7. Under the Equal Credit Opportunity Act (ECOA), it is unlawful to discriminate against an applicant for credit on the basis of: O a. income. O b. length of employment. O c. felony conviction. O d. age.

7. Under the Equal Credit Opportunity Act (ECOA), it is unlawful to discriminate against an applicant for credit on the basis of: O a. income. O b. length of employment. O c. felony conviction. O d. age.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 6TP: When a customer is delinquent on paying a notes receivable, your company has the option to continue...

Related questions

Question

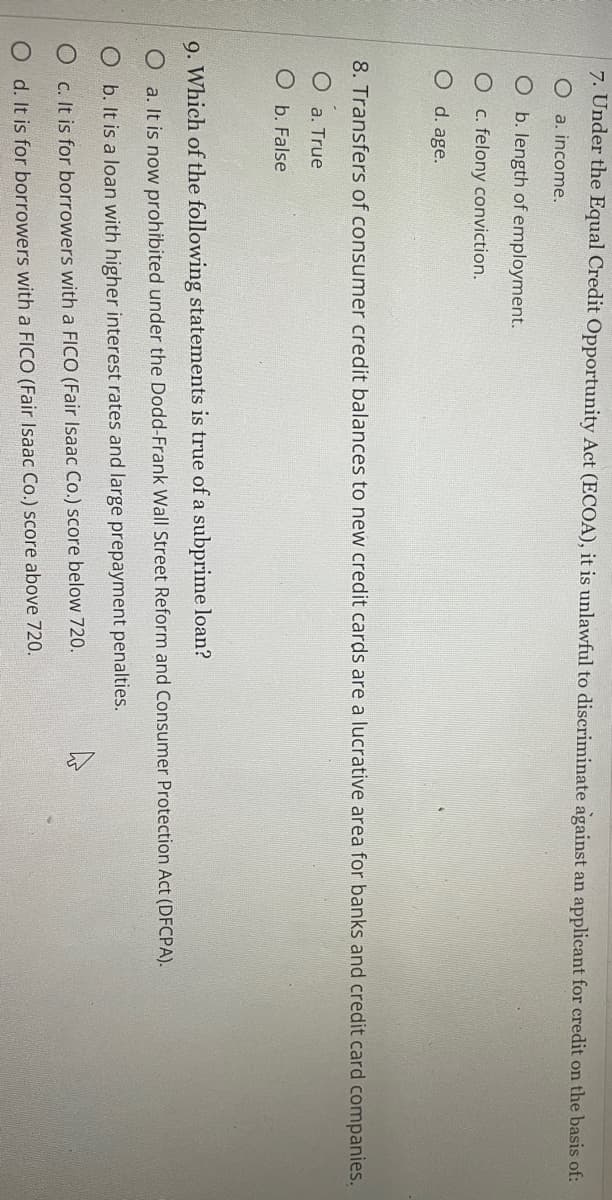

Transcribed Image Text:7. Under the Equal Credit Opportunity Act (ECOA), it is unlawful to discriminate against an applicant for credit on the basis of:

O a. income.

O b. length of employment.

O c. felony conviction.

O d. age.

8. Transfers of consumer credit balances to new credit cards are a lucrative area for banks and credit card companies.

a. True

O b. False

9. Which of the following statements is true of a subprime loan?

O a. It is now prohibited under the Dodd-Frank Wall Street Reform and Consumer Protection Act (DFCPA).

b. It is a loan with higher interest rates and large prepayment penalties.

O c. It is for borrowers with a FICO (Fair Isaac Co.) score below 720.

O d. It is for borrowers with a FICO (Fair Isaac Co.) score above 720.

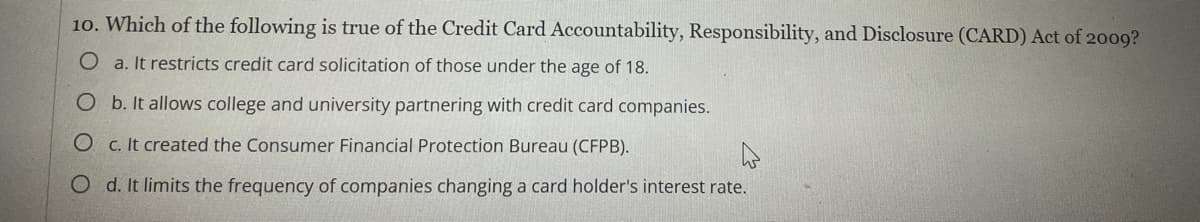

Transcribed Image Text:10. Which of the following is true of the Credit Card Accountability, Responsibility, and Disclosure (CARD) Act of 2009?

O a. It restricts credit card solicitation of those under the age of 18.

O b. It allows college and university partnering with credit card companies.

O c. It created the Consumer Financial Protection Bureau (CFPB).

O d. It limits the frequency of companies changing a card holder's interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Business Its Legal Ethical & Global Environment

Accounting

ISBN:

9781305224414

Author:

JENNINGS

Publisher:

Cengage