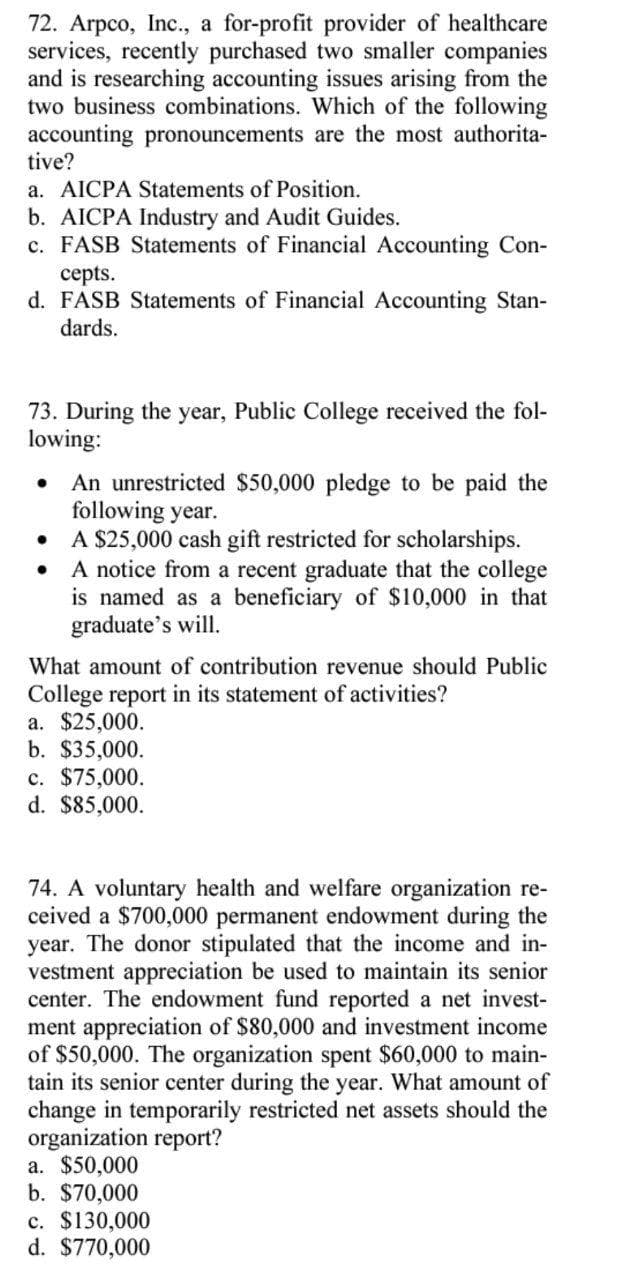

72. Arpco, Inc., a for-profit provider of healthcare services, recently purchased two smaller companies and is researching accounting issues arising from the two business combinations. Which of the following accounting pronouncements are the most authorita- tive? a. AICPA Statements of Position. b. AICPA Industry and Audit Guides. c. FASB Statements of Financial Accounting Con- cepts. d. FASB Statements of Financial Accounting Stan- dards.

72. Arpco, Inc., a for-profit provider of healthcare services, recently purchased two smaller companies and is researching accounting issues arising from the two business combinations. Which of the following accounting pronouncements are the most authorita- tive? a. AICPA Statements of Position. b. AICPA Industry and Audit Guides. c. FASB Statements of Financial Accounting Con- cepts. d. FASB Statements of Financial Accounting Stan- dards.

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter1: Accounting As A Form Of Communication

Section: Chapter Questions

Problem 1.13E

Related questions

Question

Transcribed Image Text:72. Arpco, Inc., a for-profit provider of healthcare

services, recently purchased two smaller companies

and is researching accounting issues arising from the

two business combinations. Which of the following

accounting pronouncements are the most authorita-

tive?

a. AICPA Statements of Position.

b. AICPA Industry and Audit Guides.

c. FASB Statements of Financial Accounting Con-

сepts.

d. FASB Statements of Financial Accounting Stan-

dards.

73. During the year, Public College received the fol-

lowing:

An unrestricted $50,000 pledge to be paid the

following year.

A $25,000 cash gift restricted for scholarships.

A notice from a recent graduate that the college

is named as a beneficiary of $10,000 in that

graduate's will.

What amount of contribution revenue should Public

College report in its statement of activities?

а. $25,000.

b. $35,000.

c. $75,000.

d. $85,000.

74. A voluntary health and welfare organization re-

ceived a $700,000 permanent endowment during the

year. The donor stipulated that the income and in-

vestment appreciation be used to maintain its senior

center. The endowment fund reported a net invest-

ment appreciation of $80,000 and investment income

of $50,000. The organization spent $60,000 to main-

tain its senior center during the year. What amount of

change in temporarily restricted net assets should the

organization report?

a. $50,000

b. $70,000

c. $130,000

d. $770,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage