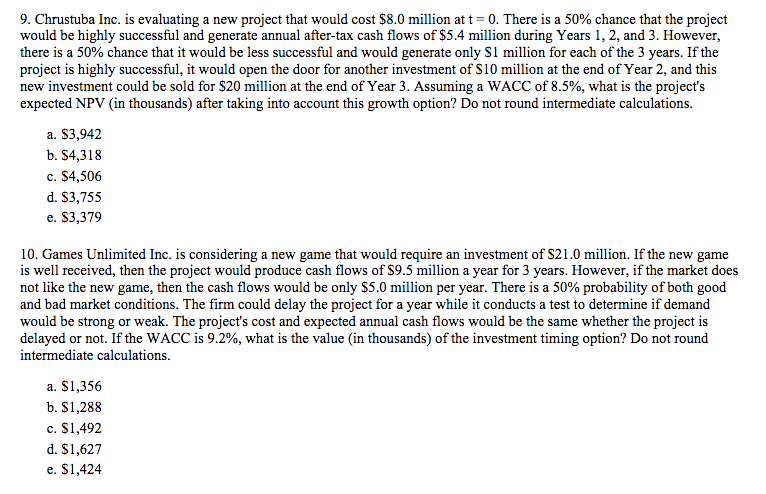

9. Chrustuba Inc. is evaluating a new project that would cost $8.0 million at t= 0. There is a 50% chance that the project would be highly successful and generate annual after-tax cash flows of $5.4 million during Years 1, 2, and 3. However, there is a 50% chance that it would be less successful and would generate only S1 million for each of the 3 years. If the project is highly successful, it would open the door for another investment of S10 million at the end of Year 2, and this new investment could be sold for $20 million at the end of Year 3. Assuming a WACC of 8.5%, what is the project's expected NPV (in thousands) after taking into account this growth option? Do not round intermediate calculations. a. $3,942 b. $4,318 c. S4,506 d. S3,755 e. $3,379

9. Chrustuba Inc. is evaluating a new project that would cost $8.0 million at t= 0. There is a 50% chance that the project would be highly successful and generate annual after-tax cash flows of $5.4 million during Years 1, 2, and 3. However, there is a 50% chance that it would be less successful and would generate only S1 million for each of the 3 years. If the project is highly successful, it would open the door for another investment of S10 million at the end of Year 2, and this new investment could be sold for $20 million at the end of Year 3. Assuming a WACC of 8.5%, what is the project's expected NPV (in thousands) after taking into account this growth option? Do not round intermediate calculations. a. $3,942 b. $4,318 c. S4,506 d. S3,755 e. $3,379

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter14: Real Options

Section: Chapter Questions

Problem 3MC: Tropical Sweets is considering a project that will cost $70 million and will generate expected cash...

Related questions

Question

Transcribed Image Text:9. Chrustuba Inc. is evaluating a new project that would cost $8.0 million at t= 0. There is a 50% chance that the project

would be highly successful and generate annual after-tax cash flows of $5.4 million during Years 1, 2, and 3. However,

there is a 50% chance that it would be less successful and would generate only S1 million for each of the 3 years. If the

project is highly successful, it would open the door for another investment of Ss10 million at the end of Year 2, and this

new investment could be sold for $20 million at the end of Year 3. Assuming a WACC of 8.5%, what is the project's

expected NPV (in thousands) after taking into account this growth option? Do not round intermediate calculations.

a. $3,942

b. $4,318

c. $4,506

d. S3,755

e. $3,379

10. Games Unlimited Inc. is considering a new game that would require an investment of $21.0 million. If the new game

is well received, then the project would produce cash flows of $9.5 million a year for 3 years. However, if the market does

not like the new game, then the cash flows would be only $5.0 million per year. There is a 50% probability of both good

and bad market conditions. The firm could delay the project for a year while it conducts a test to determine if demand

would be strong or weak. The project's cost and expected annual cash flows would be the same whether the project is

delayed or not. If the WACC is 9.2%, what is the value (in thousands) of the investment timing option? Do not round

intermediate calculations.

a. $1,356

b. $1,288

c. $1,492

d. $1,627

e. $1,424

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,