6. Table 6-1 contains historical data for nominal GDP, M1, and M2. 6.1 Use this data to compute V1, velocity based on M1; and V2, velocity based on M2. Be sure to round your answers for velocity to two decimal places. Note that Nominal GDP indicates PY in the quantity theory of money. Table 6-1. GDP, Money, and Velocity Year Nominal GDP ($B) M1 ($B) 1995 1996 1997 1998 1999 7,000 7,500 8,300 8,700 9,200 900 1,100 1,000 1,200 1,300 M2 ($B) 3,200 3,700 3,600 4,100 4,300 V1 V2

6. Table 6-1 contains historical data for nominal GDP, M1, and M2. 6.1 Use this data to compute V1, velocity based on M1; and V2, velocity based on M2. Be sure to round your answers for velocity to two decimal places. Note that Nominal GDP indicates PY in the quantity theory of money. Table 6-1. GDP, Money, and Velocity Year Nominal GDP ($B) M1 ($B) 1995 1996 1997 1998 1999 7,000 7,500 8,300 8,700 9,200 900 1,100 1,000 1,200 1,300 M2 ($B) 3,200 3,700 3,600 4,100 4,300 V1 V2

Macroeconomics: Principles and Policy (MindTap Course List)

13th Edition

ISBN:9781305280601

Author:William J. Baumol, Alan S. Blinder

Publisher:William J. Baumol, Alan S. Blinder

Chapter15: The Debate Over Monetary And Fiscal Policy

Section: Chapter Questions

Problem 2TY

Related questions

Question

Transcribed Image Text:Question 41

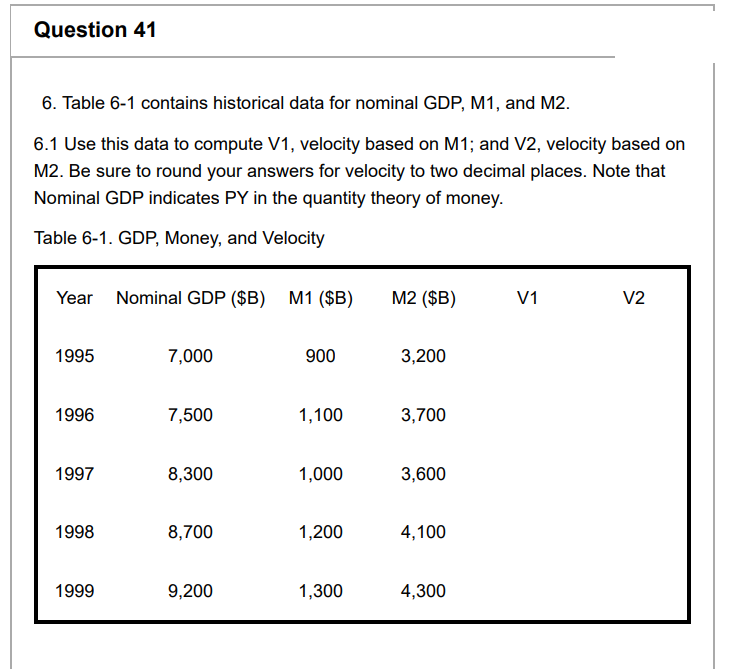

6. Table 6-1 contains historical data for nominal GDP, M1, and M2.

6.1 Use this data to compute V1, velocity based on M1; and V2, velocity based on

M2. Be sure to round your answers for velocity to two decimal places. Note that

Nominal GDP indicates PY in the quantity theory of money.

Table 6-1. GDP, Money, and Velocity

Year Nominal GDP ($B) M1 ($B)

1995

1996

1997

1998

1999

7,000

7,500

8,300

8,700

9,200

900

1,100

1,000

1,200

1,300

M2 ($B)

3,200

3,700

3,600

4,100

4,300

V1

V2

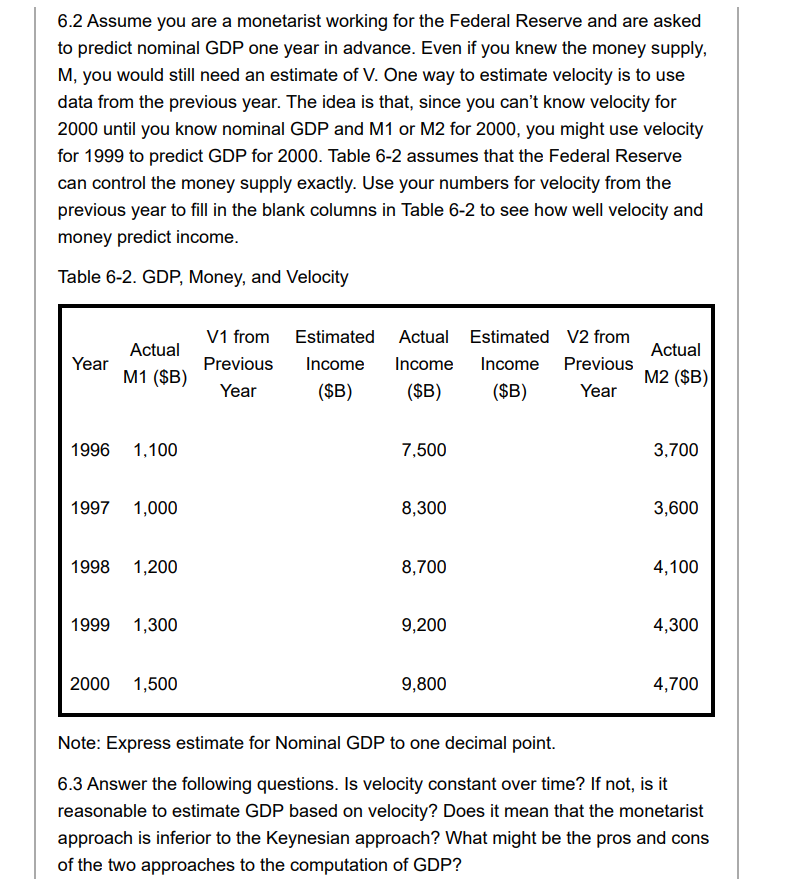

Transcribed Image Text:6.2 Assume you are a monetarist working for the Federal Reserve and are asked

to predict nominal GDP one year in advance. Even if you knew the money supply,

M, you would still need an estimate of V. One way to estimate velocity is to use

data from the previous year. The idea is that, since you can't know velocity for

2000 until you know nominal GDP and M1 or M2 for 2000, you might use velocity

for 1999 to predict GDP for 2000. Table 6-2 assumes that the Federal Reserve

can control the money supply exactly. Use your numbers for velocity from the

previous year to fill in the blank columns in Table 6-2 to see how well velocity and

money predict income.

Table 6-2. GDP, Money, and Velocity

Year

Actual

M1 ($B)

1996 1,100

1997 1,000

1998 1,200

1999 1,300

2000 1,500

V1 from

Previous

Year

Estimated Actual Estimated V2 from

Income Income

Income Previous

($B)

($B)

($B)

Year

7,500

8,300

8,700

9,200

9,800

Actual

M2 ($B)

3,700

3,600

4,100

4,300

4,700

Note: Express estimate for Nominal GDP to one decimal point.

6.3 Answer the following questions. Is velocity constant over time? If not, is it

reasonable to estimate GDP based on velocity? Does it mean that the monetarist

approach is inferior to the Keynesian approach? What might be the pros and cons

of the two approaches to the computation of GDP?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Macroeconomics: Principles and Policy (MindTap Co…

Economics

ISBN:

9781305280601

Author:

William J. Baumol, Alan S. Blinder

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning