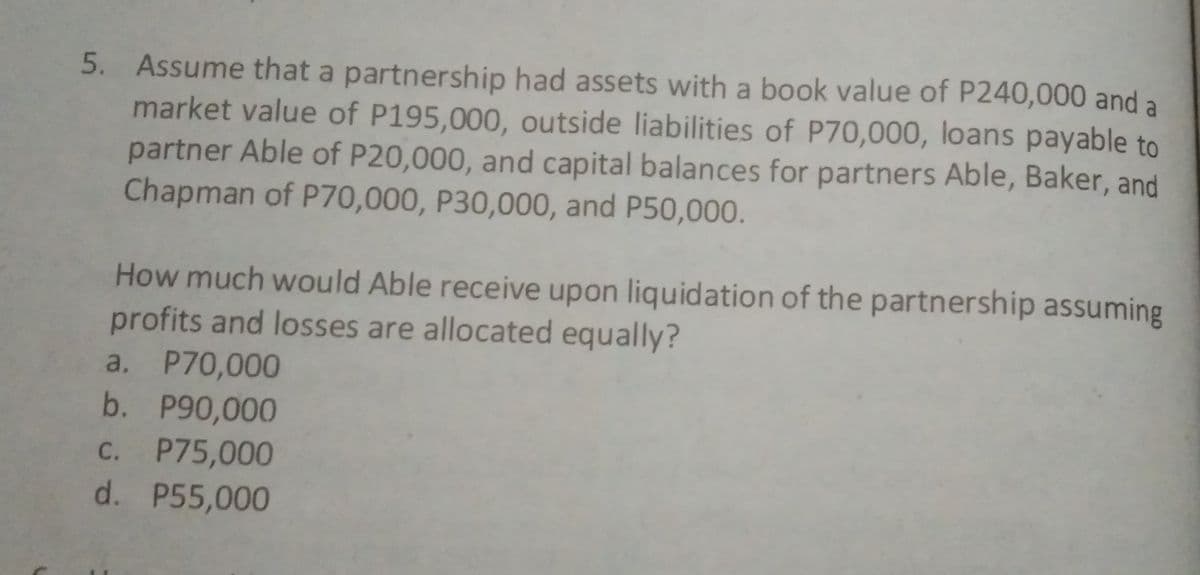

5. Assume that a partnership had assets with a book value of P240,000 and a market value of P195,000, outside liabilities of P70,000, loans payable to partner Able of P20,000, and capital balances for partners Able, Baker, and Chapman of P70,000, P30,000, and P50,000. How much would Able receive upon liquidation of the partnership assuming profits and losses are allocated equally? a. P70,000 b. P90,000 C. P75,000

5. Assume that a partnership had assets with a book value of P240,000 and a market value of P195,000, outside liabilities of P70,000, loans payable to partner Able of P20,000, and capital balances for partners Able, Baker, and Chapman of P70,000, P30,000, and P50,000. How much would Able receive upon liquidation of the partnership assuming profits and losses are allocated equally? a. P70,000 b. P90,000 C. P75,000

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 3EA: The partnership of Tasha and Bill shares profits and losses in a 50:50 ratio, and the partners have...

Related questions

Question

Transcribed Image Text:5. Assume that a partnership had assets with a book value of P240,000 and a

market value of P195,000, outside liabilities of P70,000, loans payable to

partner Able of P20,000, and capital balances for partners Able, Baker, and

Chapman of P70,000, P30,000, and P50,000.

How much would Able receive upon liquidation of the partnership assuming

profits and losses are allocated equally?

a. P70,000

b. P90,000

C. P75,000

d. P55,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT