6. Using a 5% discount rate, what is the present value of receiving $10,000 today, $10,000 in one year, and $20,000 in three years? (Hint: PV=FV/(1+r)¹) a. $30,000.00 b. $28,162.19 c. $28,594.10 d. $27,000.00

6. Using a 5% discount rate, what is the present value of receiving $10,000 today, $10,000 in one year, and $20,000 in three years? (Hint: PV=FV/(1+r)¹) a. $30,000.00 b. $28,162.19 c. $28,594.10 d. $27,000.00

Chapter13: Investment Fundamentals

Section: Chapter Questions

Problem 3DTM

Related questions

Question

Please help with #6

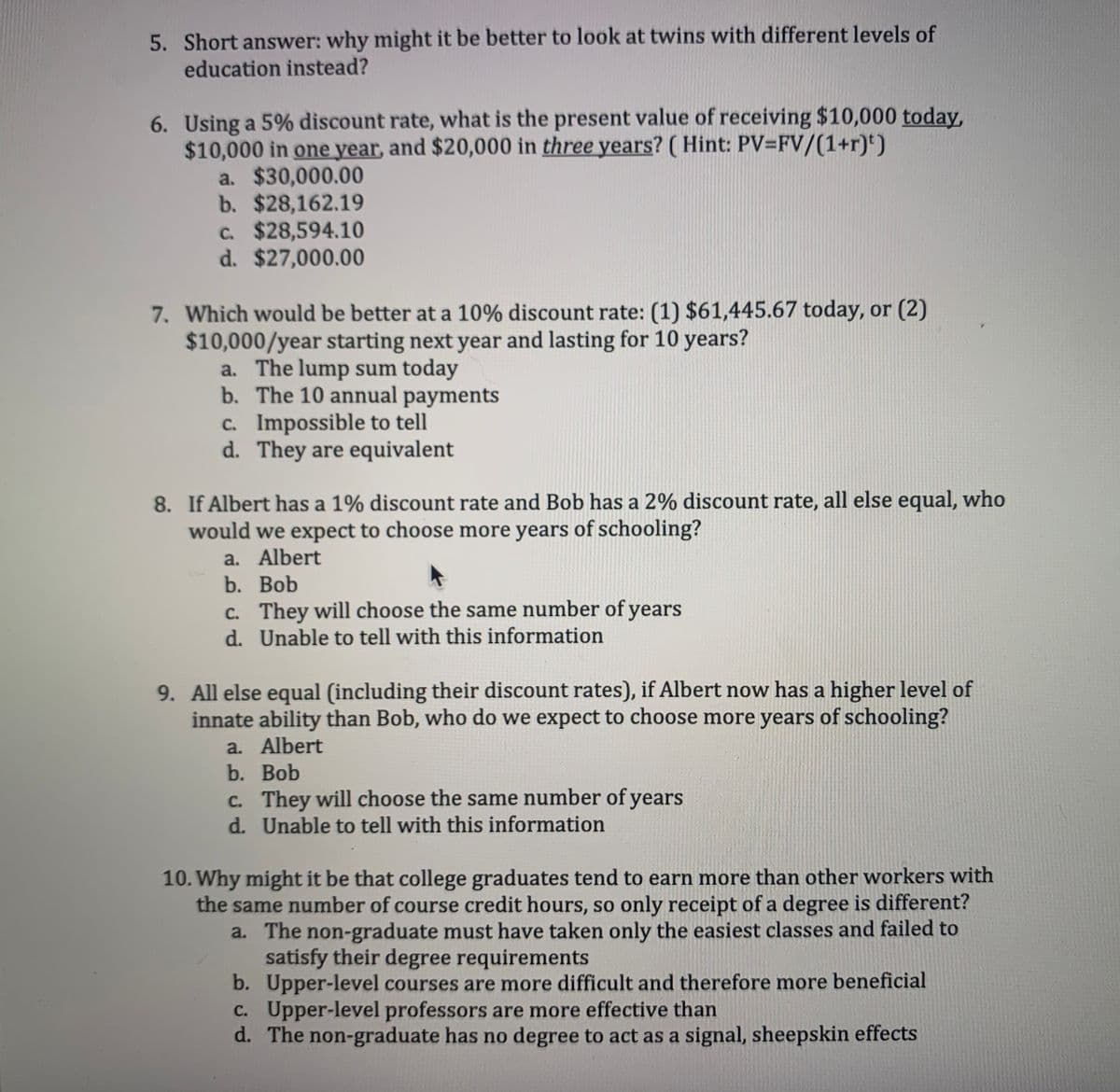

Transcribed Image Text:5. Short answer: why might it be better to look at twins with different levels of

education instead?

6. Using a 5% discount rate, what is the present value of receiving $10,000 today,

$10,000 in one year, and $20,000 in three years? (Hint: PV=FV/(1+r)')

a. $30,000.00

b. $28,162.19

c. $28,594.10

d. $27,000.00

7. Which would be better at a 10% discount rate: (1) $61,445.67 today, or (2)

$10,000/year starting next year and lasting for 10 years?

a. The lump sum today

b. The 10 annual payments

c. Impossible to tell

d.

They are equivalent

8. If Albert has a 1% discount rate and Bob has a 2% discount rate, all else equal, who

would we expect to choose more years of schooling?

a. Albert

b.

Bob

c. They will choose the same number of years

d. Unable to tell with this information

9. All else equal (including their discount rates), if Albert now has a higher level of

innate ability than Bob, who do we expect to choose more years of schooling?

a. Albert

b.

Bob

c. They will choose the same number of years

d. Unable to tell with this information

10. Why might it be that college graduates tend to earn more than other workers with

the same number of course credit hours, so only receipt of a degree is different?

a. The non-graduate must have taken only the easiest classes and failed to

satisfy their degree requirements

b. Upper-level courses are more difficult and therefore more beneficial

c. Upper-level professors are more effective than

d. The non-graduate has no degree to act as a signal, sheepskin effects

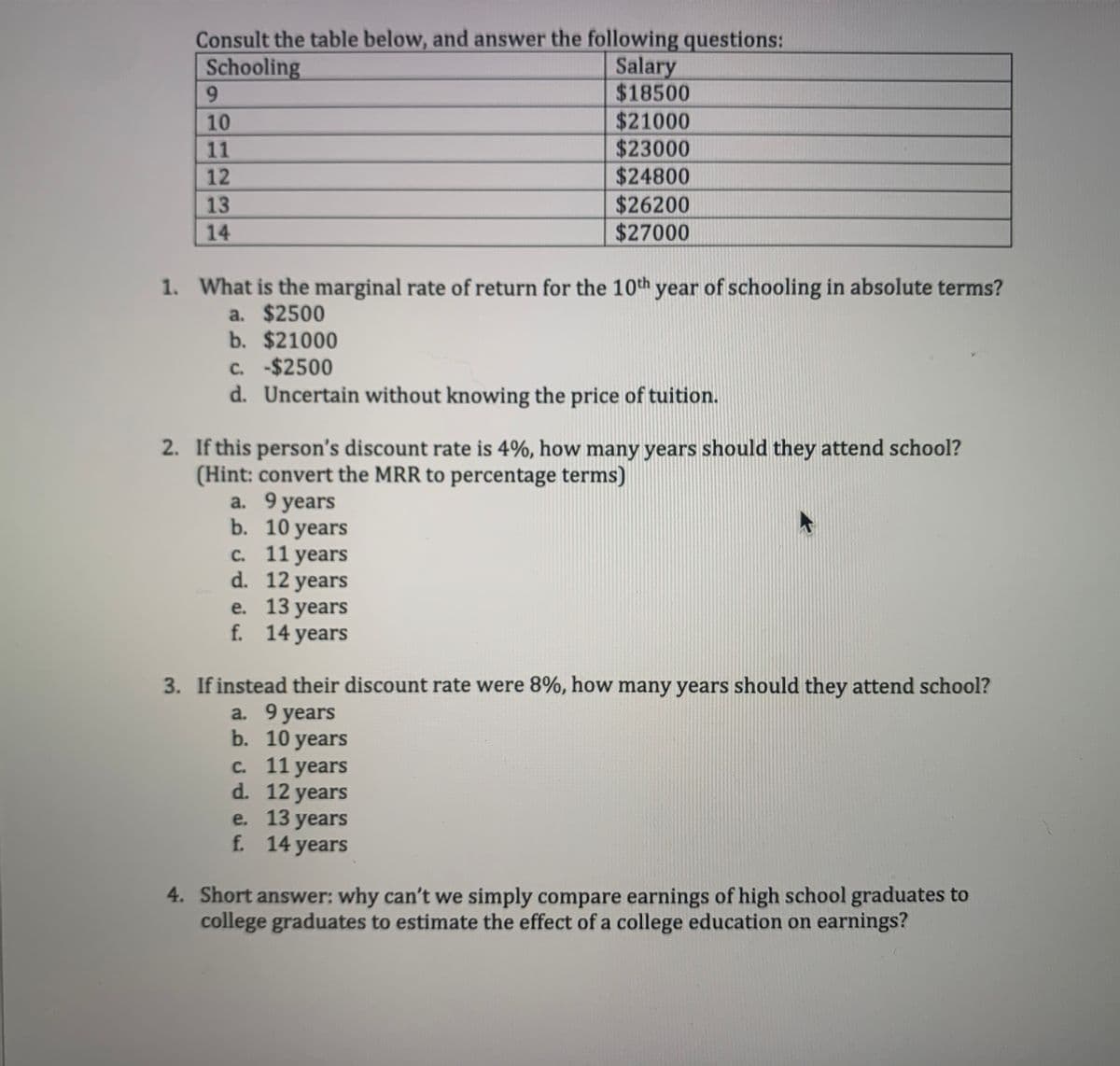

Transcribed Image Text:Consult the table below, and answer the following questions:

Schooling

Salary

$18500

$21000

$23000

$24800

9

10

11

12

13

14

1. What is the marginal rate of return for the 10th year of schooling in absolute terms?

a. $2500

b. $21000

C. -$2500

d. Uncertain without knowing the price of tuition.

2. If this person's discount rate is 4%, how many years should they attend school?

(Hint: convert the MRR to percentage terms)

a. 9 years

b.

$26200

$27000

10 years

11 years

12 years

e. 13 years

f.

14 years

c.

d.

3. If instead their discount rate were 8%, how many years should they attend school?

a. 9 years

b. 10 years

c. 11 years

d.

12 years

e. 13 years

f. 14 years

4. Short answer: why can't we simply compare earnings of high school graduates to

college graduates to estimate the effect of a college education on earnings?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you