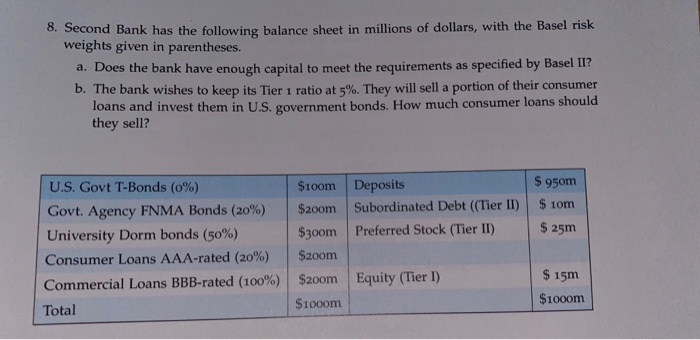

8. Second Bank has the following balance sheet in millions of dollars, with the Basel risk weights given in parentheses. a. Does the bank have enough capital to meet the requirements as specified by Basel II? b. The bank wishes to keep its Tier 1 ratio at 5%. They will sell a portion of their consumer Toans and invest them in U.S. government bonds. How much consumer loans should they sell? U.S. Govt T-Bonds (o%) $100m Deposits $ 950m Govt. Agency FNMA Bonds (20%) $200m Subordinated Debt (Tier II) $ 1om University Dorm bonds (50%) $300m Preferred Stock (Tier II) $ 25m Consumer Loans AAA-rated (20%) $200m $ 15m Commercial Loans BBB-rated (100%) $200m Equity (Tier I) $1000m Total $100om

8. Second Bank has the following balance sheet in millions of dollars, with the Basel risk weights given in parentheses. a. Does the bank have enough capital to meet the requirements as specified by Basel II? b. The bank wishes to keep its Tier 1 ratio at 5%. They will sell a portion of their consumer Toans and invest them in U.S. government bonds. How much consumer loans should they sell? U.S. Govt T-Bonds (o%) $100m Deposits $ 950m Govt. Agency FNMA Bonds (20%) $200m Subordinated Debt (Tier II) $ 1om University Dorm bonds (50%) $300m Preferred Stock (Tier II) $ 25m Consumer Loans AAA-rated (20%) $200m $ 15m Commercial Loans BBB-rated (100%) $200m Equity (Tier I) $1000m Total $100om

Chapter18: Long-term Debt Financing

Section: Chapter Questions

Problem 12QA

Related questions

Question

Transcribed Image Text:8. Second Bank has the following balance sheet in millions of dollars, with the Basel risk

weights given in parentheses.

a. Does the bank have enough capital to meet the requirements as specified by Basel II?

b. The bank wishes to keep its Tier 1 ratio at 5%. They will sell a portion of their consumer

loans and invest them in U.S. government bonds. How much consumer loans should

they sell?

U.S. Govt T-Bonds (o%)

$10om Deposits

$ 950m

Govt. Agency FNMA Bonds (20%)

$200m Subordinated Debt ((Tier II)

$ 1om

University Dorm bonds (50%)

$30om Preferred Stock (Tier II)

$ 25m

Consumer Loans AAA-rated (20%)

$20om

Commercial Loans BBB-rated (100%)

$200m Equity (Tier I)

$ 15m

$100om

$1000m

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning