REQUIRED: 1. What increase in selling price is necessary to cover the 15% increase in direct labor cost and still maintain the current contribution margin ratio of 30%? 2. How many tape decks must be sold to maintain the current operating income of P350,000 if the sales price remains at P100 and the 15% wage inerease goes into effect? (Hint: first compute the unit contribution margin.) 3. The president believes that an additional P700,000 of machinery (to be depreciated at 20% annually) will increase present capacity (20,000 units) by 25%. If all tape decks produced can be sold at the present price of P100 per unit and the wage increase goes into effect, how would the estimated operating income before capacity is inereased compare with the estimated operating income at full capacity before and after the expansion.

REQUIRED: 1. What increase in selling price is necessary to cover the 15% increase in direct labor cost and still maintain the current contribution margin ratio of 30%? 2. How many tape decks must be sold to maintain the current operating income of P350,000 if the sales price remains at P100 and the 15% wage inerease goes into effect? (Hint: first compute the unit contribution margin.) 3. The president believes that an additional P700,000 of machinery (to be depreciated at 20% annually) will increase present capacity (20,000 units) by 25%. If all tape decks produced can be sold at the present price of P100 per unit and the wage increase goes into effect, how would the estimated operating income before capacity is inereased compare with the estimated operating income at full capacity before and after the expansion.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter11: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 11.4C: Variable costs and activity bases in decision making The owner of Dawg Prints, a printing company,...

Related questions

Question

Transcribed Image Text:Exercise 4-23/

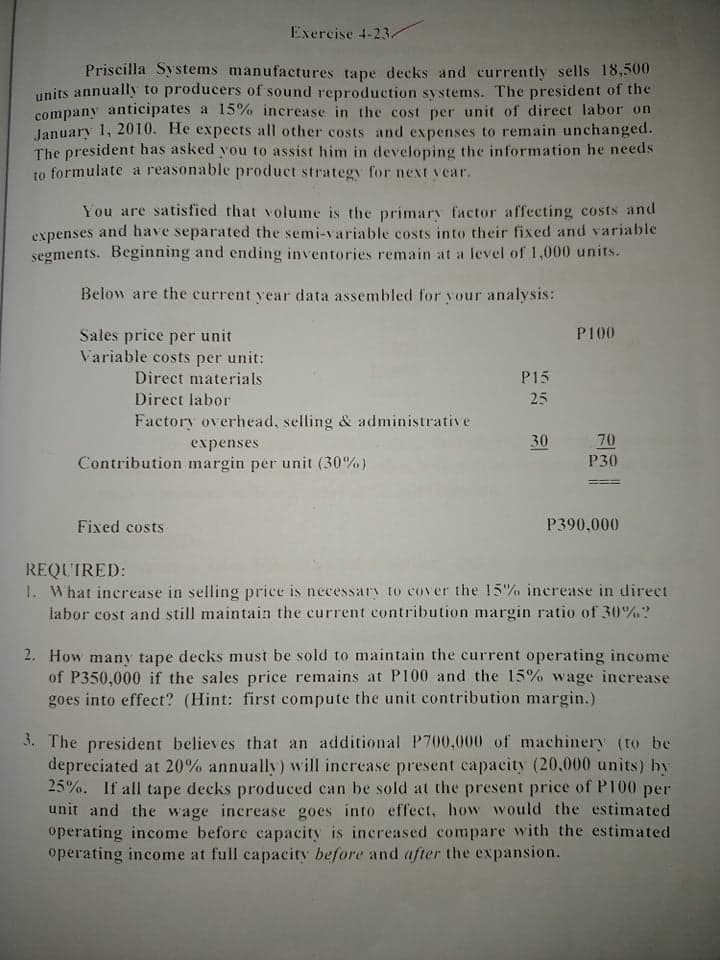

Priscilla Systems manufactures tape decks and currently sells 18,500

units annually to producers of sound reproduction systems. The president of the

company anticipates a 15%o increase in the cost per unit of direct labor on

January 1, 2010. He expects all other costs and expenses to remain unchanged.

The president has asked you to assist him in developing the information he needs

to formulate a reasonable product strategy for next year.

You are satisfied that volume is the primary factor affecting costs and

expenses and have separated the semi-variable costs into their fixed and variable

segments. Beginning and ending inventories remain at a level of 1,000 units.

Below are the current year data assembled for your analysis:

P100

Sales price per unit

Variable costs per unit:

Direct materials

P15

Direct labor

25

Factory overhead, selling & administrative

70

Р30

expenses

30

Contribution margin per unit (30%)

Fixed costs

P390,000

REQUIRED:

1. What inerease in selling price is necessary to cover the 15% inerease in direct

labor cost and still maintain the current contribution margin ratio of 30%?

2. How many tape decks must be sold to maintain the current operating income

of P350,000 if the sales price remains at P100 and the 15% wage increase

goes into effect? (Hint: first compute the unit contribution margin.)

3. The president believes that an additional P700,000 of machinery (to be

depreciated at 20% annually) will increase present capacity (20,000 units) by

25%. If all tape decks produced can be sold at the present price of P100 per

unit and the wage increase goes into effect, how would the estimated

operating income before capacity is inereased compare with the estimated

operating income at full capacity before and after the expansion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning