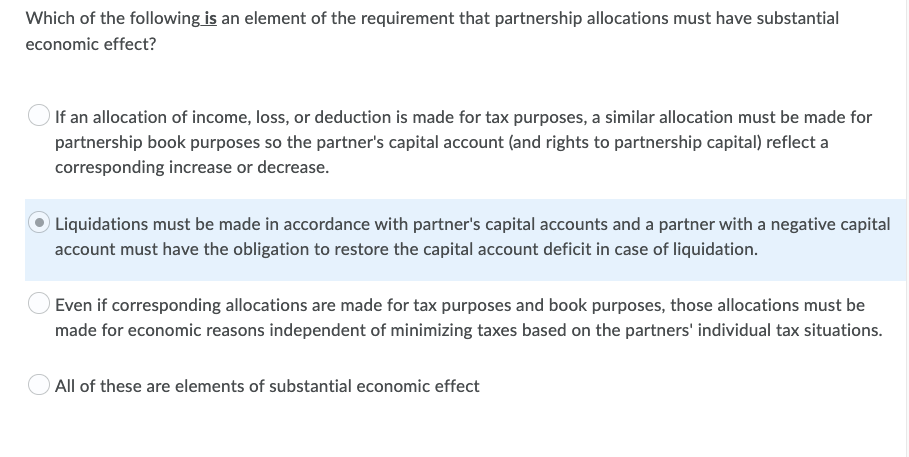

Which of the following is an element of the requirement that partnership allocations must have substantial economic effect? If an allocation of income, loss, or deduction is made for tax purposes, a similar allocation must be made for partnership book purposes so the partner's capital account (and rights to partnership capital) reflect a corresponding increase or decrease. Liquidations must be made in accordance with partner's capital accounts and a partner with a negative capital account must have the obligation to restore the capital account deficit in case of liquidation. Even if corresponding allocations are made for tax purposes and book purposes, those allocations must be made for economic reasons independent of minimizing taxes based on the partners' individual tax situations.

Which of the following is an element of the requirement that partnership allocations must have substantial economic effect? If an allocation of income, loss, or deduction is made for tax purposes, a similar allocation must be made for partnership book purposes so the partner's capital account (and rights to partnership capital) reflect a corresponding increase or decrease. Liquidations must be made in accordance with partner's capital accounts and a partner with a negative capital account must have the obligation to restore the capital account deficit in case of liquidation. Even if corresponding allocations are made for tax purposes and book purposes, those allocations must be made for economic reasons independent of minimizing taxes based on the partners' individual tax situations.

Chapter21: Partnerships

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

Transcribed Image Text:Which of the following is an element of the requirement that partnership allocations must have substantial

economic effect?

If an allocation of income, loss, or deduction is made for tax purposes, a similar allocation must be made for

partnership book purposes so the partner's capital account (and rights to partnership capital) reflect a

corresponding increase or decrease.

Liquidations must be made in accordance with partner's capital accounts and a partner with a negative capital

account must have the obligation to restore the capital account deficit in case of liquidation.

Even if corresponding allocations are made for tax purposes and book purposes, those allocations must be

made for economic reasons independent of minimizing taxes based on the partners' individual tax situations.

All of these are elements of substantial economic effect

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT