Chapter10: The Basics Of Capital Budgeting: Evaluating Cash Flows

Section10.4: Internal Rate Of Return (irr)

Problem 6ST

Related questions

Question

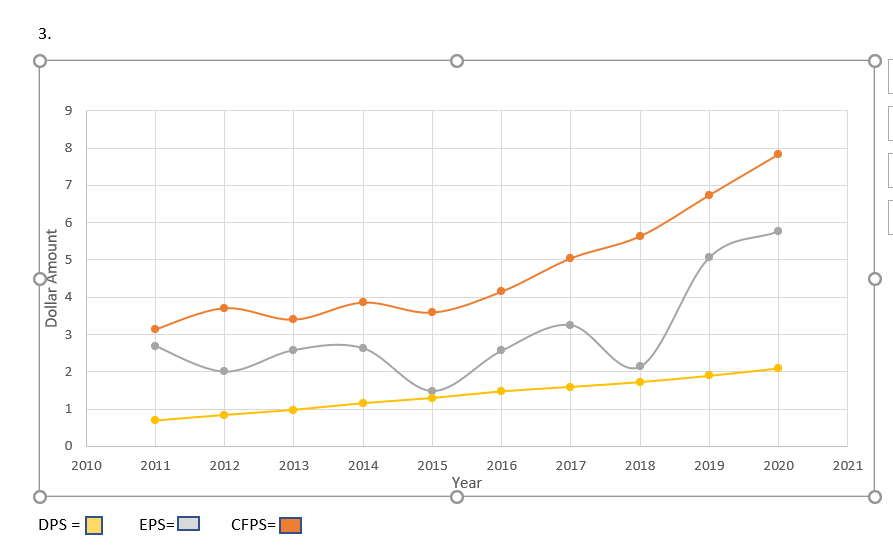

4. Describe the output of the graph. Is there are any relation between the CFPS, EPS, and DPS.

5. Describe how volatile the payout ratios are based on earnings and cash flows.

6. Is there any correlation between (a) dividends and cash flows AND (b) dividends and

earnings. From your analysis, can you say which of the two that dividend is more dependent

on?

Transcribed Image Text:7

2.

1.

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Year

DPS

EPS=D

CFPS=|

3.

3.

unowy

Dollar Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you