8. James earned $55,000 of net earnings from a tax preparation business that he runs during tax season. He also earned a salary of $50,000 from his full-time job. How much selff-employment tax must he pay for 2019? 9. Richard purchased an apartment building on May 1, 2019, for S400,000, $100,000 of which was for the land. What is the cost recovery deduction for 20197 10. Emma purchased an office building on March 30, 2016, for $800,000. $200,000 of which was for the land. On August 1, 2019, she sold the office building. What is the cost recovery deduction for 2019?

8. James earned $55,000 of net earnings from a tax preparation business that he runs during tax season. He also earned a salary of $50,000 from his full-time job. How much selff-employment tax must he pay for 2019? 9. Richard purchased an apartment building on May 1, 2019, for S400,000, $100,000 of which was for the land. What is the cost recovery deduction for 20197 10. Emma purchased an office building on March 30, 2016, for $800,000. $200,000 of which was for the land. On August 1, 2019, she sold the office building. What is the cost recovery deduction for 2019?

Chapter10: Cost Recovery On Property: Depreciation, Depletion, And Amortization

Section: Chapter Questions

Problem 56P

Related questions

Question

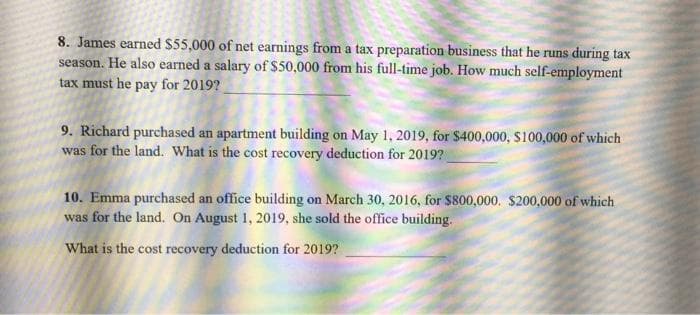

Transcribed Image Text:8. James earned $55,000 of net earnings from a tax preparation business that he runs during tax

season. He also earned a salary of $50,000 from his full-time job. How much self-employment

tax must he pay for 2019?

9. Richard purchased an apartment building on May 1, 2019, for $400,000, $100,000 of which

was for the land. What is the cost recovery deduction for 2019?

10. Emma purchased an office building on March 30, 2016, for $800,000. $200,000 of which

was for the land. On August 1, 2019, she sold the office building.

What is the cost recovery deduction for 2019?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT