Which of the following costs would be classified as capital expenditure for a restaurant business? 8.6 Which of the following best explains what is meant by 'capital expenditure? Expenditure on non-current assets, including repairs and maintenance Expenditure on expensive assets Expenditure relating to the issue of share capital Expenditure relating to the acquisition or improvement of non-current assets B D 8.7 Which of the following costs would be classified as capital expenditure for a restaurant business A replacement for a broken window B Repainting the restaurant C An illuminated sign advertising the business name D Cleaning of the kitchen floors Which one of the following costs would be classified as revenue expenditure on the invoice for a hew company car? 8.8 A Road tax B Number plates C Fitted stereo D Delivery costs

Which of the following costs would be classified as capital expenditure for a restaurant business? 8.6 Which of the following best explains what is meant by 'capital expenditure? Expenditure on non-current assets, including repairs and maintenance Expenditure on expensive assets Expenditure relating to the issue of share capital Expenditure relating to the acquisition or improvement of non-current assets B D 8.7 Which of the following costs would be classified as capital expenditure for a restaurant business A replacement for a broken window B Repainting the restaurant C An illuminated sign advertising the business name D Cleaning of the kitchen floors Which one of the following costs would be classified as revenue expenditure on the invoice for a hew company car? 8.8 A Road tax B Number plates C Fitted stereo D Delivery costs

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter7: Operating Assets

Section: Chapter Questions

Problem 12MCQ: Which of the following statements is true? a. The fixed asset turnover ratio assists managers in...

Related questions

Question

Transcribed Image Text:Which of the following costs would be classified as capital expenditure for a restaurant business?

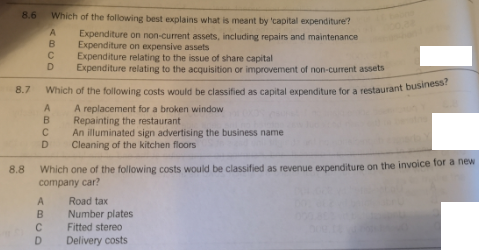

8.6 Which of the following best explains what is meant by 'capital expenditure?

Expenditure on non-current assets, including repairs and maintenance

Expenditure on expensive assets

Expenditure relating to the issue of share capital

Expenditure relating to the acquisition or improvement of non-current assets

B

D

8.7

Which of the following costs would be classified as capital expenditure for a restaurant business

A replacement for a broken window

B Repainting the restaurant

C An illuminated sign advertising the business name

D

Cleaning of the kitchen floors

Which one of the following costs would be classified as revenue expenditure on the invoice for a hew

company car?

8.8

A

Road tax

B

Number plates

C

Fitted stereo

D

Delivery costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College