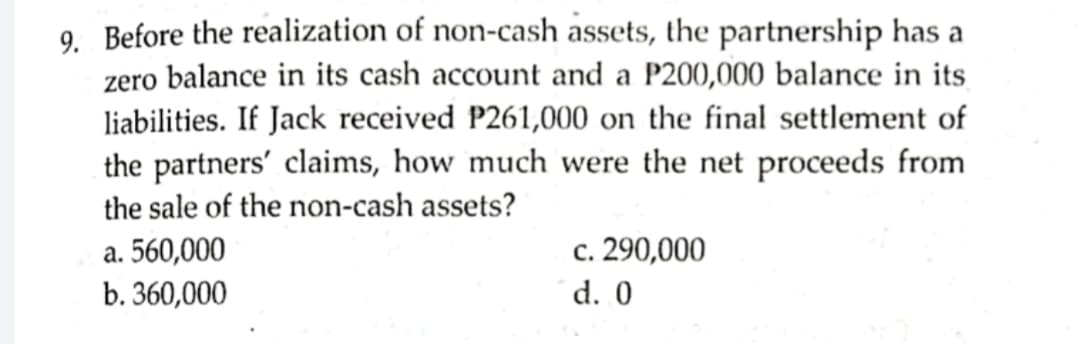

9. Before the realization of non-cash assets, the partnership has a zero balance in its cash account and a P200,000 balance in its liabilities. If Jack received P261,000 on the final settlement of the partners' claims, how much were the net proceeds from the sale of the non-cash assets? a. 560,000 b. 360,000 c. 290,000 d. 0

9. Before the realization of non-cash assets, the partnership has a zero balance in its cash account and a P200,000 balance in its liabilities. If Jack received P261,000 on the final settlement of the partners' claims, how much were the net proceeds from the sale of the non-cash assets? a. 560,000 b. 360,000 c. 290,000 d. 0

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 5MC: Chani contributes equipment to a partnership that she purchased 2 years ago for $10,000. The current...

Related questions

Question

I got 540,000 as my answer but it is not included in the choices. Pls help in order for me to review it also. Thank you

Transcribed Image Text:9. Before the realization of non-cash assets, the partnership has a

zero balance in its cash account and a P200,000 balance in its

liabilities. If Jack received P261,000 on the final settlement of

the partners' claims, how much were the net proceeds from

the sale of the non-cash assets?

a. 560,000

b. 360,000

c. 290,000

d. 0

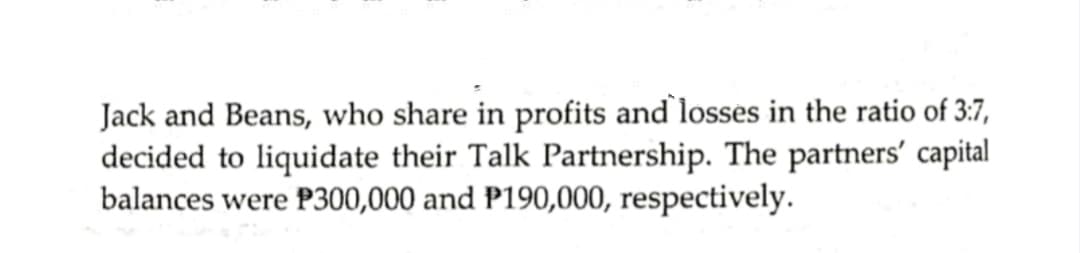

Transcribed Image Text:Jack and Beans, who share in profits and losses in the ratio of 3:7,

decided to liquidate their Talk Partnership. The partners' capital

balances were P300,000 and P190,000, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT