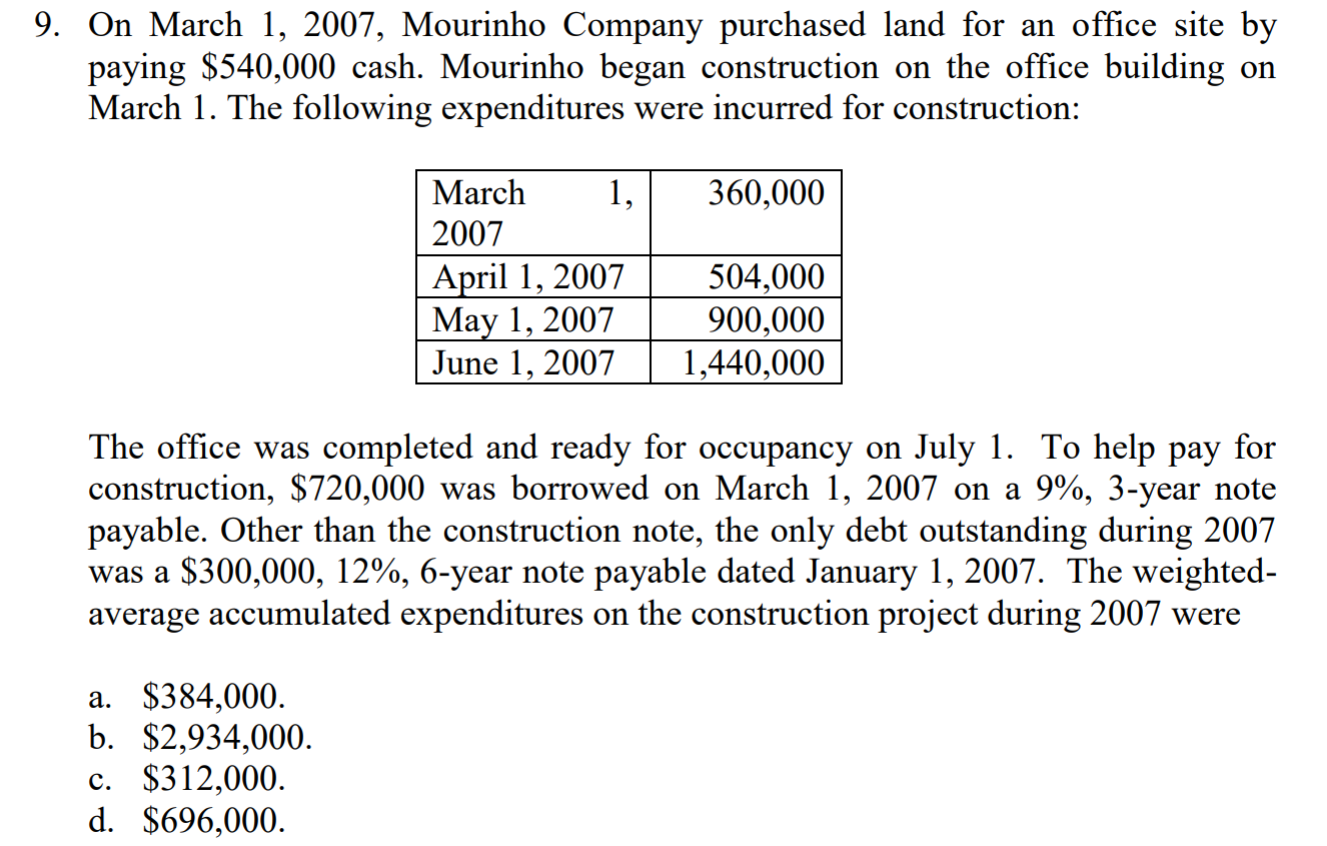

9. On March 1, 2007, Mourinho Company purchased land for an office site by paying $540,000 cash. Mourinho began construction on the office building on March 1. The following expenditures were incurred for construction: 1,360,000 March 2007 April 1, 2007 May 1, 2007 June 1, 20071,440,000 504,000 900,000 The office was completed and ready for occupancy on July 1. To help pay for construction, $720,000 was borrowed on March 1, 2007 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2007 was $300,000, 12%, 6-year note payable dated January 1, 2007. The weighted- average accumulated expenditures on the construction project during 2007 were a. $384,000 b. $2,934,000 c. $312,000 d. $696,000

9. On March 1, 2007, Mourinho Company purchased land for an office site by paying $540,000 cash. Mourinho began construction on the office building on March 1. The following expenditures were incurred for construction: 1,360,000 March 2007 April 1, 2007 May 1, 2007 June 1, 20071,440,000 504,000 900,000 The office was completed and ready for occupancy on July 1. To help pay for construction, $720,000 was borrowed on March 1, 2007 on a 9%, 3-year note payable. Other than the construction note, the only debt outstanding during 2007 was $300,000, 12%, 6-year note payable dated January 1, 2007. The weighted- average accumulated expenditures on the construction project during 2007 were a. $384,000 b. $2,934,000 c. $312,000 d. $696,000

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.12MCE

Related questions

Question

Transcribed Image Text:9. On March 1, 2007, Mourinho Company purchased land for an office site by

paying $540,000 cash. Mourinho began construction on the office building on

March 1. The following expenditures were incurred for construction:

1,360,000

March

2007

April 1, 2007

May 1, 2007

June 1, 20071,440,000

504,000

900,000

The office was completed and ready for occupancy on July 1. To help pay for

construction, $720,000 was borrowed on March 1, 2007 on a 9%, 3-year note

payable. Other than the construction note, the only debt outstanding during 2007

was $300,000, 12%, 6-year note payable dated January 1, 2007. The weighted-

average accumulated expenditures on the construction project during 2007 were

a. $384,000

b. $2,934,000

c. $312,000

d. $696,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1

VIEWTrending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning