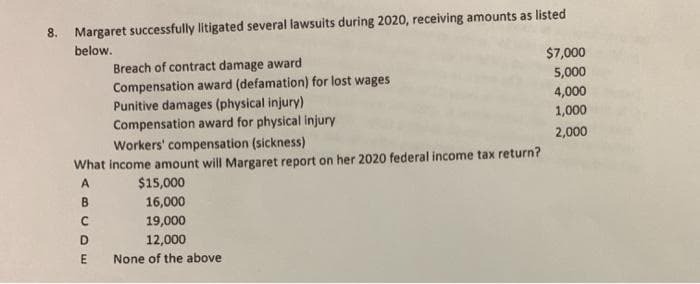

8. Margaret sUccessfully litigated several lawsuits during 2020, receiving amounts as listed below. $7,000 Breach of contract damage award 5,000 Compensation award (defamation) for lost wages Punitive damages (physical injury) Compensation award for physical injury Workers' compensation (sickness) What income amount will Margaret report on her 2020 federal income tax return? 4,000 1,000 2,000 $15,000 16,000 19,000 D 12,000 None of the above ABCC E

8. Margaret sUccessfully litigated several lawsuits during 2020, receiving amounts as listed below. $7,000 Breach of contract damage award 5,000 Compensation award (defamation) for lost wages Punitive damages (physical injury) Compensation award for physical injury Workers' compensation (sickness) What income amount will Margaret report on her 2020 federal income tax return? 4,000 1,000 2,000 $15,000 16,000 19,000 D 12,000 None of the above ABCC E

Chapter12: Alternative Minimum Tax

Section: Chapter Questions

Problem 1CPA

Related questions

Question

Transcribed Image Text:8. Margaret successfully litigated several lawsuits during 2020, receiving amounts as listed

below.

$7,000

5,000

Breach of contract damage award

Compensation award (defamation) for lost wages

Punitive damages (physical injury)

Compensation award for physical injury

Workers' compensation (sickness)

4,000

1,000

2,000

What income amount will Margaret report on her 2020 federal income tax return?

A.

$15,000

B

16,000

19,000

D

12,000

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT