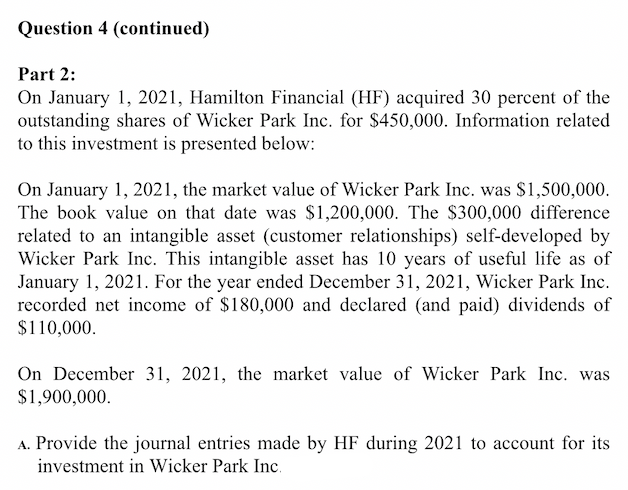

Question 4 (continued) Part 2: On January 1, 2021, Hamilton Financial (HF) acquired 30 percent of the outstanding shares of Wicker Park Inc. for $450,000. Information related to this investment is presented below: On January 1, 2021, the market value of Wicker Park Inc. was $1,500,000. The book value on that date was $1,200,000. The $300,000 difference related to an intangible asset (customer relationships) self-developed by Wicker Park Inc. This intangible asset has 10 years of useful life as of January 1, 2021. For the year ended December 31, 2021, Wicker Park Inc. recorded net income of $180,000 and declared (and paid) dividends of $110,000. On December 31, 2021, the market value of Wicker Park Inc. was $1,900,000. A. Provide the journal entries made by HF during 2021 to account for its investment in Wicker Park Inc.

Question 4 (continued) Part 2: On January 1, 2021, Hamilton Financial (HF) acquired 30 percent of the outstanding shares of Wicker Park Inc. for $450,000. Information related to this investment is presented below: On January 1, 2021, the market value of Wicker Park Inc. was $1,500,000. The book value on that date was $1,200,000. The $300,000 difference related to an intangible asset (customer relationships) self-developed by Wicker Park Inc. This intangible asset has 10 years of useful life as of January 1, 2021. For the year ended December 31, 2021, Wicker Park Inc. recorded net income of $180,000 and declared (and paid) dividends of $110,000. On December 31, 2021, the market value of Wicker Park Inc. was $1,900,000. A. Provide the journal entries made by HF during 2021 to account for its investment in Wicker Park Inc.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 8MC

Related questions

Question

Transcribed Image Text:Question 4 (continued)

Part 2:

On January 1, 2021, Hamilton Financial (HF) acquired 30 percent of the

outstanding shares of Wicker Park Inc. for $450,000. Information related

to this investment is presented below:

On January 1, 2021, the market value of Wicker Park Inc. was $1,500,000.

The book value on that date was $1,200,000. The $300,000 difference

related to an intangible asset (customer relationships) self-developed by

Wicker Park Inc. This intangible asset has 10 years of useful life as of

January 1, 2021. For the year ended December 31, 2021, Wicker Park Inc.

recorded net income of $180,000 and declared (and paid) dividends of

$110,000.

On December 31, 2021, the market value of Wicker Park Inc. was

$1,900,000.

A. Provide the journal entries made by HF during 2021 to account for its

investment in Wicker Park Inc.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning