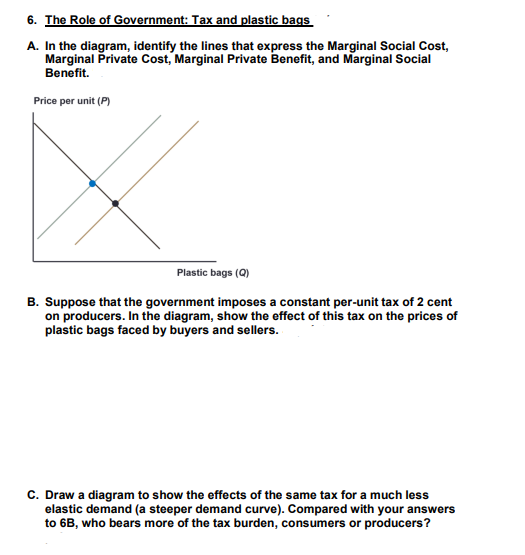

6. The Role of Government: Tax and plastic bags A. In the diagram, identify the lines that express the Marginal Social Cost, Marginal Private Cost, Marginal Private Benefit, and Marginal Social Benefit. Price per unit (P) Plastic bags (Q) B. Suppose that the government imposes a constant per-unit tax of 2 cent on producers. In the diagram, show the effect of this tax on the prices of plastic bags faced by buyers and sellers. C. Draw a diagram to show the effects of the same tax for a much less elastic demand (a steeper demand curve). Compared with your answers to 6B, who bears more of the tax burden, consumers or producers?

6. The Role of Government: Tax and plastic bags A. In the diagram, identify the lines that express the Marginal Social Cost, Marginal Private Cost, Marginal Private Benefit, and Marginal Social Benefit. Price per unit (P) Plastic bags (Q) B. Suppose that the government imposes a constant per-unit tax of 2 cent on producers. In the diagram, show the effect of this tax on the prices of plastic bags faced by buyers and sellers. C. Draw a diagram to show the effects of the same tax for a much less elastic demand (a steeper demand curve). Compared with your answers to 6B, who bears more of the tax burden, consumers or producers?

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter13: Positive Externalities And Public Goods

Section: Chapter Questions

Problem 24P: Assume that the marginal private costs of a film producing fuel-efficient can; is greater than the...

Related questions

Question

part C

Transcribed Image Text:6. The Role of Government: Tax and plastic bags

A. In the diagram, identify the lines that express the Marginal Social Cost,

Marginal Private Cost, Marginal Private Benefit, and Marginal Social

Benefit.

Price per unit (P)

Plastic bags (Q)

B. Suppose that the government imposes a constant per-unit tax of 2 cent

on producers. In the diagram, show the effect of this tax on the prices of

plastic bags faced by buyers and sellers.

C. Draw a diagram to show the effects of the same tax for a much less

elastic demand (a steeper demand curve). Compared with your answers

to 6B, who bears more of the tax burden, consumers or producers?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou…

Economics

ISBN:

9781285165875

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning