New York simultaneously calls Citibank in New York City and Barclays in London. The banks give the following quotes on the euro simultaneously. Citibank NYC Barclays London Bid: $0.7551 = €1.00 Bid: $0.7545 = €1.00 Ask: $0.7561 = €1.00 Ask: $0.7575 = €1.00 Using $1 million or its euro equivalent, show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes.

New York simultaneously calls Citibank in New York City and Barclays in London. The banks give the following quotes on the euro simultaneously. Citibank NYC Barclays London Bid: $0.7551 = €1.00 Bid: $0.7545 = €1.00 Ask: $0.7561 = €1.00 Ask: $0.7575 = €1.00 Using $1 million or its euro equivalent, show how the corporate treasury could make geographic arbitrage profit with the two different exchange rate quotes.

Fundamentals of Financial Management, Concise Edition (MindTap Course List)

9th Edition

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter17: Multinational Financial Management

Section: Chapter Questions

Problem 2DQ

Related questions

Question

Transcribed Image Text:5.12

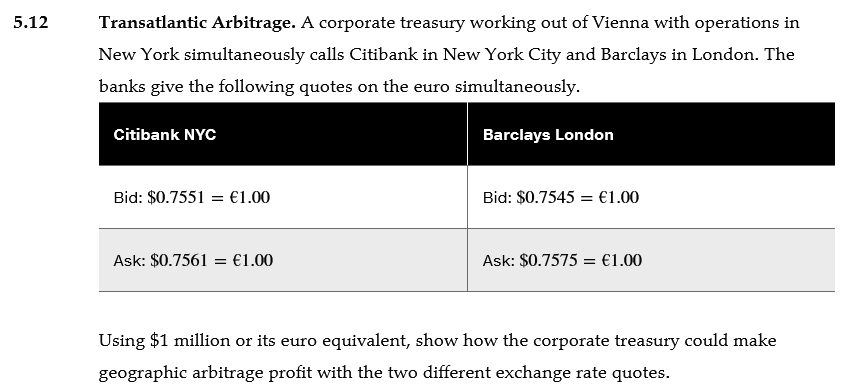

Transatlantic Arbitrage. A corporate treasury working out of Vienna with operations in

New York simultaneously calls Citibank in New York City and Barclays in London. The

banks give the following quotes on the euro simultaneously.

Citibank NYC

Barclays London

Bid: $0.7551 = €1.00

Bid: $0.7545 = €1.00

Ask: $0.7561 = €1.00

Ask: $0.7575 = €1.00

Using $1 million or its euro equivalent, show how the corporate treasury could make

geographic arbitrage profit with the two different exchange rate quotes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning