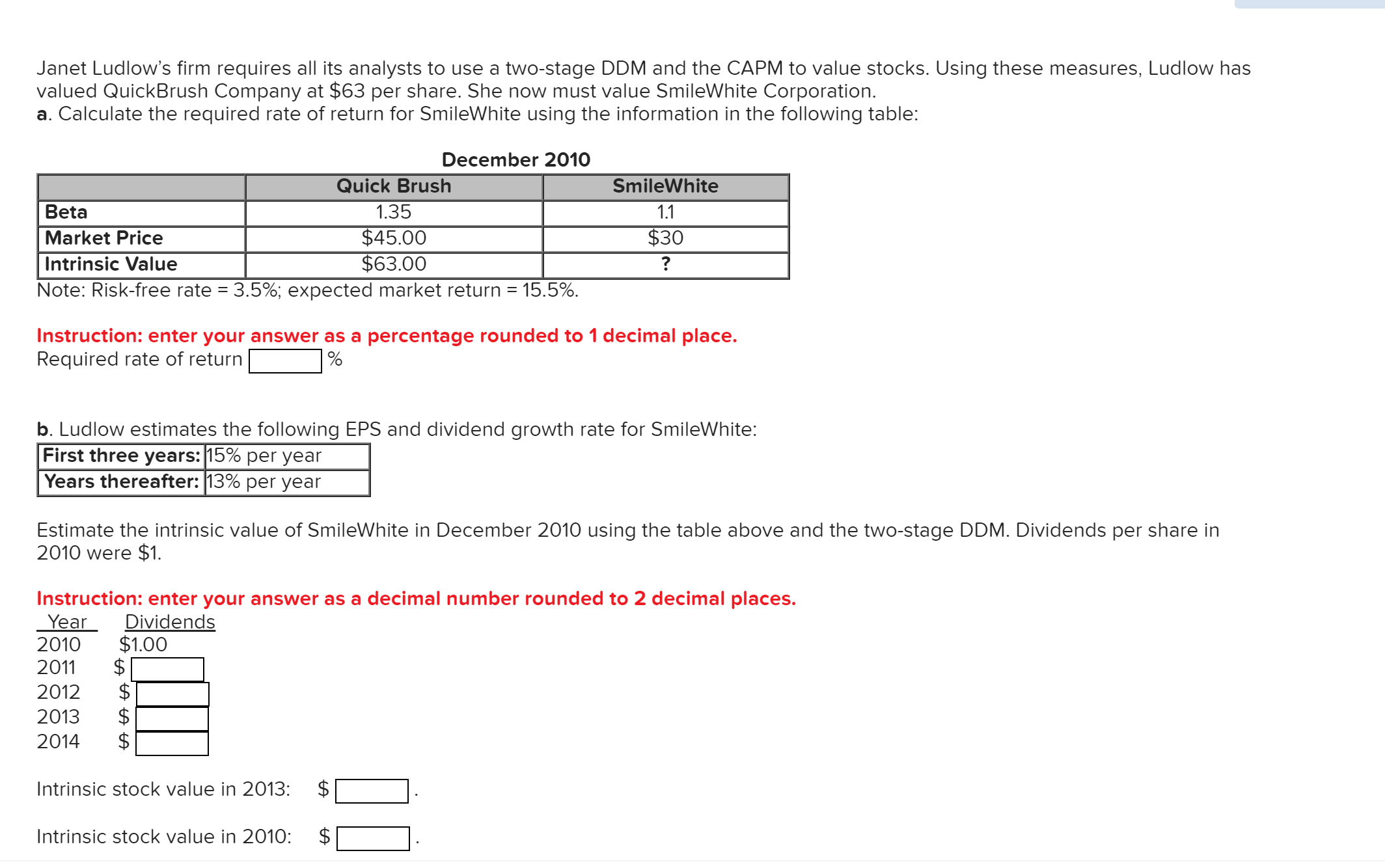

Janet Ludlow's firm requires all its analysts to use a two-stage DDM and the CAPM to value stocks. Using these measures, Ludlow has valued QuickBrush Company at $63 per share. She now must value SmileWhite Corporation. a. Calculate the required rate of return for SmileWhite using the information in the following table: December 2010 Quick Brush SmileWhite 1.35 Beta 1.1 $30 $45.00 $63.00 Market Price Intrinsic Value Note: Risk-free rate 3.5%; expected market return 15.5%. Instruction: enter your answer as a percentage rounded to 1 decimal place. Required rate of return b. Ludlow estimates the following EPS and dividend growth rate for SmileWhite: First three years: 15% per year Years thereafter: 13% per year Estimate the intrinsic value of SmileWhite in December 2010 using the table above and the two-stage DDM. Dividends per share in 2010 were $1. Instruction: enter your answer as a decimal number rounded to 2 decimal places. Year 2010 Dividends $1.00 $ $ $ $ 2011 2012 2013 2014 $ Intrinsic stock value in 2013: $ Intrinsic stock value in 201O:

Janet Ludlow's firm requires all its analysts to use a two-stage DDM and the CAPM to value stocks. Using these measures, Ludlow has valued QuickBrush Company at $63 per share. She now must value SmileWhite Corporation. a. Calculate the required rate of return for SmileWhite using the information in the following table: December 2010 Quick Brush SmileWhite 1.35 Beta 1.1 $30 $45.00 $63.00 Market Price Intrinsic Value Note: Risk-free rate 3.5%; expected market return 15.5%. Instruction: enter your answer as a percentage rounded to 1 decimal place. Required rate of return b. Ludlow estimates the following EPS and dividend growth rate for SmileWhite: First three years: 15% per year Years thereafter: 13% per year Estimate the intrinsic value of SmileWhite in December 2010 using the table above and the two-stage DDM. Dividends per share in 2010 were $1. Instruction: enter your answer as a decimal number rounded to 2 decimal places. Year 2010 Dividends $1.00 $ $ $ $ 2011 2012 2013 2014 $ Intrinsic stock value in 2013: $ Intrinsic stock value in 201O:

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter22: Mergers And Corporate Control

Section: Chapter Questions

Problem 12MC

Related questions

Question

need help on all

Transcribed Image Text:Janet Ludlow's firm requires all its analysts to use a two-stage DDM and the CAPM to value stocks. Using these measures, Ludlow has

valued QuickBrush Company at $63 per share. She now must value SmileWhite Corporation.

a. Calculate the required rate of return for SmileWhite using the information in the following table:

December 2010

Quick Brush

SmileWhite

1.35

Beta

1.1

$30

$45.00

$63.00

Market Price

Intrinsic Value

Note: Risk-free rate 3.5%; expected market return 15.5%.

Instruction: enter your answer as a percentage rounded to 1 decimal place.

Required rate of return

b. Ludlow estimates the following EPS and dividend growth rate for SmileWhite:

First three years: 15% per year

Years thereafter: 13% per year

Estimate the intrinsic value of SmileWhite in December 2010 using the table above and the two-stage DDM. Dividends per share in

2010 were $1.

Instruction: enter your answer as a decimal number rounded to 2 decimal places.

Year

2010

Dividends

$1.00

$

$

$

$

2011

2012

2013

2014

$

Intrinsic stock value in 2013:

$

Intrinsic stock value in 201O:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub