6. You are contemplating the purchase of a twenty-four year (variable) annuity that promises cash flows in the following pattern, repeating every four years: 1e 2 3 4e 24 $1,600 $1,500 $1,400 $1,300 21 22 23 $1,600 $1,500 $1,400 $1,300 Suppose you don't like the fluctuations in the amount of your annual benefits. a. What annual rate of return would you use to convert these (end-of-year) cash flows to equal annual (end-of-year) amounts if you required an APR of 14.4%, compounded monthly?

6. You are contemplating the purchase of a twenty-four year (variable) annuity that promises cash flows in the following pattern, repeating every four years: 1e 2 3 4e 24 $1,600 $1,500 $1,400 $1,300 21 22 23 $1,600 $1,500 $1,400 $1,300 Suppose you don't like the fluctuations in the amount of your annual benefits. a. What annual rate of return would you use to convert these (end-of-year) cash flows to equal annual (end-of-year) amounts if you required an APR of 14.4%, compounded monthly?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

ChapterM: Time Value Of Money Module

Section: Chapter Questions

Problem 7MC

Related questions

Question

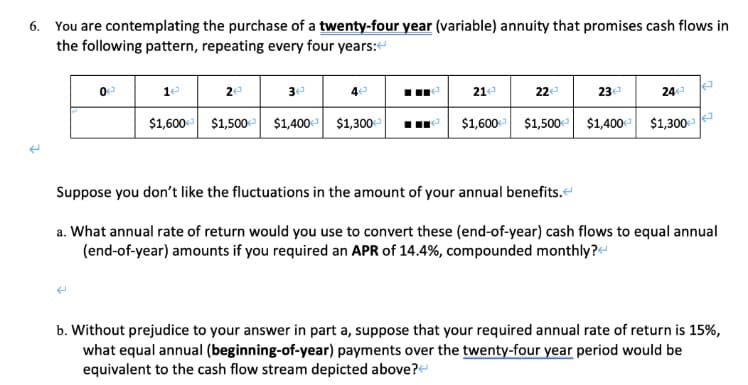

Transcribed Image Text:6. You are contemplating the purchase of a twenty-four year (variable) annuity that promises cash flows in

the following pattern, repeating every four years:

1e

2e

3e

4e

21e

24

22

23

$1,600- $1,500- $1,400 $1,300-

$1,600 $1,500 $1,400 $1,300

Suppose you don't like the fluctuations in the amount of your annual benefits.e

a. What annual rate of return would you use to convert these (end-of-year) cash flows to equal annual

(end-of-year) amounts if you required an APR of 14.4%, compounded monthly?e

b. Without prejudice to your answer in part a, suppose that your required annual rate of return is 15%,

what equal annual (beginning-of-year) payments over the twenty-four year period would be

equivalent to the cash flow stream depicted above?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College