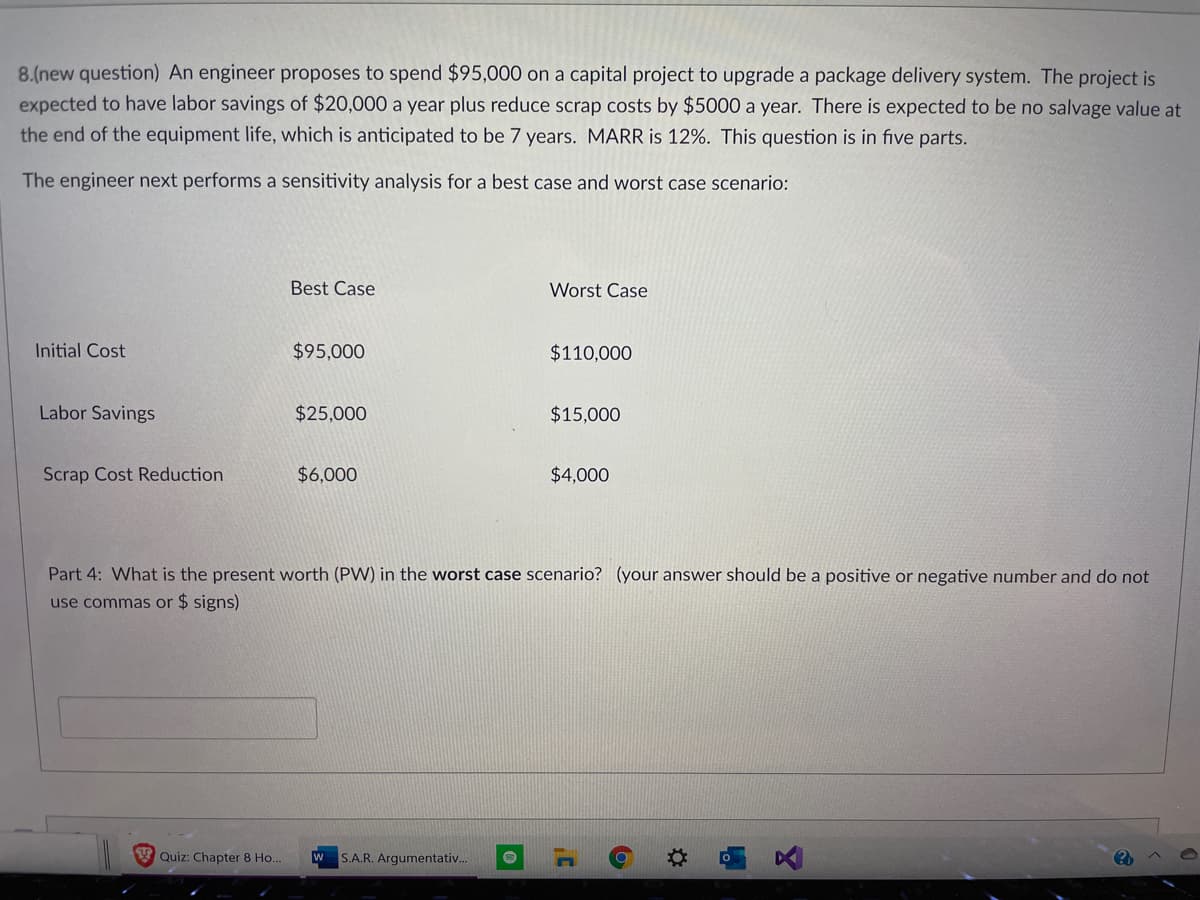

8.(new question) An engineer proposes to spend $95,000 on a capital project to upgrade a package delivery system. The project is expected to have labor savings of $20,000 a year plus reduce scrap costs by $5000 a year. There is expected to be no salvage value- the end of the equipment life, which is anticipated to be 7 years. MARR is 12%. This question is in five parts. The engineer next performs a sensitivity analysis for a best case and worst case scenario: Best Case Worst Case Initial Cost $95,000 $110,000 Labor Savings $25,000 $15,000 Scrap Cost Reduction $6,000 $4,000

8.(new question) An engineer proposes to spend $95,000 on a capital project to upgrade a package delivery system. The project is expected to have labor savings of $20,000 a year plus reduce scrap costs by $5000 a year. There is expected to be no salvage value- the end of the equipment life, which is anticipated to be 7 years. MARR is 12%. This question is in five parts. The engineer next performs a sensitivity analysis for a best case and worst case scenario: Best Case Worst Case Initial Cost $95,000 $110,000 Labor Savings $25,000 $15,000 Scrap Cost Reduction $6,000 $4,000

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section10.A: Mutually Exclusive Investments Having Unequal Lives

Problem 2P

Related questions

Question

Transcribed Image Text:8.(new question) An engineer proposes to spend $95,000 on a capital project to upgrade a package delivery system. The project is

expected to have labor savings of $20,000 a year plus reduce scrap costs by $5000 a year. There is expected to be no salvage value at

the end of the equipment life, which is anticipated to be 7 years. MARR is 12%. This question is in five parts.

The engineer next performs a sensitivity analysis for a best case and worst case scenario:

Best Case

Worst Case

Initial Cost

$95,000

$110,000

Labor Savings

$25,000

$15,000

Scrap Cost Reduction

$6,000

$4,000

Part 4: What is the present worth (PW) in the worst case scenario? (your answer should be a positive or negative number and do not

use commas or $ signs)

Quiz: Chapter 8 Ho..

w

S.A.R. Argumentativ..

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning