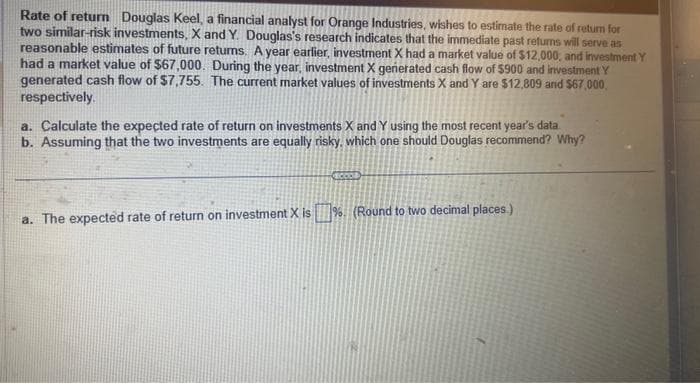

Rate of return Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate of return for two similar-risk investments, X and Y. Douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. A year earlier, investment X had a market value of $12,000, and investment Y had a market value of $67,000. During the year, investment X generated cash flow of $900 and investment Y generated cash flow of $7,755. The current market values of investments X and Y are $12,809 and $67,000, respectively. a. Calculate the expected rate of return on investments X and Y using the most recent year's data. b. Assuming that the two investments are equally risky, which one should Douglas recommend? Why? OOO a. The expected rate of return on investment X is% (Round to two decimal places.)

Rate of return Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate of return for two similar-risk investments, X and Y. Douglas's research indicates that the immediate past returns will serve as reasonable estimates of future returns. A year earlier, investment X had a market value of $12,000, and investment Y had a market value of $67,000. During the year, investment X generated cash flow of $900 and investment Y generated cash flow of $7,755. The current market values of investments X and Y are $12,809 and $67,000, respectively. a. Calculate the expected rate of return on investments X and Y using the most recent year's data. b. Assuming that the two investments are equally risky, which one should Douglas recommend? Why? OOO a. The expected rate of return on investment X is% (Round to two decimal places.)

Chapter10: Valuing Early-stage Ventures

Section: Chapter Questions

Problem 2EP

Related questions

Question

Hi there help me with this its kinda easy for you please cross check once after doing ( by eyes only)

Transcribed Image Text:Rate of return Douglas Keel, a financial analyst for Orange Industries, wishes to estimate the rate of return for

two similar-risk investments, X and Y. Douglas's research indicates that the immediate past returns will serve as

reasonable estimates of future returns. A year earlier, investment X had a market value of $12,000, and investment Y

had a market value of $67,000. During the year, investment X generated cash flow of $900 and investment Y

generated cash flow of $7,755. The current market values of investments X and Y are $12,809 and $67,000,

respectively.

a. Calculate the expected rate of return on investments X and Y using the most recent year's data.

b. Assuming that the two investments are equally risky, which one should Douglas recommend? Why?

a. The expected rate of return on investment X is% (Round to two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning