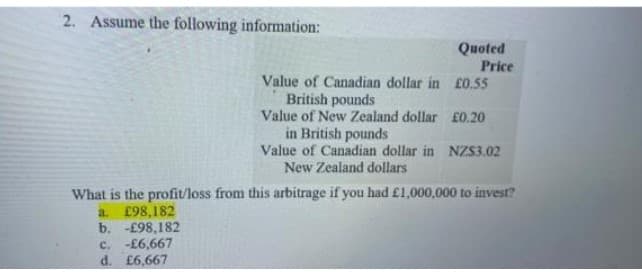

7 Assume the following information: Quoted Price Value of Canadian dollar in British pounds Value of New Zealand dollar in British pounds Value of Canadian dollar in NZS3.02 New Zealand dollars £0.55 £0.20 What is the profit/loss from this arbitrage if you had £1,000,000 to invest? a. £98,182 b. -£98,182 c. -£6,667 d. £6,667

Q: Problem 2: A man deposited ABCDE.00 in a bank of 1D. E% per annum from January 10, 1999 to November…

A: We have; A=1B=5C=7D=6E=8 The amount deposited is ABCDE.00 i.e.15768.00 The annual Interest rate is…

Q: The tax bracket and holdings of your client are as follows: Federal tax bracket = 33%…

A: Data given: Investment Annual Income ($) June 30,Last Year's Purchase Price ($) June 30, This…

Q: Ratio Liquidity Ratio Current ratio Activity Ratio Inventory turnover Leverage ratio Debt ratio %…

A: Financial ratios are used to evaluate the financial performance of a company by comparing different…

Q: compounding periods wrong

A: Compounding Period: It represents the period of time between the last time interest was compounded…

Q: A call option on a non-dividend-paying stock has a market price of +212. The stock price is $15, the…

A: To calculate the implied volatility, we need to use an options pricing model to solve for the…

Q: Tim Houston purchased a wall unit for $2,200. He made a $800 down payment and financed the balance…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: You expect to deliver 50,000 bushels of wheat to the market in July. Assume you nedged your position…

A: Number of Futures = Total number of BushelsBushels per Future

Q: Vigour Pharmaceuticals Ltd. is considering investing in a new production line for its pain-reliever…

A: Initial cost includes the cost of equipment, installation cost and increase in net working capital.…

Q: Rate of return Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate…

A: Rate of return is help to calculate the net gain/loss from the investment. In this we consider the…

Q: Give typing answer with explanation and conclusion What is the change in the NPV of a one-year…

A: Explanation : NPV is also known as Net Present Value. It is a Capital Budgeting techniques which…

Q: Darrel buys a home for $314,945 and he outs 25% down. He finances the remainder at 3% for 15 years.…

A: Purchase value of house = $314,945 Down payment = 25% Compound = monthly = 12 Interest rate = r =…

Q: Question 13 4) Listen How much must you deposit in an account today so that you have a balance of…

A: Step 1 Present Value The total of future investment returns discounted at a given level of expected…

Q: A $1,000 bond originally issued at par maturing in exactly ten years bears a coupon rate of 8%…

A: Yield To Maturity: It represents the expected rate of return on the bond for the bondholders…

Q: Professor Very Busy needs to allocate time next week to include time for office hours. He needs to…

A: The forecast using simple moving average is calculated by Ft=At-1+At-2+At-3+....+At-nn Where, Ft =…

Q: You can afford a $1150 per month mortgage payment. You've found a 30 year loan at 8% interest. a)…

A: When we make a mortgage payment we pay fixed monthly amounts as payments towards the mortgage.…

Q: Calculate the missing information for the installment loan that is being paid off early. Number of…

A: Step 1 The rebate on finance charges is calculated using this fraction. The denominator is the total…

Q: A young professional wishes to have $820000 in her retirement account. Its current value is $36000.…

A: This question can be solved using the Goal seek function of What if Analysis. Let the number of…

Q: As the assistant to the CFO of Johnstone Inc., you must estimate its cost of common equity. You have…

A: When companies earn profits from their financial operations, they distributed part of their profits…

Q: Suppose our portfolio consists of two stocks A and B. What should be the correlation between them so…

A: Correlation between stocks is an important concept while building a portfolio. Stock selected…

Q: Consider the Excel template for the two-asset efficient frontier as provided in the announcement for…

A: Expected Returns and the risk of a portfolio: The expected return of a portfolio is the weighted…

Q: QZY, Inc. is evaluating new widget machines offered by three companies. The chosen machine will be…

A: To evaluate which machine to choose, we can use the Rate of Return (ROR) analysis. The ROR is the…

Q: Suppose that a limit order to sell 175 shares at $15.58 is followed by a market order to sell 50…

A: In a sell limit order, the transaction will only go through if the broker is able to sell at the…

Q: Since he was 24 years old, Ben has been depositing $225 at the end of each month into a tax-free…

A:

Q: Gary wants to save $555,000 in 8 ears, he currently has $225,000 in an investment. Due to financial…

A: We will calculate interest rate using RATE function in excel for accurate results as nothing is…

Q: Complete solution for letters ABC please

A: A list of projects with their IRR has been provided. The sources of capital are known with their…

Q: You own a stock portfolio invested 32 percent in Stock Q, 22 percent in Stock R, 19 percent in Stock…

A: Beta is systematic risk factor. We will calculate weighted average beta of the portfolio.

Q: Ratio Liquidity Ratio Current ratio Activity Ratio Inventory turnover Leverage ratio Debt ratio %…

A: The liquidity ratios of Toyota, as measured by its current ratio, suggest that the company has a…

Q: Ken borrowed $2000 from Sam at 8% per annum. After 6 year he cleare mount by giving $2600 cash and a…

A: In the given case, we have provided the borrowed amount . It is the loan amount . And, the loan is…

Q: Vandalay Industries is considering the purchase of a new machine for the production of latex.…

A:

Q: Give typing answer with explanation and conclusion Question 16: Which of the following…

A: The answer to the question is given below :

Q: A 3-month zero-coupon bond is selling for $99.7 and a 10-year zero-coupon bond is selling for $54.3.…

A: It is the case of calculation of spread in yields given by 3-month maturity bonds and 10 years…

Q: Matheson Electronics has just developed a new electronic device that it believes will have broad…

A: Net Present Value: It represents the profit generated by the firm in absolute terms after…

Q: 1. An overview of a firm's cost of debt The Cold Goose Metal Works (CGMW) can borrow funds at an…

A: The cost of debt is the effective interest rate that a company pays on its debt, such as bonds or…

Q: I need help using the present value of a bond calculator at…

A: Bond: The price of a bond is estimated by discounting the par value and the coupon payments using…

Q: The golf range is considering adding an additional driving range to its facility. The range would…

A: Internal rate of return is the modern method of capital budgeting that is used to determine the…

Q: MF Corp. has an ROE of 14% and a plowback ratio of 60%. The market capitalization rate is 14%. a. If…

A: Step 1 The total dollar market value of a company's outstanding shares of stock is referred to as…

Q: Problem 4: A bank pays (A+B+C+D+E) % interest on saving account for times a year. Find the effective…

A: To calculate the effective annual interest rate for a savings account that pays interest…

Q: Give typing answer with explanation and conclusion A share valued at $277.60 pays quarterly…

A: Step 1 A dividend is a payment made by a corporation to its shareholders in the form of cash or…

Q: Since he was 24 years old, Ben has been depositing $225 at the end of each month into a tax-free…

A: To solve the problem, we can use the formula for the future value of an annuity, which is: FV = PMT…

Q: Please could you anwser it with true or false :

A: In a risk neutral evaluation with no arbitrage opportunity especially for options, we can determine…

Q: Supreme Depths plc, an oil exploration company, issued a 10 year 0% Bond valued at $3 million with a…

A: Bond: It represents a financial security that is issued to raise capital in the form of debt. The…

Q: The expected return on the market is 15% with a standard deviation of 12.5% and the risk-free rate…

A: Explanation : If the Expected return from the stock is equal to actual return from the stock it…

Q: jane bought 2 apples and 3 oranges, the total amount she paid at most P^(123). what is the cost of…

A: Total amount used to buy apples and oranges = P 123 Number of apples purchased = 2 Number of oranges…

Q: question 1 A BBB-rated corporate bond has a yield to maturity of 7.8%. A U.S. Treasury security has…

A: A treasury bill is a kind of debt security issued by the government and private companies for…

Q: How much interest is earned over the 65 year period?

A: Annuity ordinary means the payment is starting at end of the period for a specific period. Monthly…

Q: What would be the interest rate that would allow you to convert an investment from B/.5,000 to…

A: To calculate the interest rate that would allow an investment to grow from B/.5,000 to B/.20,227.79…

Q: What if she had made the purchase with her credit card and paid off her bill in full promptly?…

A: Credit Card: It represents a product issued by the banks allowing the cardholders by paying for…

Q: Calculate the durations and volatilities of securities A, B, and C. The interest rate is 8%,…

A: To calculate the duration and volatility of each security, we will use the following formulas:…

Q: A total of four students belong to all three teams, the baseball, basketball and football team.…

A: Let's assume that the number of players on the baseball team is B, the number of players on the…

Q: If you purchase $27,000 in U.S. Treasury Bills with a discount rate of 4.2% for a period of 26…

A: Data given: P=Principal amount=$27000 r=Discount rate=4.2%=0.042 t=Time=26 weeks=26/52=0.5 Formula:…

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Assume the Canadian dollar rose from US$0.9475 to US$0.9875. A client owns an investment that pays 6% interest in US dollars. What is the client's addition rate of return in US dollars? 4.05% 0.00% 1.78% 4.22%Assume Singapore dollars (SGD) is worth RM3.1422 and the Great Britain pound (GBP) is worth RM5.5739. What is the cross rate of the SGD with respect to GBP? That is, how many GBP equal a SGD? * A) SGD0.5637/GBP B) GBP0.5637/SGD C) SGD3.1422/GBP D) SDG5.5739/GBPInternational financial management : MCQ Assume the Canadian dollar is equal to £0.51 and the Peruvian Sol is equal to £0.16. The value of the Peruvian Sol in Canadian dollar is: (a) about 3.1875 Canadian dollars. (b) about .3137 Canadian dollars. (c) about 2.36 Canadian dollars. (d) about .3137 British pound (e) about .3137 Peruvian Sol. 2. Assume that a bank’s bid rate on Swiss francs is £0.25 and its ask rate is £0.26. Its bid-ask percentage spread is: (a) about 3.85 (b) about 4.00% (c) about 3.55% (d) about 4.15%

- ASAP If answer is correct I'll give you Upvote. Caculation: A company exports commodity X to Canada, if the total purchase price(including VAT 17%) is RMB 247500, the rate of expense standard is 5%, the rate of export tax rebate is 14%, the total freight is USD245.00, the company insures against all risks for 110% of invoice value, the premium rate is 1.5%, the profit is 10% based on purchase price. Rate of foreign exchange: USD1.00=RMB6.50 what are FOB price, CFR price and CIF price respectively?Suppose a bank provides the following quotes: Bid 1.2567 CAD per U.S. Dollar and Ask 1.2682 CAD per U.S. Dollar Suppose you would like to buy Canadian Dollars and sell U.S. Dollars. Given the quotes above, what rate would you receive? Group of answer choices 0.0115 CAD per USD 2.5249 CAD per USD 1.2682 CAD per USD 1.2567 CAD per USDGiven this information. Is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage and compute the profit from this strategy if you had $1,000,000 to use. Value of Canadian dollar in US dollars $ 0.90 Value of New Zealand dollar in US dollars $ 0.30 Value of Canadian dollar in New Zealand dollars NZ$ 3.02

- The value of Malaysian ringgit abruptly changes against the Singapore dollar from MYR3.06/SGD to MYR3.00/SGD. This represents the ringgit has ________ by ________. a. appreciated; 2.00% b. depreciated; 2.00% c. appreciated; 1.96% d. depreciated; 1.96%You observed the following quotes between Canadian dollars (CS), euros (€) and Swiss francs (CHF) on 3/1/XX: C$1-.90, CS.70/CHF On 3/2/xx, quotes for each currency were as follows: C$1.15-1, Cs.75/CHF You converted 600,000 Swiss francs into euros on 3/1. On 3/2 you converted your euros back to Swiss francs. How many francs would you have on 3/2? flound intermediate steps to four decimals. 715,555 56 665357.14 246,521.74 579,587.4If the Singaporean dollar appreciates by 12.63% against the Malaysian Ringgit, then by how much has the Malaysian Ringgit depreciated against the Singaporean dollar? Question 1Answer a. 12.63% b. 0.00% c. 11.21% d. -12.63% e. 11.92%

- Given this information. Is triangular arbitrage possible? If so, explain the steps that would reflect triangular arbitrage and compute the profit from this strategy if you had $1,000,000 to use. Value of Canadian dollar in US dollars $ 0.90 Value of New Zealand dollar in US dollars $ 0.30 Value of Canadian dollar in New Zealand dollars NZ$ 3.02 Step 1 1) Different i for Base rate -Quote rate = 2) Different between Spot and Forward = (1) + (2) = invest in _ borrow in _ Step 2 explain using tableYou have 1000000 CHF Assume the following exchange rates are quoted: Bank of America CHF/USD 1.56 Barclays Bank GBP/USD 1.71 Deutsche Bank GBP/CHF 1.13 Is triangular arbitrage possible? Describe the procedure step by step. What's the profit?ABC Bank quotes the following for the British pound and the New Zealand dollar: Quoted Bid Price Quoted Ask Price Value of a British pound (£) in $ $1.61 $1.62 Value of a New Zealand dollar (NZ$) in $ $.55 $.56 Value of a British pound in New Zealand dollars NZ$2.95 NZ$2.96 Assume you have $10,000 to conduct triangular arbitrage. What is your profit from this strategy? What is your profit?