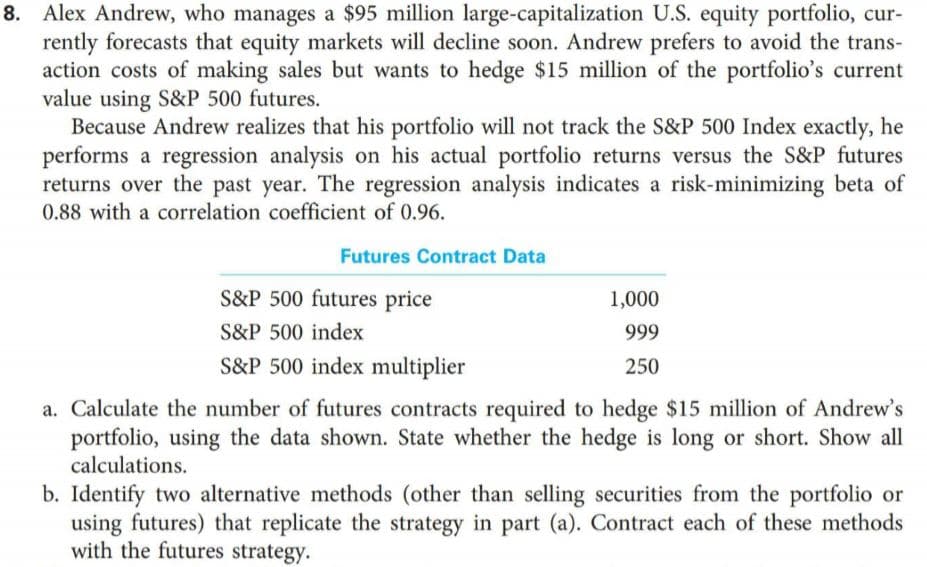

8. Alex Andrew, who manages a $95 million large-capitalization U.S. equity portfolio, cur- rently forecasts that equity markets will decline soon. Andrew prefers to avoid the trans- action costs of making sales but wants to hedge $15 million of the portfolio's current value using S&P 500 futures. Because Andrew realizes that his portfolio will not track the S&P 500 Index exactly, he performs a regression analysis on his actual portfolio returns versus the S&P futures returns over the past year. The regression analysis indicates a risk-minimizing beta of 0.88 with a correlation coefficient of 0.96. Futures Contract Data S&P 500 futures price 1,000 S&P 500 index 999 S&P 500 index multiplier 250 a. Calculate the number of futures contracts required to hedge $15 million of Andrew's portfolio, using the data shown. State whether the hedge is long or short. Show all calculations. b. Identify two alternative methods (other than selling securities from the portfolio or using futures) that replicate the strategy in part (a). Contract each of these methods with the futures strategy.

8. Alex Andrew, who manages a $95 million large-capitalization U.S. equity portfolio, cur- rently forecasts that equity markets will decline soon. Andrew prefers to avoid the trans- action costs of making sales but wants to hedge $15 million of the portfolio's current value using S&P 500 futures. Because Andrew realizes that his portfolio will not track the S&P 500 Index exactly, he performs a regression analysis on his actual portfolio returns versus the S&P futures returns over the past year. The regression analysis indicates a risk-minimizing beta of 0.88 with a correlation coefficient of 0.96. Futures Contract Data S&P 500 futures price 1,000 S&P 500 index 999 S&P 500 index multiplier 250 a. Calculate the number of futures contracts required to hedge $15 million of Andrew's portfolio, using the data shown. State whether the hedge is long or short. Show all calculations. b. Identify two alternative methods (other than selling securities from the portfolio or using futures) that replicate the strategy in part (a). Contract each of these methods with the futures strategy.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter25: Portfolio Theory And Asset Pricing Models

Section: Chapter Questions

Problem 7MC: You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand...

Related questions

Question

Transcribed Image Text:8. Alex Andrew, who manages a $95 million large-capitalization U.S. equity portfolio, cur-

rently forecasts that equity markets will decline soon. Andrew prefers to avoid the trans-

action costs of making sales but wants to hedge $15 million of the portfolio's current

value using S&P 500 futures.

Because Andrew realizes that his portfolio will not track the S&P 500 Index exactly, he

performs a regression analysis on his actual portfolio returns versus the S&P futures

returns over the past year. The regression analysis indicates a risk-minimizing beta of

0.88 with a correlation coefficient of 0.96.

Futures Contract Data

S&P 500 futures price

1,000

S&P 500 index

999

S&P 500 index multiplier

250

a. Calculate the number of futures contracts required to hedge $15 million of Andrew's

portfolio, using the data shown. State whether the hedge is long or short. Show all

calculations.

b. Identify two alternative methods (other than selling securities from the portfolio or

using futures) that replicate the strategy in part (a). Contract each of these methods

with the futures strategy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT