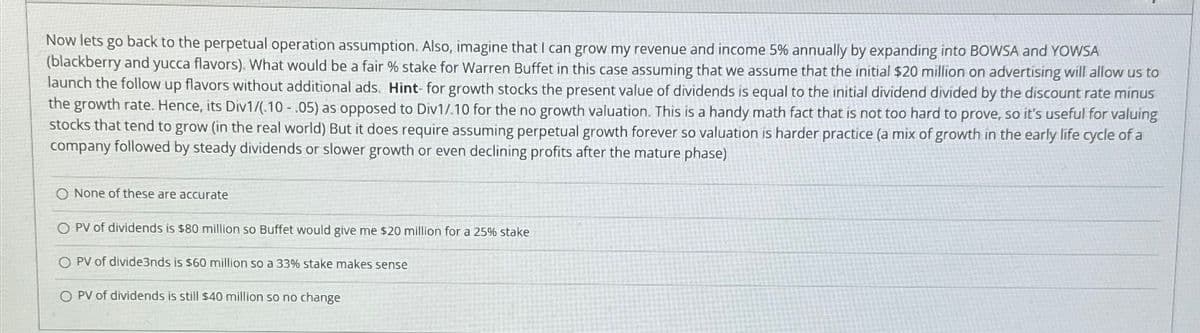

Now lets go back to the perpetual operation assumption. Also, imagine that I can grow my revenue and income 5% annually by expanding into BOWSA and YOWSA (blackberry and yucca flavors). What would be a fair % stake for Warren Buffet in this case assuming that we assume that the initial $20 million on advertising will allow us to launch the follow up flavors without additional ads. Hint for growth stocks the present value of dividends is equal to the initial dividend divided by the discount rate minus the growth rate. Hence, its Div1/(.10-.05) as opposed to Div1/.10 for the no growth valuation. This is a handy math fact that is not too hard to prove, so it's useful for valuing stocks that tend to grow (in the real world) But it does require assuming perpetual growth forever so valuation is harder practice (a mix of growth in the early life cycle of a company followed by steady dividends or slower growth or even declining profits after the mature phase) O None of these are accurate O PV of dividends is $80 million so Buffet would give me $20 million for a 25% stake O PV of divide3nds is $60 million so a 33% stake makes sense O PV of dividends is still $40 million so no change

Now lets go back to the perpetual operation assumption. Also, imagine that I can grow my revenue and income 5% annually by expanding into BOWSA and YOWSA (blackberry and yucca flavors). What would be a fair % stake for Warren Buffet in this case assuming that we assume that the initial $20 million on advertising will allow us to launch the follow up flavors without additional ads. Hint for growth stocks the present value of dividends is equal to the initial dividend divided by the discount rate minus the growth rate. Hence, its Div1/(.10-.05) as opposed to Div1/.10 for the no growth valuation. This is a handy math fact that is not too hard to prove, so it's useful for valuing stocks that tend to grow (in the real world) But it does require assuming perpetual growth forever so valuation is harder practice (a mix of growth in the early life cycle of a company followed by steady dividends or slower growth or even declining profits after the mature phase) O None of these are accurate O PV of dividends is $80 million so Buffet would give me $20 million for a 25% stake O PV of divide3nds is $60 million so a 33% stake makes sense O PV of dividends is still $40 million so no change

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 6MC

Related questions

Question

Transcribed Image Text:Now lets go back to the perpetual operation assumption. Also, imagine that I can grow my revenue and income 5% annually by expanding into BOWSA and YOWSA

(blackberry and yucca flavors). What would be a fair % stake for Warren Buffet in this case assuming that we assume that the initial $20 million on advertising will allow us to

launch the follow up flavors without additional ads. Hint for growth stocks the present value of dividends is equal to the initial dividend divided by the discount rate minus

the growth rate. Hence, its Div1/(.10-.05) as opposed to Div1/.10 for the no growth valuation. This is a handy math fact that is not too hard to prove, so it's useful for valuing

stocks that tend to grow (in the real world) But it does require assuming perpetual growth forever so valuation is harder practice (a mix of growth in the early life cycle of a

company followed by steady dividends or slower growth or even declining profits after the mature phase)

O None of these are accurate

O PV of dividends is $80 million so Buffet would give me $20 million for a 25% stake

O PV of divide3nds is $60 million so a 33% stake makes sense

O PV of dividends is still $40 million so no change

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT