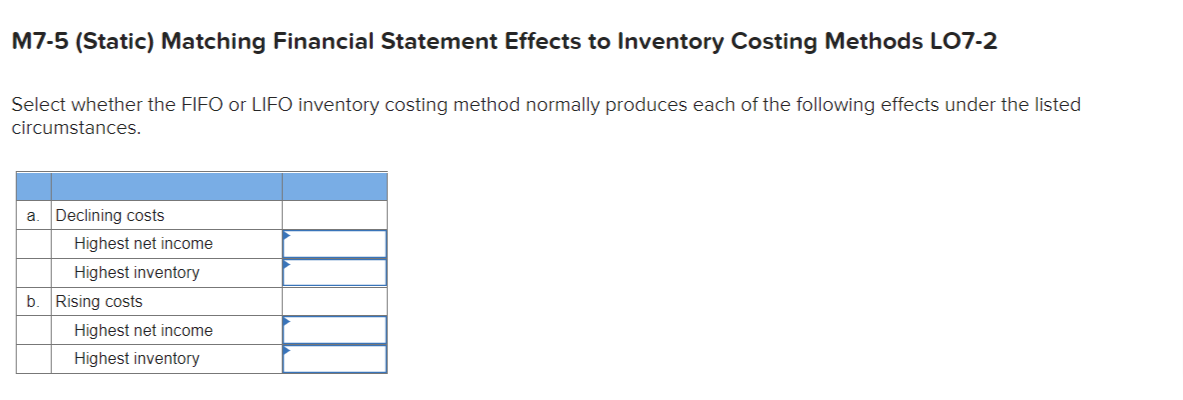

M7-5 (Static) Matching Financial Statement Effects to Inventory Costing Methods LO7-2 Select whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed circumstances. a. Declining costs Highest net income Highest inventory b. Rising costs Highest net income Highest inventory

M7-5 (Static) Matching Financial Statement Effects to Inventory Costing Methods LO7-2 Select whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed circumstances. a. Declining costs Highest net income Highest inventory b. Rising costs Highest net income Highest inventory

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Topic Video

Question

Transcribed Image Text:M7-5 (Static) Matching Financial Statement Effects to Inventory Costing Methods LO7-2

Select whether the FIFO or LIFO inventory costing method normally produces each of the following effects under the listed

circumstances.

a. Declining costs

b.

Highest net income

Highest inventory

Rising costs

Highest net income

Highest inventory

![!

Required information

E7-11 (Static) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and

Cash Flow Effects LO7-2, 7-3

[The following information applies to the questions displayed below.]

Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending

inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes),

$184,500; ending inventory per physical count at December 31, current year, 1,800 units; sales, 8,200 units; sales price per

unit, $75; and average income tax rate, 30 percent.

E7-11 Part 3

3. Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow), assuming that

prices were falling?

Net income

Income taxes paid (cash flow)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F266d5c88-4132-4eca-8561-6ebd3b0393f5%2Ff2b735bf-68cb-47b0-80f3-cc53ec93ae86%2F0lp7gie_processed.png&w=3840&q=75)

Transcribed Image Text:!

Required information

E7-11 (Static) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and

Cash Flow Effects LO7-2, 7-3

[The following information applies to the questions displayed below.]

Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending

inventory December 31, prior year), 2,000 units at $38; purchases, 8,000 units at $40; expenses (excluding income taxes),

$184,500; ending inventory per physical count at December 31, current year, 1,800 units; sales, 8,200 units; sales price per

unit, $75; and average income tax rate, 30 percent.

E7-11 Part 3

3. Between FIFO and LIFO, which method is preferable in terms of (a) net income and (b) income taxes paid (cash flow), assuming that

prices were falling?

Net income

Income taxes paid (cash flow)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning