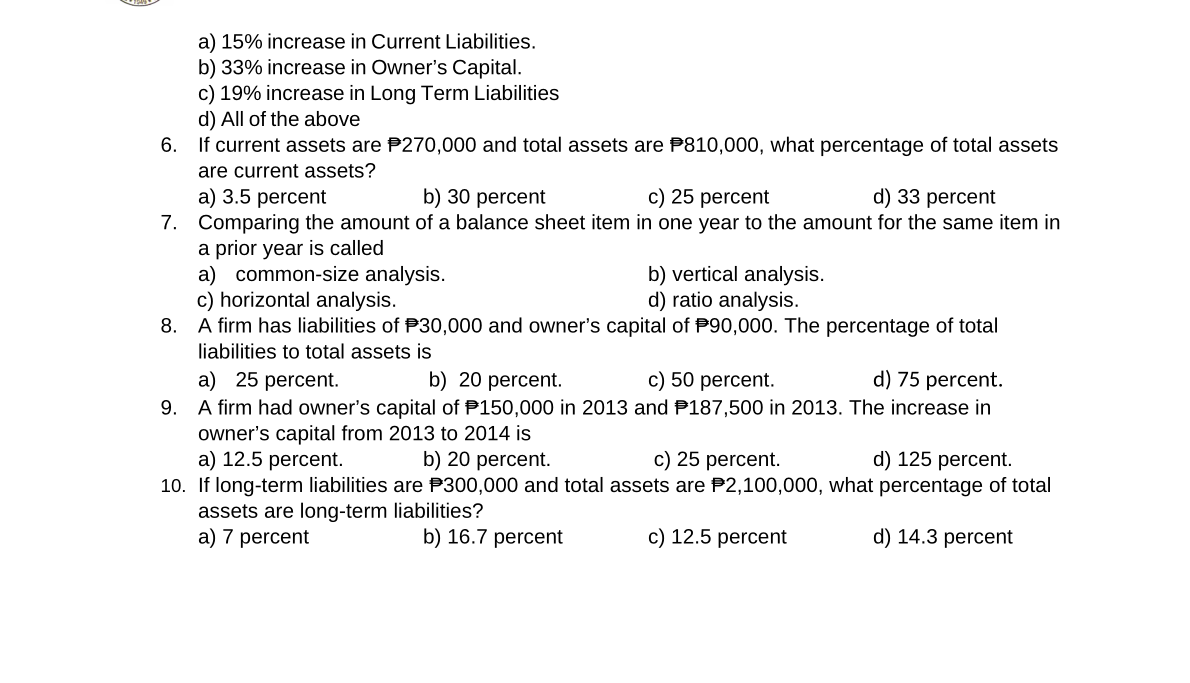

Transcribed Image Text:a) 15% increase in Current Liabilities.

b) 33% increase in Owner's Capital.

c) 19% increase in Long Term Liabilities

d) All of the above

6. If current assets are P270,000 and total assets are P810,000, what percentage of total assets

are current assets?

c) 25 percent

a) 3.5 percent

7. Comparing the amount of a balance sheet item in one year to the amount for the same item in

a prior year is called

a) common-size analysis.

c) horizontal analysis.

8. A firm has liabilities of P30,000 and owner's capital of P90,000. The percentage of total

liabilities to total assets is

b) 30 percent

d) 33 percent

b) vertical analysis.

d) ratio analysis.

b) 20 percent.

c) 50 percent.

d) 75 percent.

a) 25 percent.

9. A firm had owner's capital of P150,000 in 2013 and P187,500 in 2013. The increase in

owner's capital from 2013 to 2014 is

a) 12.5 percent.

10. If long-term liabilities are P300,000 and total assets are P2,100,000, what percentage of total

assets are long-term liabilities?

a) 7 percent

b) 20 percent.

c) 25 percent.

d) 125 percent.

b) 16.7 percent

c) 12.5 percent

d) 14.3 percent

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College