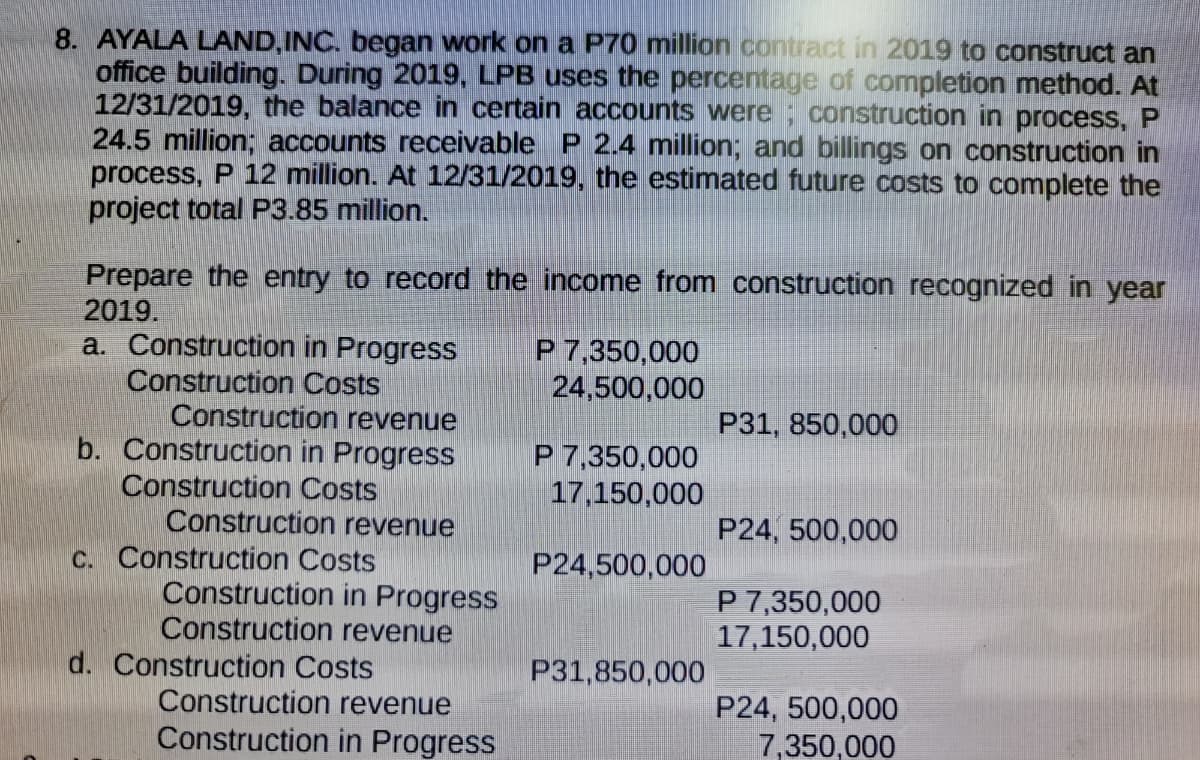

8. AYALA LAND,INC. began work on a P70 million contract in 2019 to construct an office building. During 2019, LPB uses the percentage of completion method. At 12/31/2019, the balance in certain accounts were ; construction in process, P 24.5 million; accounts receivable P 2.4 million; and billings on construction in process, P 12 million. At 12/31/2019, the estimated future costs to complete the project total P3.85 million. Prepare the entry to record the income from construction recognized in year 2019. a. Construction in Progress Construction Costs P 7,350,000 24,500,000 Construction revenue P31, 850,000 b. Construction in Progress P 7,350,000 17,150,000 Construction Costs Construction revenue C. Construction Costs P24, 500,000 P24,500,000 Construction in Progress Construction revenue P 7,350,000 17,150,000 d. Construction Costs P31,850,000 Construction revenue P24, 500,000

8. AYALA LAND,INC. began work on a P70 million contract in 2019 to construct an office building. During 2019, LPB uses the percentage of completion method. At 12/31/2019, the balance in certain accounts were ; construction in process, P 24.5 million; accounts receivable P 2.4 million; and billings on construction in process, P 12 million. At 12/31/2019, the estimated future costs to complete the project total P3.85 million. Prepare the entry to record the income from construction recognized in year 2019. a. Construction in Progress Construction Costs P 7,350,000 24,500,000 Construction revenue P31, 850,000 b. Construction in Progress P 7,350,000 17,150,000 Construction Costs Construction revenue C. Construction Costs P24, 500,000 P24,500,000 Construction in Progress Construction revenue P 7,350,000 17,150,000 d. Construction Costs P31,850,000 Construction revenue P24, 500,000

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter8: Revenue Recognition, Receivables, And Advances From Customers

Section: Chapter Questions

Problem 48P

Related questions

Question

100%

Please refer to the picture below to answer the question.

Question: What is the journal entry to record the income from construction recognized in year 2019?

Transcribed Image Text:8. AYALA LAND, INC. began work on a P70 million contract in 2019 to construct an

office building. During 2019, LPB uses the percentage of completion method. At

12/31/2019, the balance in certain accounts were ; construction in process, P

24.5 million; accounts receivable P 2.4 million; and billings on construction in

process, P 12 million. At 12/31/2019, the estimated future costs to complete the

project total P3.85 million.

Prepare the entry to record the income from construction recognized in year

2019.

a. Construction in Progress

Construction Costs

Construction revenue

b. Construction in Progress

P 7,350,000

24,500,000

P31, 850,000

P 7,350,000

17,150,000

Construction Costs

Construction revenue

C. Construction Costs

P24, 500,000

P24,500,000

Construction in Progress

Construction revenue

P 7,350,000

17,150,000

d. Construction Costs

Construction revenue

Construction in Progress

P31,850,000

P24, 500,000

7,350,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT