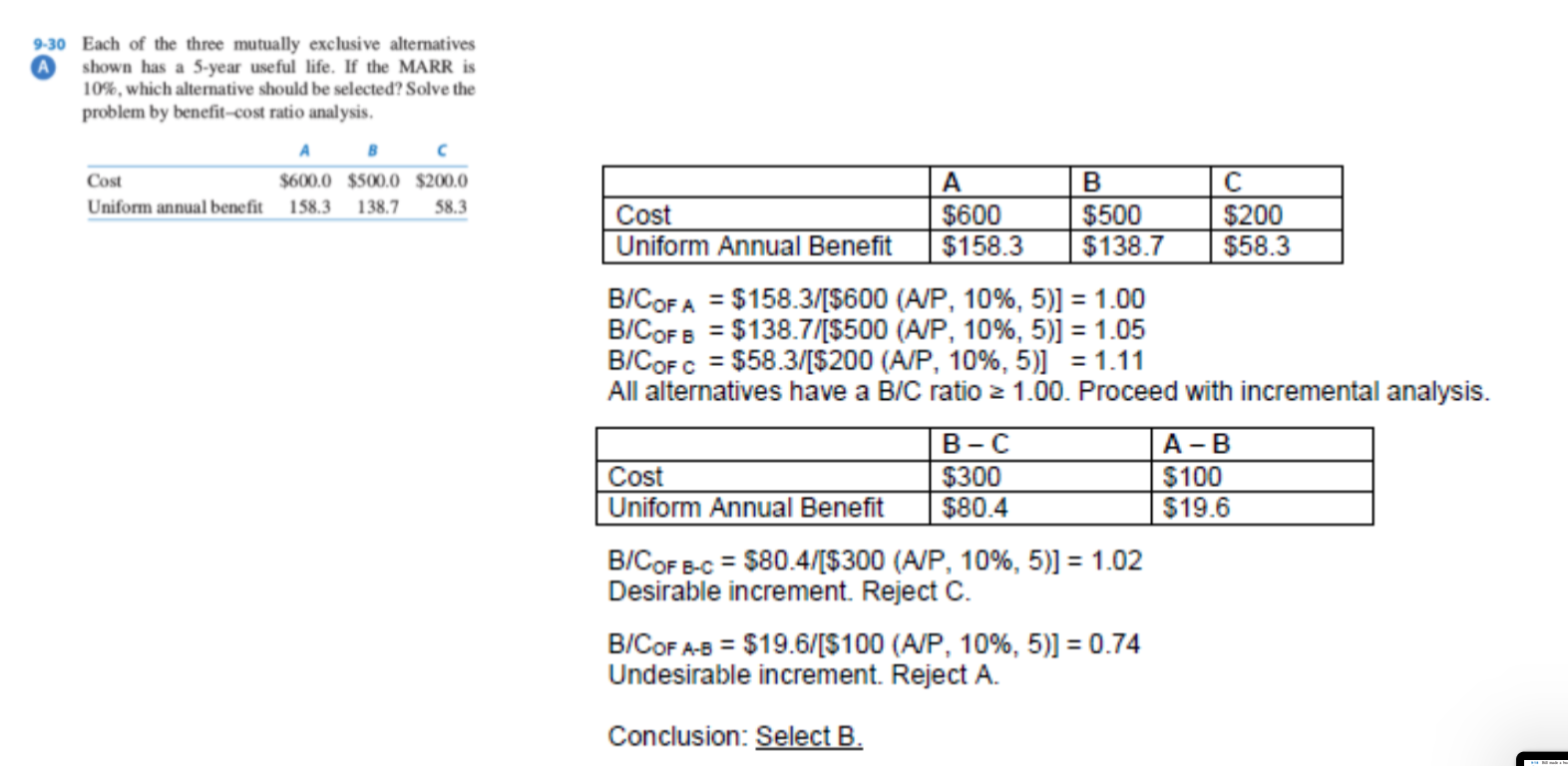

9-30 Each of the three mutually exclusive alternatives A shown has a 5-year useful life. If the MARR is 10%, which alternative should be selected? Solve the problem by benefit-cost ratio analysis. A Cost $600.0 $500.0 $200.0 Uniform annual benefit 158.3 138.7 58.3

9-30 Each of the three mutually exclusive alternatives A shown has a 5-year useful life. If the MARR is 10%, which alternative should be selected? Solve the problem by benefit-cost ratio analysis. A Cost $600.0 $500.0 $200.0 Uniform annual benefit 158.3 138.7 58.3

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 15PROB

Related questions

Question

Transcribed Image Text:9-30 Each of the three mutually exclusive alternatives

A shown has a 5-year useful life. If the MARR is

10%, which alternative should be selected? Solve the

problem by benefit-cost ratio analysis.

A

Cost

$600.0 $500.0 $200.0

Uniform annual benefit

158.3 138.7

58.3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you