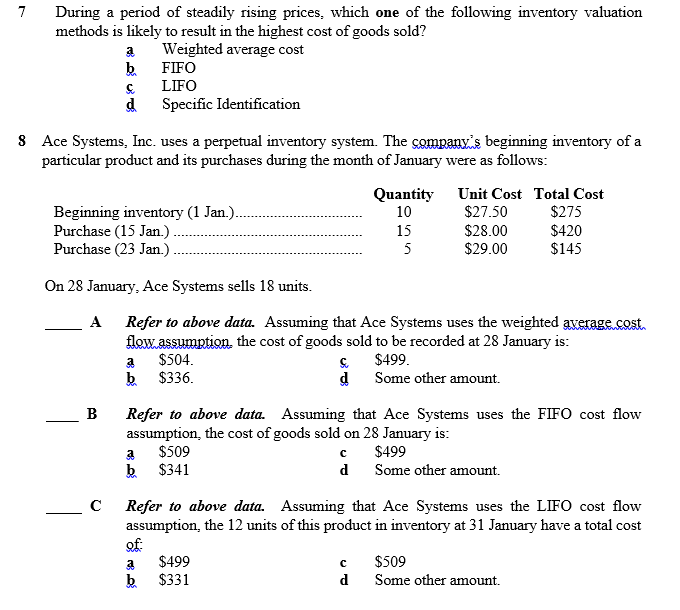

7 During a period of steadily rising prices, which one of the following inventory valuation methods is likely to result in the highest cost of goods sold? a Weighted average cost FIFO LIFO d Specific Identification

7 During a period of steadily rising prices, which one of the following inventory valuation methods is likely to result in the highest cost of goods sold? a Weighted average cost FIFO LIFO d Specific Identification

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2E: Inventory Write-Down Stiles Corporation uses the FIFO cost flow assumption and is in the process of...

Related questions

Question

Indicate the best answer(s) for each question:

Transcribed Image Text:7

During a period of steadily rising prices, which one of the following inventory valuation

methods is likely to result in the highest cost of goods sold?

a

Weighted average cost

FIFO

LIFO

d Specific Identification

8 Ace Systems, Inc. uses a perpetual inventory system. The company's beginning inventory of a

particular product and its purchases during the month of January were as follows:

Unit Cost Total Cost

$27.50

$28.00

$29.00

Quantity

10

Beginning inventory (1 Jan.).

Purchase (15 Jan.)

Purchase (23 Jan.)

$275

$420

$145

15

5

On 28 January, Ace Systems sells 18 units.

Refer to above data. Assuming that Ace Systems uses the weighted average cost.

flow assumption, the cost of goods sold to be recorded at 28 January is:

$504.

b $336.

A

S.

$499.

d

Some other amount.

B

Refer to above data. Assuming that Ace Systems uses the FIFO cost flow

assumption, the cost of goods sold on 28 January is:

$509

$341

с

$499

b

d

Some other amount.

C

Refer to above data. Assuming that Ace Systems uses the LIFO cost flow

assumption, the 12 units of this product in inventory at 31 January have a total cost

of

$499

$331

$509

b

d

Some other amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning