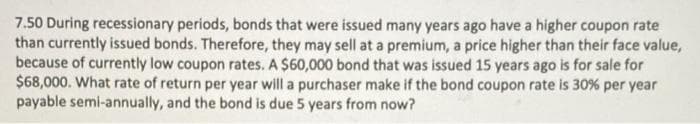

7.50 During recessionary periods, bonds that were issued many years ago have a higher coupon rate than currently issued bonds. Therefore, they may sell at a premium, a price higher than their face value, because of currently low coupon rates. A $60,000 bond that was issued 15 years ago is for sale for $68,000. What rate of return per year will a purchaser make if the bond coupon rate is 30% per year payable semi-annually, and the bond is due 5 years from now?

Q: 19. Hale's TV Productions is considering producing a pilot for a comedy series in the hope of…

A: For the solution, the decision tree is required. The decision tree is as follows. The payoffs are…

Q: 2. Given an EOQ problem modelled below, compute for L (lead time in days). Only final answer is…

A: EOQ stands for economic order quantity. It is a company's optimal order quantity that undervalues…

Q: a) The throughput time of the new work cell is minutes (enter your response as a whole number). b)…

A: Production is the process in which inputs are combined to have the required output. It includes a…

Q: injured when a person drove a car through a crowd of protestors during a white nationalist…

A: 1) How has the current cultural environment of our country shaped the way that companies are looking…

Q: B.) Convert the following function to standared form Min Z = 2x₂ + 5x3 S.t: x₁-x₂ ≥2 2x₁ + x₂ + 6x3…

A: Linear programming is a mathematical technique that is also used in operations management…

Q: Procter, president of a food company, must decide whether to market a new breakfast drink which the…

A: Find the Given details below: Given details: Profit/Loss Probability Accept the product…

Q: How characteristics of a product influence logistical costs? Examine the impact of these…

A: Product Characteristics: The following product characteristic may influence the…

Q: GENERATE THE DECISION VARIABLE SOLUTION AND GENERATE AN ANSWER REPORT 2. During the winter WeeMow…

A: Let, R = Number of residential jobs C = Number of commercial jobs Objective function: Maximize Z =…

Q: The college you are attending has a very busy canteen. Students are allowed to place and pay for…

A: Transaction processing system helps in completing a business transaction and also helps in tracking…

Q: I will give an upvote if you follow my instructions. thank you. please skip if you have already done…

A: The question is related Classification of Cost. It means the grouping of costs according to their…

Q: Highlight the importance of supply chain management within a business context. Highlight the role…

A: Supply chain management would be critical to a company's success. The route from each and every…

Q: Describe how strategic decisions differ from other decisions that managers make. Are you able to…

A: 1) Any effective choice made by management in a company is based on strategy. A well-planned and…

Q: What is the role of Aggregate Planning in operations at your organization?

A: Operations are the day-to-day activities performed y the organizations. These activities are…

Q: Based on the process capability ratio Cp for the given information, one can say that the process is…

A:

Q: 1. supply chain Design has helped organisations with alternative ways or choices to realize their…

A: 1. Supply chain design can be broadly defined as the methodology through which an organization…

Q: a. Solve the model formulated for Southern Sporting Goods Company using the computer. b. What would…

A: Linear programming is a mathematical technique that is also used in operations management…

Q: In Myanmar, five laborers, each making the equivalent of $3.50 per day, can produce 40 units per…

A: Given data Total labor costs =5×3.50=17.5 Total shipping cost =40×1.75=70 Total labor cost and…

Q: i) Is this a balanced problem? Why? ii) Obtain the initial feasible solution using the Northwest…

A: The transportation model is used to calculate the minimum cost of the route by selecting different…

Q: From the perspective of safety, is it possible to identify the benefits and drawbacks associated…

A: A verification system is a process of checking that a system achieves its requirements without any…

Q: Describe legal issues in channel management.

A: Legal Issues in Channel Management

Q: Focusing on your organization or a Caribbean company/organization of your choice within your…

A: A PESTEL study, also referred as a Pestel methodology, is a methodology or method for analysing and…

Q: Determine the optimal Q and TC given the following information: D = 3,000 liters Selling price per…

A: EOQ= 2*D*CoChANNUAL HOLDING COST (HC)= EOQ2*(Ch)ANNUAL ORDERING COST (OC) = DEOQ*(Co)ANNUAL…

Q: What are the differences between the Performance Management and Operations Management?

A: Operations management is a management area where the designing and controlling part of the…

Q: INSTRUCTIONS: 1. Read and understand the cases/problems properly. 2. Create an excel solution for…

A: Let, B = Units of basketball to be produced F = Units of Football to be produced Objective…

Q: Complete the MPS record below for an end item. (Enter your responses as integers. A response of "0"…

A: Given data is

Q: 1. Southern Sporting Goods Company makes basketballs and footballs. Each product is produced from…

A: Objective Functions and Constraints: Based on the given details, the objective…

Q: QUESTION ONE Product X is made of two units of Y and three units of Z. Y is made of one unit of A…

A: The Bills of material is the visual representation of the material required for a product.

Q: Solve the previous formulated model (Universal Claims Processors problem) by using graphical…

A: Linear programming is a mathematical technique that is also used in operations management…

Q: How the various fast-food outlets and FMCG companies in South Africa can address the use of palm oil…

A: Fast Moving Consumer Goods are products and goods that have high consumer demand with less profit…

Q: Explain the four factors to decrease the rate of the absenteeism in the organisation.

A: Absenteeism is a term used to describe an employee's habitual absence from work. This excludes any…

Q: Create a project management of a Construction business

A: Project Management of a Construction Business Construction project management comprises managing and…

Q: Why is it essential to collect data on a consistent basis?

A: Data should be collected consistently, here, we would take the data from different sites or…

Q: Roger Ginde is developing a program in supply chain management certification for managers. Ginde has…

A: Given data is

Q: al monitoring and evaluation system components

A: Conventional monitoring: he executives measure, targets and execution markers set by site or…

Q: Which option should the firm choose if it thinks it can sell 1400 boards at a price of $50 apiece?

A: For the given problem we need to calculate the expected profit for each alternative. Alternative:-…

Q: XYZ Steel Company manufactures two kinds of wrought-iron rails: Model E, the elegant, and Model D,…

A: Given data is Cost Selling price Profit Model D $90 $99 99-90=$9 Model E $81 $88 88-81=$7…

Q: A company makes two products X and Y, using a single resource pool. The resource is available for 8…

A: Production is the process in which inputs are combined to have the required output. It includes a…

Q: a. Create a set of linear equations to describe the objective function and the constraints. b. Use…

A: Linear programming is a mathematical technique that is also used in operations management…

Q: Each of the following four factories produces three products at the daily quantities and unit costs…

A: A matrix is used in organizations to structure the flow of management and organization. It helps to…

Q: Identify the eight key processes of excellent supply chainmanagement, and discuss how each of these…

A: Supply chain management- is based on the systematic process for handling the distribution of…

Q: Explain the trade-offs that inventory managers facewhen they reorder products or supplies. How is…

A: Inventory managers are responsible for making sure that the company has enough of the right products…

Q: co-own a business for the purpose of making profit is A sole proprietorship B Franchise C…

A: A business is an economic activity that one carries out in order to generate income. The main…

Q: Consider the transportation table below. (a) Use the Northwest-Corner Method, the Least-Cost Method…

A: Find the given details below: Given details: Factory Warehouse A B C D Supply 1 4 7 7 1…

Q: Determine the variables that have an impact on business and the problems that lie ahead for…

A: The business landscape will face greater uncertainty in the post-COVID period. Businesses need to…

Q: Why should we consider the internal factors in a SWOT analysis while developing a product since we…

A: SWOT analysis is a method to identify the strengths, weaknesses, opportunities, and threats of a…

Q: What is it about the event delegation model and the components that it entails that tickles our…

A: Delegation is required in an organization to make sure that the organization can work more…

Q: What qualities does a project need to be able to use critical path scheduling?

A: Critical path scheduling is an invaluable tool that project managers have at their disposal. Without…

Q: A manufacturing organisation has successfully implemented a supply chain system. However, the…

A: A supply chain system is a web between an organization and distributors to deliver finished goods to…

Q: GENERATE GENERATE THE DECISION VARIABLE SOLUTION AND A SENSITIVITY REPORT 2. During the winter…

A: Let, R = Number of residential jobs C = Number of commercial jobs Objective function: Maximize Z =…

Q: How does this supply chain differ from that in a manufacturing firm?

A: A supply chain is indeed the web of people, businesses, materials, operations, and technology…

1v

Step by step

Solved in 2 steps with 3 images

- Assume the demand for a companys drug Wozac during the current year is 50,000, and assume demand will grow at 5% a year. If the company builds a plant that can produce x units of Wozac per year, it will cost 16x. Each unit of Wozac is sold for 3. Each unit of Wozac produced incurs a variable production cost of 0.20. It costs 0.40 per year to operate a unit of capacity. Determine how large a Wozac plant the company should build to maximize its expected profit over the next 10 years.In the financial world, there are many types of complex instruments called derivatives that derive their value from the value of an underlying asset. Consider the following simple derivative. A stocks current price is 80 per share. You purchase a derivative whose value to you becomes known a month from now. Specifically, let P be the price of the stock in a month. If P is between 75 and 85, the derivative is worth nothing to you. If P is less than 75, the derivative results in a loss of 100(75-P) dollars to you. (The factor of 100 is because many derivatives involve 100 shares.) If P is greater than 85, the derivative results in a gain of 100(P-85) dollars to you. Assume that the distribution of the change in the stock price from now to a month from now is normally distributed with mean 1 and standard deviation 8. Let EMV be the expected gain/loss from this derivative. It is a weighted average of all the possible losses and gains, weighted by their likelihoods. (Of course, any loss should be expressed as a negative number. For example, a loss of 1500 should be expressed as -1500.) Unfortunately, this is a difficult probability calculation, but EMV can be estimated by an @RISK simulation. Perform this simulation with at least 1000 iterations. What is your best estimate of EMV?It is January 1 of year 0, and Merck is trying to determine whether to continue development of a new drug. The following information is relevant. You can assume that all cash flows occur at the ends of the respective years. Clinical trials (the trials where the drug is tested on humans) are equally likely to be completed in year 1 or 2. There is an 80% chance that clinical trials will succeed. If these trials fail, the FDA will not allow the drug to be marketed. The cost of clinical trials is assumed to follow a triangular distribution with best case 100 million, most likely case 150 million, and worst case 250 million. Clinical trial costs are incurred at the end of the year clinical trials are completed. If clinical trials succeed, the drug will be sold for five years, earning a profit of 6 per unit sold. If clinical trials succeed, a plant will be built during the same year trials are completed. The cost of the plant is assumed to follow a triangular distribution with best case 1 billion, most likely case 1.5 billion, and worst case 2.5 billion. The plant cost will be depreciated on a straight-line basis during the five years of sales. Sales begin the year after successful clinical trials. Of course, if the clinical trials fail, there are no sales. During the first year of sales, Merck believe sales will be between 100 million and 200 million units. Sales of 140 million units are assumed to be three times as likely as sales of 120 million units, and sales of 160 million units are assumed to be twice as likely as sales of 120 million units. Merck assumes that for years 2 to 5 that the drug is on the market, the growth rate will be the same each year. The annual growth in sales will be between 5% and 15%. There is a 25% chance that the annual growth will be 7% or less, a 50% chance that it will be 9% or less, and a 75% chance that it will be 12% or less. Cash flows are discounted 15% per year, and the tax rate is 40%. Use simulation to model Mercks situation. Based on the simulation output, would you recommend that Merck continue developing? Explain your reasoning. What are the three key drivers of the projects NPV? (Hint: The way the uncertainty about the first year sales is stated suggests using the General distribution, implemented with the RISKGENERAL function. Similarly, the way the uncertainty about the annual growth rate is stated suggests using the Cumul distribution, implemented with the RISKCUMUL function. Look these functions up in @RISKs online help.)

- Play Things is developing a new Lady Gaga doll. The company has made the following assumptions: The doll will sell for a random number of years from 1 to 10. Each of these 10 possibilities is equally likely. At the beginning of year 1, the potential market for the doll is two million. The potential market grows by an average of 4% per year. The company is 95% sure that the growth in the potential market during any year will be between 2.5% and 5.5%. It uses a normal distribution to model this. The company believes its share of the potential market during year 1 will be at worst 30%, most likely 50%, and at best 60%. It uses a triangular distribution to model this. The variable cost of producing a doll during year 1 has a triangular distribution with parameters 15, 17, and 20. The current selling price is 45. Each year, the variable cost of producing the doll will increase by an amount that is triangularly distributed with parameters 2.5%, 3%, and 3.5%. You can assume that once this change is generated, it will be the same for each year. You can also assume that the company will change its selling price by the same percentage each year. The fixed cost of developing the doll (which is incurred right away, at time 0) has a triangular distribution with parameters 5 million, 7.5 million, and 12 million. Right now there is one competitor in the market. During each year that begins with four or fewer competitors, there is a 25% chance that a new competitor will enter the market. Year t sales (for t 1) are determined as follows. Suppose that at the end of year t 1, n competitors are present (including Play Things). Then during year t, a fraction 0.9 0.1n of the company's loyal customers (last year's purchasers) will buy a doll from Play Things this year, and a fraction 0.2 0.04n of customers currently in the market ho did not purchase a doll last year will purchase a doll from Play Things this year. Adding these two provides the mean sales for this year. Then the actual sales this year is normally distributed with this mean and standard deviation equal to 7.5% of the mean. a. Use @RISK to estimate the expected NPV of this project. b. Use the percentiles in @ RISKs output to find an interval such that you are 95% certain that the companys actual NPV will be within this interval.The IRR is the discount rate r that makes a project have an NPV of 0. You can find IRR in Excel with the built-in IRR function, using the syntax =IRR(range of cash flows). However, it can be tricky. In fact, if the IRR is not near 10%, this function might not find an answer, and you would get an error message. Then you must try the syntax =IRR(range of cash flows, guess), where guess" is your best guess for the IRR. It is best to try a range of guesses (say, 90% to 100%). Find the IRR of the project described in Problem 34. 34. Consider a project with the following cash flows: year 1, 400; year 2, 200; year 3, 600; year 4, 900; year 5, 1000; year 6, 250; year 7, 230. Assume a discount rate of 15% per year. a. Find the projects NPV if cash flows occur at the ends of the respective years. b. Find the projects NPV if cash flows occur at the beginnings of the respective years. c. Find the projects NPV if cash flows occur at the middles of the respective years.Suppose you are borrowing 25,000 and making monthly payments with 1% interest. Show that the monthly payments should equal 556.11. The key relationships are that for any month t (Ending month t balance) = (Ending month t 1 balance) ((Monthly payment) (Month t interest)) (Month t interest) = (Beginning month t balance) (Monthly interest rate) Of course, the ending month 60 balance must equal 0.

- A company manufacturers a product in the United States and sells it in England. The unit cost of manufacturing is 50. The current exchange rate (dollars per pound) is 1.221. The demand function, which indicates how many units the company can sell in England as a function of price (in pounds) is of the power type, with constant 27556759 and exponent 2.4. a. Develop a model for the companys profit (in dollars) as a function of the price it charges (in pounds). Then use a data table to find the profit-maximizing price to the nearest pound. b. If the exchange rate varies from its current value, does the profit-maximizing price increase or decrease? Does the maximum profit increase or decrease?Rollo Megabux has $1 million to invest in stocks orbonds. The percentage yield on each investment during thecoming year depends on whether the economy has a goodor a bad year (see Table 17). It is equally likely that theeconomy will have a good or a bad year.a If Rollo is risk-neutral, how should he invest hismoney?b For $10,000, Rollo can hire a consulting firm toforecast the state of the economy. The consulting firm’sforecasts have the following properties:P(good forecast|economy good) .80P(good forecast|economy bad) .20Should Rollo hire the consulting firm? What are EVSIand EVPI? Economy EconomyHas Good Has BadYear YearYield on stocks 22% 10%Yield on bonds 16% 14%Suppose you are 45 and have a $410,000 face amount, 15-year, limited-payment, participating policy (dividends will be used to build up the cash value of the policy). Your annual premium is $1,435. The cash value of the policy is expected to be $16,400 in 15 years. Using time value of money and assuming you could invest your money elsewhere for a 7 percent annual yield, calculate the net cost of insurance. Use (Exhibit 1-A, Exhibit 1-B, Exhibit 1-C, Exhibit 1-D)