7. Which of the following costs may be capitalized? a. Cost of internally generated goodwill, b. Cost of internally generated mastheads Cost of improving an externally purchased goodwill d. Cost of customer list acquired externally C. 8. Subsequent expenditures on intangible assets are exponood

7. Which of the following costs may be capitalized? a. Cost of internally generated goodwill, b. Cost of internally generated mastheads Cost of improving an externally purchased goodwill d. Cost of customer list acquired externally C. 8. Subsequent expenditures on intangible assets are exponood

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 4C

Related questions

Question

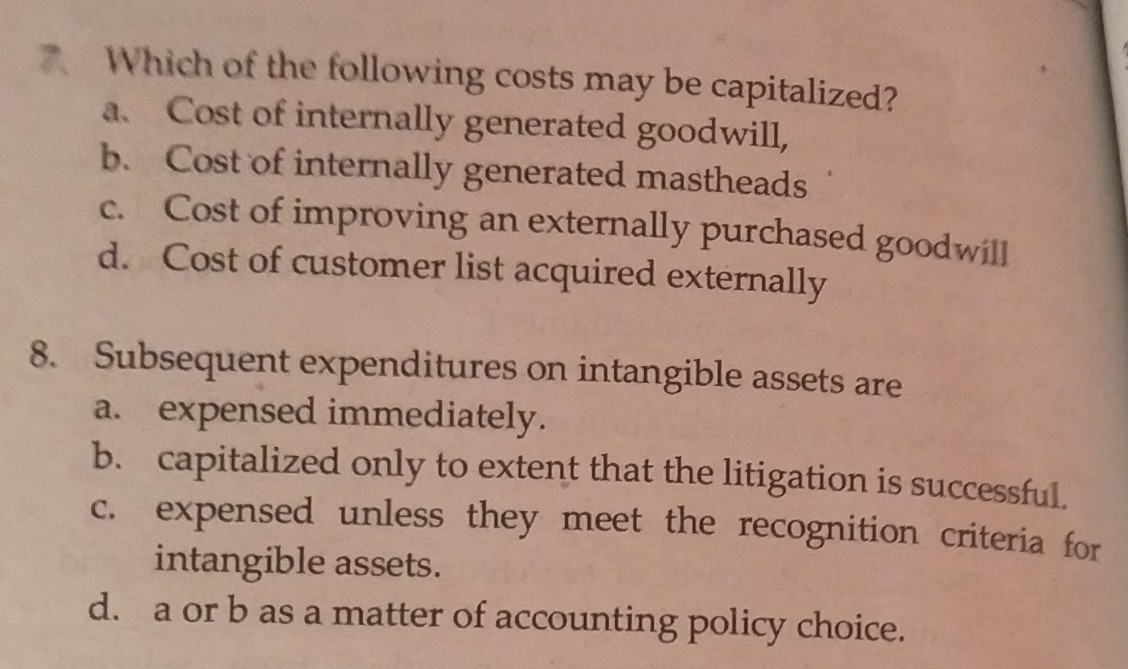

Transcribed Image Text:7 Which of the following costs may be capitalized?

a. Cost of internally generated goodwill,

b. Cost of internally generated mastheads

c. Cost of improving an externally purchased goodwill

d. Cost of customer list acquired externally

8. Subsequent expenditures on intangible assets are

a. expensed immediately.

b. capitalized only to extent that the litigation is successful.

c. expensed unless they meet the recognition criteria for

intangible assets.

d. a or b as a matter of accounting policy choice.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning