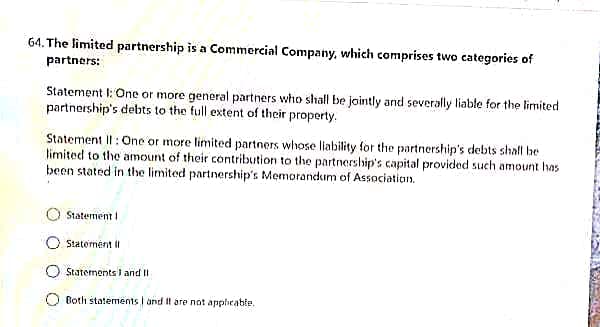

64. The limited partnership is a Commercial Company, which comprises two categories of partners: Statement I: One or more general partners who shall be jointly and severally liable for the limited partnership's debts to the full extent of their property. Statement Il: One or more limited partners whhose liability for the partnership's debts shall be limited to the amount of their contribution to the partnersbip's capital provided such amount has been stated in the limited partnership's Memorandum of Association. Statement I O Staternent i Staterments I and I O Both statements and It are not applicable.

64. The limited partnership is a Commercial Company, which comprises two categories of partners: Statement I: One or more general partners who shall be jointly and severally liable for the limited partnership's debts to the full extent of their property. Statement Il: One or more limited partners whhose liability for the partnership's debts shall be limited to the amount of their contribution to the partnersbip's capital provided such amount has been stated in the limited partnership's Memorandum of Association. Statement I O Staternent i Staterments I and I O Both statements and It are not applicable.

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 21DQ

Related questions

Question

F3

Transcribed Image Text:64, The limited partnership is a Commercial Company, which comprises two categories of

partners:

Statement I: One or more general partners who shall be jaintly and severally liable for the limited

partnership's debts to the full extent of their property.

Statement Il: One or more limited partners whose liability for the partnership's debts shall be

limited to the amount of their contribution to the partnership's capital provided such amount has

been stated in the limited partnership's Memorandum of Association.

O Statement

Staterment I

Staternents I and II

Both statements and Il are not applicable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT