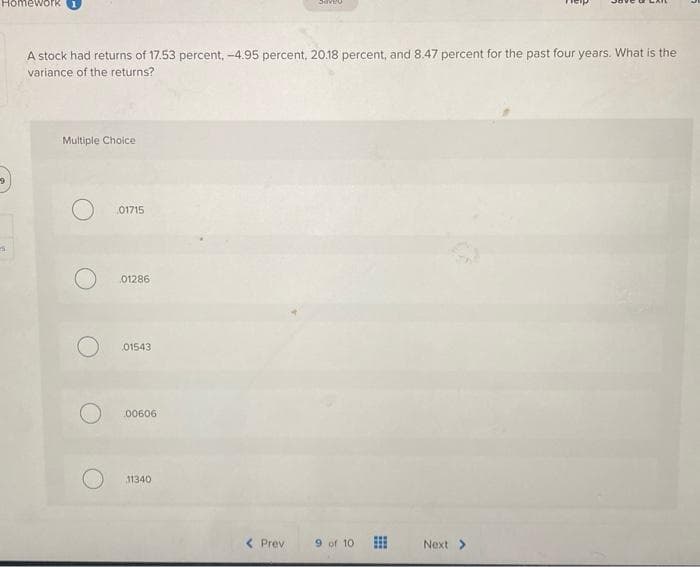

9 Homework A stock had returns of 17.53 percent, -4.95 percent, 20.18 percent, and 8.47 percent for the past four years. What is the variance of the returns? Multiple Choice O 01715 01286 01543 .00606 11340 < Prev 9 of 10 Next >

9 Homework A stock had returns of 17.53 percent, -4.95 percent, 20.18 percent, and 8.47 percent for the past four years. What is the variance of the returns? Multiple Choice O 01715 01286 01543 .00606 11340 < Prev 9 of 10 Next >

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 17P

Related questions

Question

Transcribed Image Text:9

Homework

A stock had returns of 17.53 percent, -4.95 percent, 20.18 percent, and 8.47 percent for the past four years. What is the

variance of the returns?

Multiple Choice

O

01715

01286

01543

.00606

11340

< Prev

9 of 10

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning