4. For fiscal 2020: Free Cash Flow to Equity

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.2AP

Related questions

Question

Please use the attached images as well...

Compute the following:

4. For fiscal 2020:

5. Market Capitalization, Market to Book Value and the Price-Earnings Ratio as of year-end 2020

Stock Prices in 2018 = $68.98

2019 = $84.15

2020 = $107.82

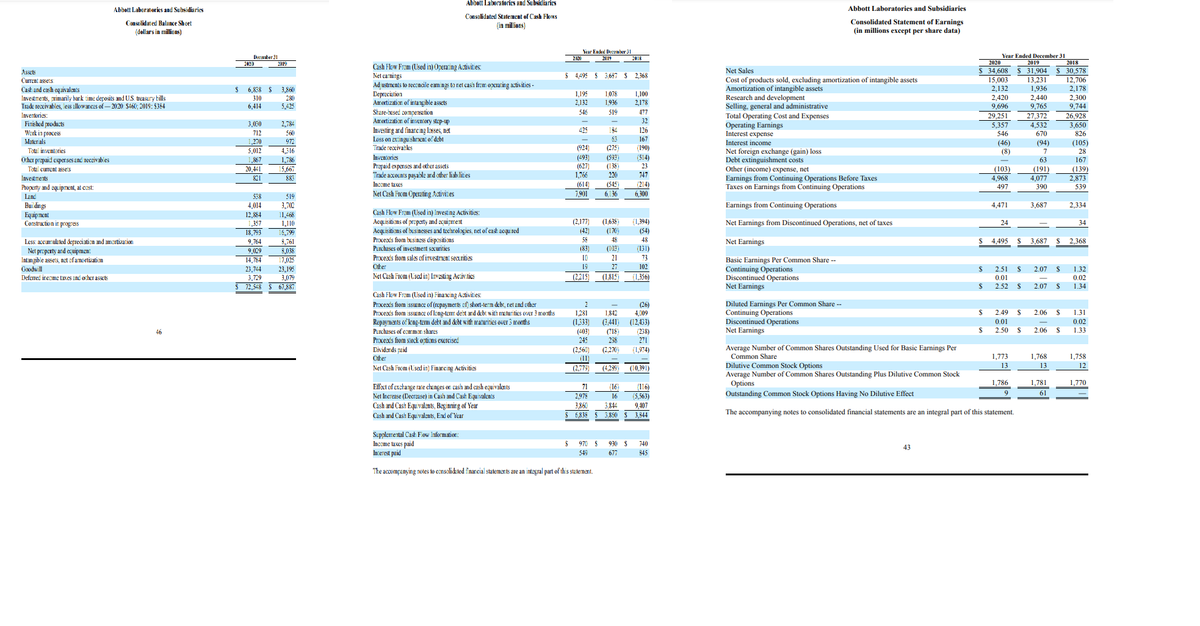

Transcribed Image Text:Abbott Laboratories and Subsidiaries

Abbott Laboratories and Subsidiaries

Abbott Laboratories and Subsidiaries

Consolidated Statement of Cash Flows

(in millions)

Consolidated Statement of Earnings

(in millions except per share data)

Consolidat ed Balance Sheet

(dellars in millions)

Year Ended December 31

Deceraber 31

2120

2019

Year Ended December 31

2020

2018

30,578

12,706

2,178

2.300

9,744

2019

Cash Flow From (Used in) Operating Activities:

Net earnings

Ad ustments to reccncile eamings to net cash from operating activities -

Depreciation

Amortization of intangible assets

Stare-based compensation

Amortization of inventory step-up

Assets

Net Sales

34,608

31,904

$ 4495 $ 3,687 $ 2,368

Cost of products sold, excluding amortization of intangible assets

Amortization of intangible assets

Research and development

Selling, general and administrative

Total Operating Cost and Expenses

Operating Earnings

Interest expense

15,003

2,132

2,420

9,696

29,251

5,357

13,231

1,936

2,440

9,765

Current assets

Cash and cash equivalents

Investments, rimarily bark time deposits and US. treasury bills

Trade receivables, less allowances of- 2020 $460; 2019: $364

Inventories:

Finished products

Werk in process

Materials

Total inventories

6,838 $

3,860

1,195

2,132

1,078

1,100

310

280

1,936

2,178

6,414

5,425

546

519

477

27,372

4,532

26,928

3,650

32

3,050

2,784

Investing ard financing loses, net

Loss on extinguishrment of debt

Trade receivables

Invemtories

Prepaid ex penses and other assets

Trade accounts payable and other liablities

425

184

126

712

560

546

670

826

53

167

1,270

972

Interest income

Net foreign exchange (gain) loss

Debt extinguishment costs

Other (income) expense, net

Earnings from Continuing Operations Before Taxes

Taxes on Earnings from Continuing Operations

(46)

(8)

(94)

(105)

28

5,012

4316

(924)

(275)

(190)

7

(493)

(627

1,766

(593)

(138)

20

Ocher prapaid experses and reczivabies

,867

(514)

167

1,786

15,667

63

23

(103)

(139)

2,873

Total current assets

20,441

(191)

4,077

747

Investments

821

883

4,968

Income taxes

(614)

7,901

(545)

(214)

Property and equipment, at cast:

497

390

539

Lad

538

519

Net Cash From Operating Activities

6,136

6,300

Bui dings

Equipment

Construction ir progress

4,014

Earnings from Continuing Operations

2,334

3,702

11,468

1,110

4,471

3,687

Cash Flow From (Used in) Investing Activities:

12,884

Acquisitions of property and aquipment

Acquisitions of businesses and technologies, net of cash acqui red

Proceads from business dispasitions

Purchases of investnment sacurities

(2,177)

(42)

(1,638)

(170)

(1,394)

Net Earnings from Discontinued Operations, net of taxes

24

34

1,357

18,793

9,764

(54)

15,799

8,761

58

48

48

Net Earnings

%24

24

Less: accurulated depreciation and amortization

Net property and ecuipmen:

Intangible assets,

Goodwill

4,495

3,687

2,368

9,029

(83)

(103)

(131)

8,038

17,025

23,195

3,079

$ 67,887

Proceads from salas of investment securities

Other

Net Cash From (Lsed in) Invasting Acivities

of amortization

14.784

21

73

Basic Earnings Per Common Share -

Continuing Operations

Discontinued Operations

Net Earnings

19

27

102

23,744

2$

2.51 $

2.07

$

1.32

Deferred income taxes and ocher assets

(2215)

(1,815

(1,356)

3,729

72,548

0.01

0.02

2.52 $

2.07 $

1.34

Cash Flow From (Used in) Financing Activities:

Proceads fiom issuance of (repayments of) short-tern debt, ret and other

Proceads from issuance of leng-term dest and debt with meturities over 3 months

Repayments of kng-term debt and debt with maturities over 3 m:Ornths

Purchases of common shares

Proceads from stock ontions exercised

Diluted Earnings Per Common Share --

Continuing Operations

Discontinued Operations

Net Earnings

(26)

4,009

1281

1,842

2$

2.49

%24

2.06

2$

1.31

(1,333)

(403)

(3,441)

(718

298

(12,433)

0.01

0.02

46

(238)

2$

2.50

$

2.06

1.33

245

271

Average Number of Common Shares Outstanding Used for Basic Earnings Per

Common Share

(2,560

Dividards paid

Cther

(2,270

(1,974)

()

1,773

1,768

1,758

Dilutive Common Stock Options

Average Number of Common Shares Outstanding Plus Dilutive Common Stock

Options

Outstanding Common Stock Options Having No Dilutive Effect

13

13

12

Net Cash From (Used in) Financing Activities

(2,775

(4,289

(10,391)

Effect of exchange rate chɛnges or cash and cash equivalents

1,786

1,781

1,770

71

(16)

(116)

2,978

16

61

Net Increase (Decrease) in Cash and Cash Equivalents

Cash and Cash Equivalents, Beginnirg of Year

Cash and Cash Equivalents, End of Year

(5,563)

3.860

9,407

3.850 $ 3,844

3,844

The accompanying notes to consolidated financial statements are an integral part of this statement.

6,838

Supplemental Cash Flow Information:

Imcome tases paid

970 S

930 $

740

43

In:erest paid

5459

677

845

The accompanying notes to cansalidated finarcial statements are an integral part of this statement.

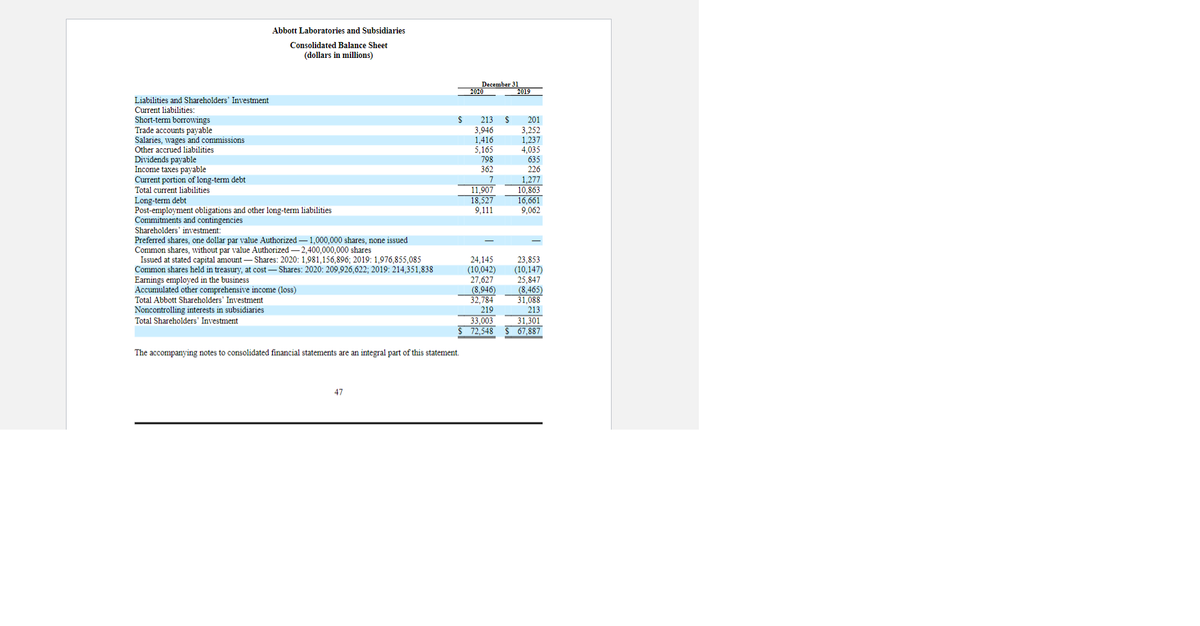

Transcribed Image Text:Abbott Laboratories and Subsidiaries

Consolidated Balance Sheet

(dollars in millions)

December 31

2020

2019

Liabilities and Shareholders' Investment

Current liabilities:

Short-term borrowings

Trade accounts payable

Salaries,

213

201

3.946

1,416

5,165

798

362

3,252

1,237

4,035

635

wages and commissions

Other accrued liabilities

Dividends payable

Income taxes payable

Current portion of long-term debt

Total current liabilities

11,907

18,527

9,111

1,277

10,863

16,661

9,062

Long-term debt

Post-employment obligations and other long-term liabilities

Commitments and contingencies

Shareholders' investment:

Preferred shares, one dollar par value Authorized – 1,000,000 shares, none issued

Common shares, without par value Authorized – 2,400,000,000 shares

Issued

Common shares held in treasury, at cost – Shares: 2020: 209,926,622; 2019: 214,351,838

Earnings employed in the business

Accumulated other comprehensive income (loss)

Total Abbott Shareholders' Investment

stated capital amount– Shares: 2020: 1,981,156,896; 2019: 1,976,855,085

23,853

(10,147)

25,847

(8,465)

31,088

213

at

24,145

(10,042)

27,627

(8,946)

32.784

Noncontrolling interests in subsidiaries

Total Shareholders' Investment

219

33.003

72,548

31,301

$ 67,887

The accompanying notes to consolidated financial statements are an integral part of this statement.

47

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning